- The Crypto Minute

- Posts

- Coinbase Earnings, ADA & XRP in Focus

Coinbase Earnings, ADA & XRP in Focus

Plus crazy CZ situation and more.

Brian Armstrong, Coinbase’s CEO, gave degens on Polymarket and Kalshi an early Christmas gift, graciously paid by said platforms. 🎁 Fed cuts Thanos-snapped institutional money, and much more! 💥🧠

⤵️ Today’s Agenda:

Institutions are chasing dino coins like $XRP and $ADA while new alts beg for scraps

CZ walks free and suddenly Binance lists Trump’s stablecoin? Lawmakers aren’t buying the coincidence

Ethereum fees hit rock bottom as upgrades finally start doing their job

Bitcoin ETFs see $470M outflows after Fed cut, markets enter profit-taking panic mode

Coinbase smashes earnings, Armstrong trolls Polymarket live on call with a word spam finale

And more…

📊 Market Snapshot

| $110,540BTC-2.8% | $3,867.5ETH-4.3% | $3.71TCrypto Market Cap-2.4% | 37 (Fear)Fear & Greed Index-3 from last week |

📅 Crypto Events You Don’t Want to Miss

📌 Monday, Nov 3rd:

US ISM Manufacturing PMI: A vibe check on how busy US factories are, treated as a sign for the overall economy.

📌 Wednesday, Nov 5th:

US ISM Services PMI: A snapshot of the service sector, from restaurants to real estate.

📌 Friday, Nov 7th:

US Average Hourly Earnings m/m: Looks for changes in workers’ pay from month to month.

US Non-Farm Employment Change: Job creation vs loss. A big surprise here can shake the markets!

US Unemployment Rate: The percentage of people out of work.

🐋Smart Money Tracker

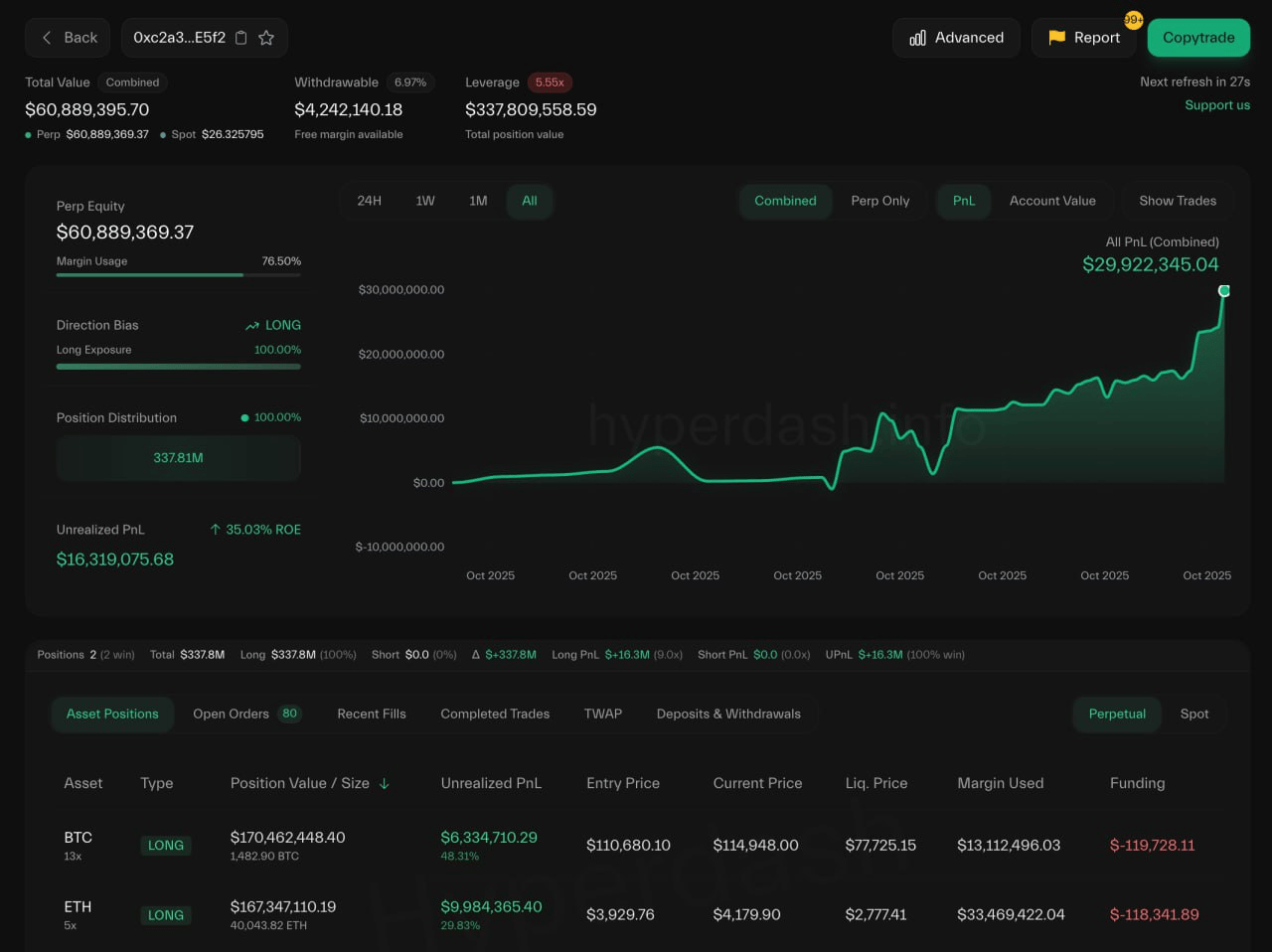

Monday, Oct 27th: Trader 0xc2a3, known for a 100% win rate, doubled down on $ETH longs and now holds $170M in $BTC and $167M in $ETH. His profits are nearing $30M!

Tuesday, Oct 28th: James Wynn got partially liquidated again on his $BTC short! Just trade the opposite of him, easy gains.

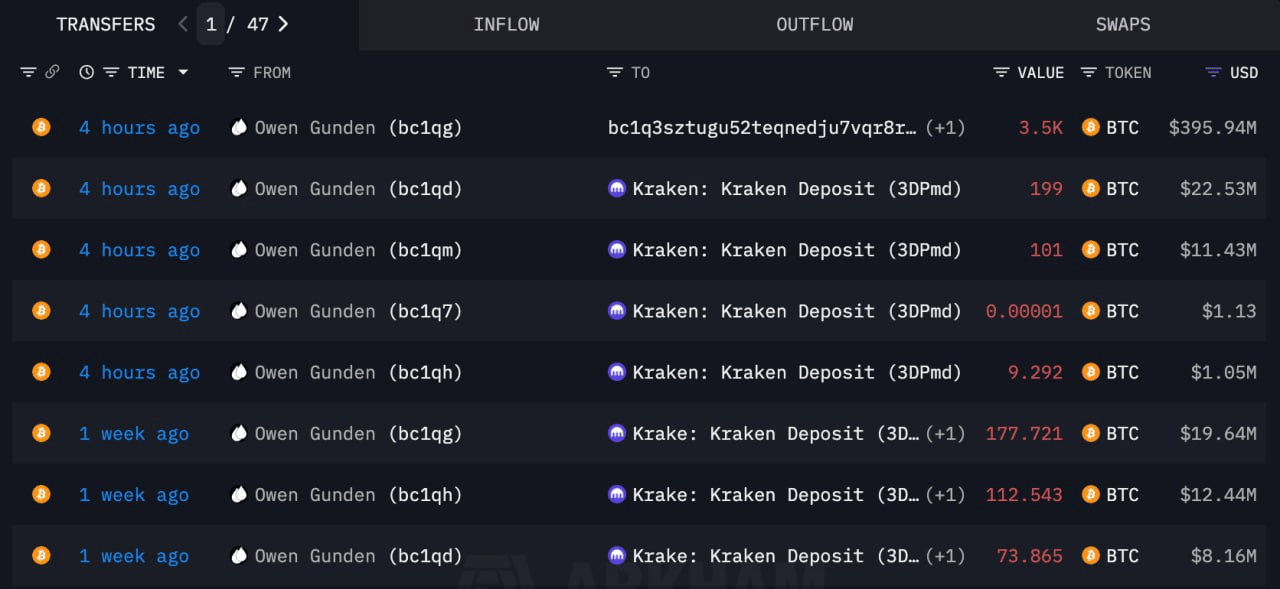

Wednesday, Oct 29th: Owen Gunden, an early $BTC whale holding 10,959 coins ($1.19B), just sent 1,448 $BTC ($164M) to Kraken.

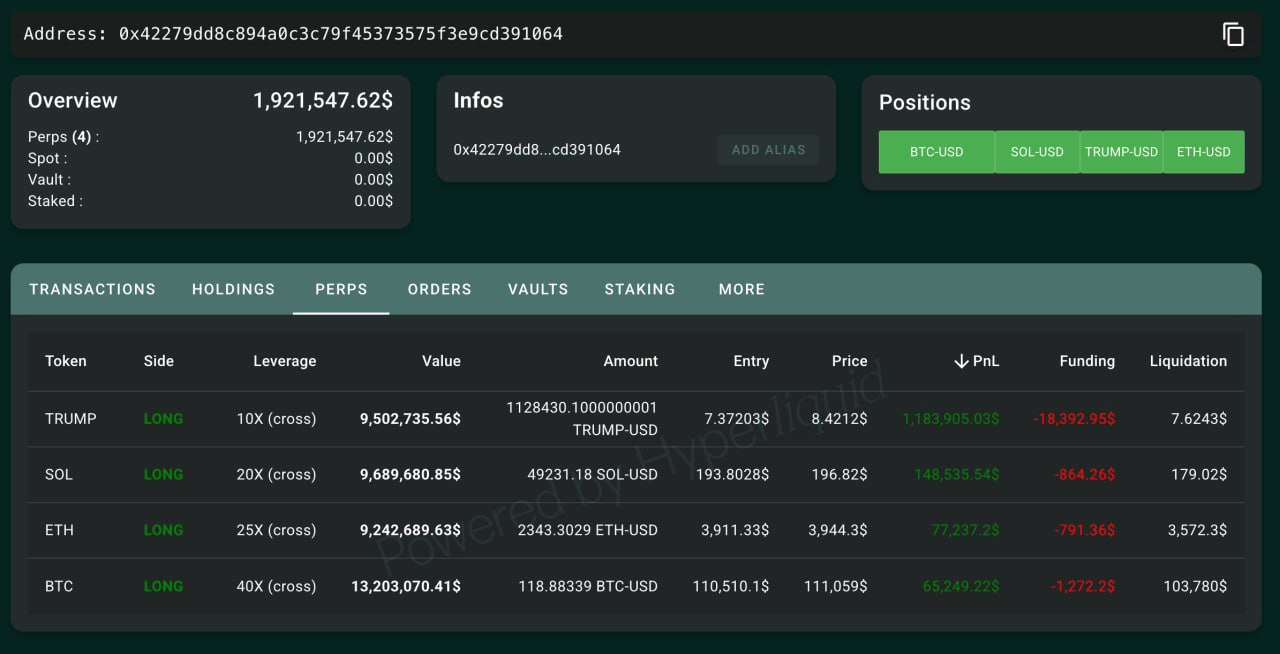

Thursday, Oct 30th: Someone opened new wallets to buy $TRUMP on Solana and went long on Hyperliquid, now sitting on about $1.5M in unrealized profit.

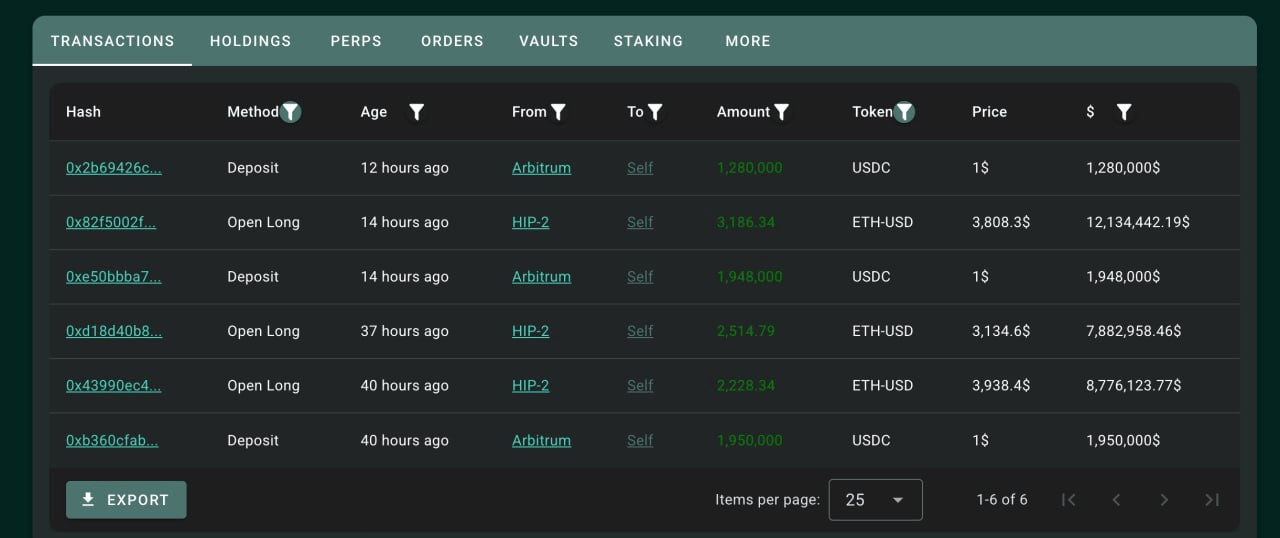

Friday, Oct 31st: A new wallet (0x6988) deposited $5.18M in $USDC to Hyperliquid to open a 25x long on $ETH, holding 7,929 $ETH ($30.32M).

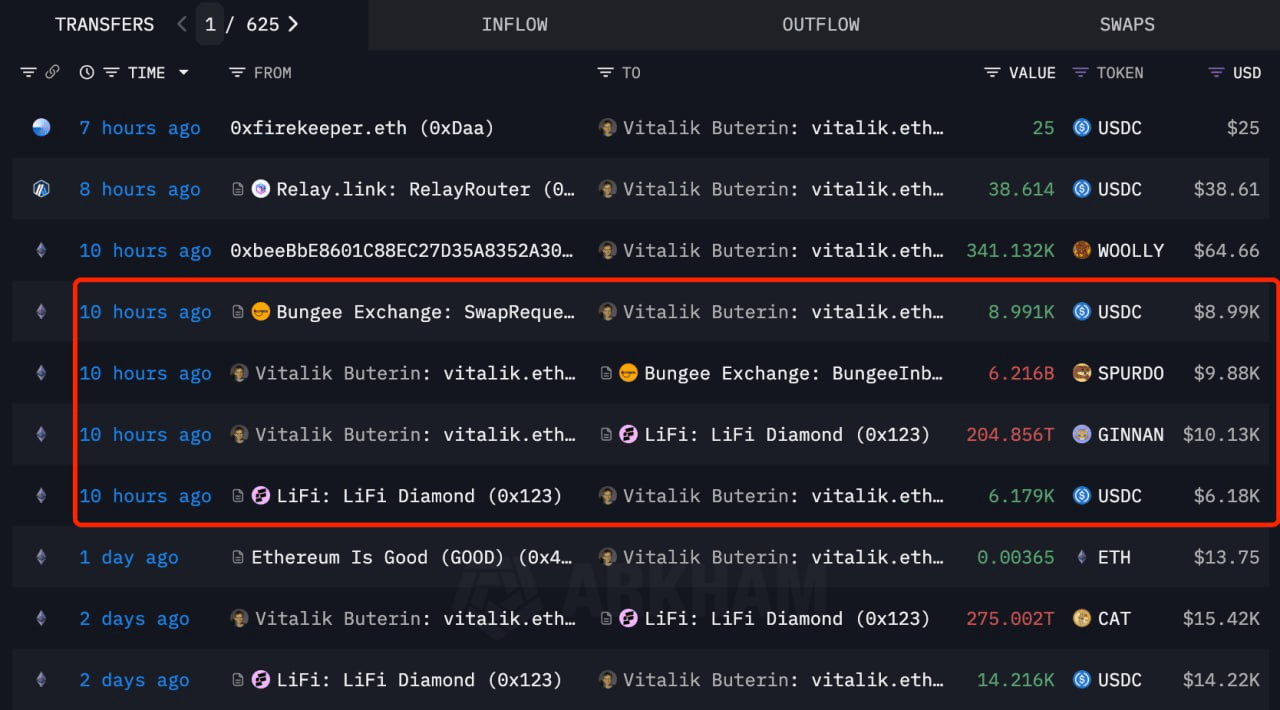

Saturday, Nov 1st: Vitalik Buterin once again dumped the free memecoins he’d been sent, converting them into $15,170 worth of $USDC.

Source: Lookonchain

📰 News Recap (Oct 27 to Nov 2)

Institutions Eye the Crypto Dinosaurs 🦖

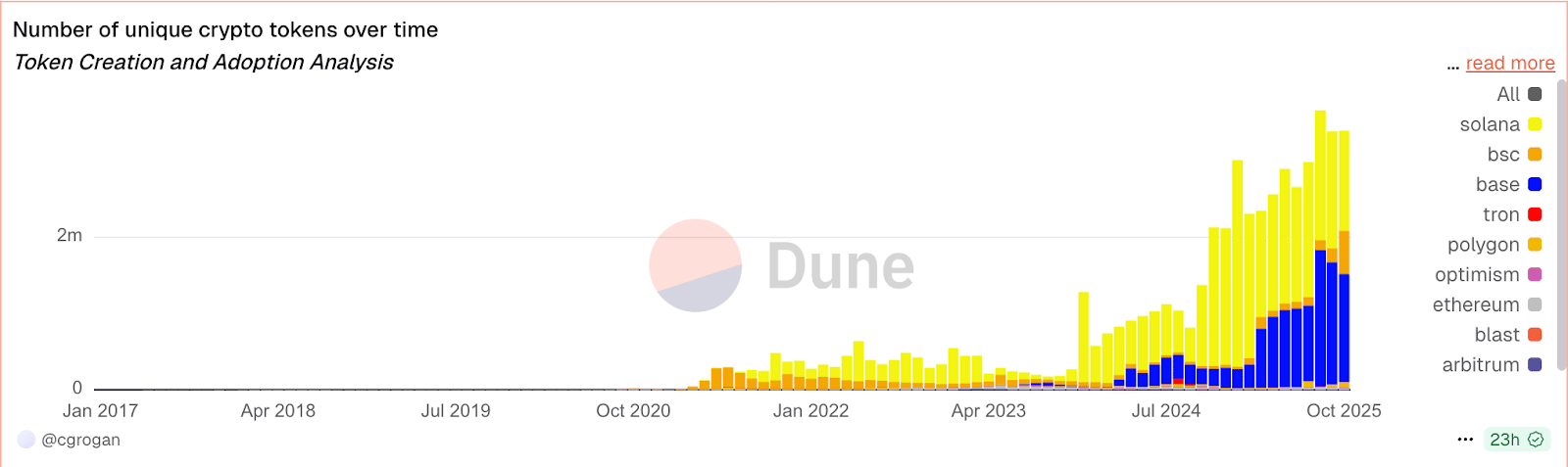

Big money seems to be heading back to the fossils of crypto. 💰 New projects do not get nearly the same attention, partly because of the humongous numbers.

Analysts say funds from ETFs and TradFi are flocking to “dino” assets like $XRP and $ADA, leaving smaller alts starving for attention. 🥶

🔎 The logic? Institutions want something with history, not hype. Simply put, coins that can survive a bear market or two without going extinct. Plenty have done exactly that.

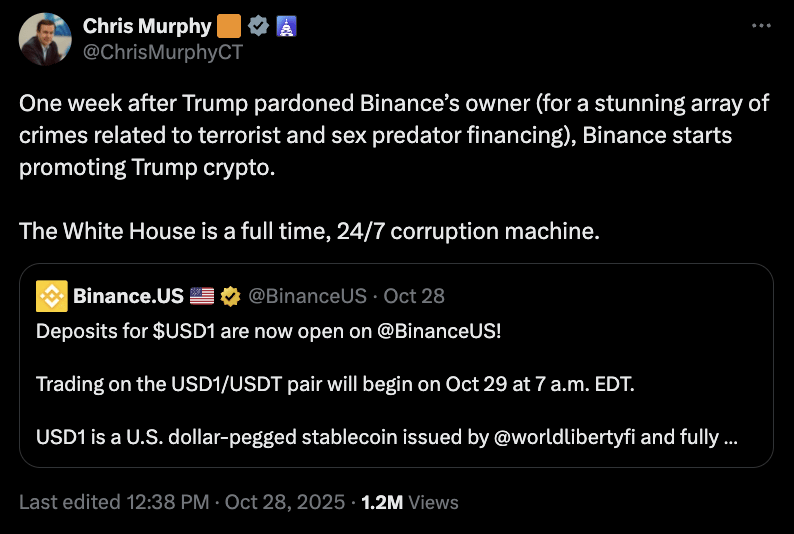

Senator Slams Binance After CZ Pardon, Suspects Corruption 😬

Just a week after Trump pardoned CZ, Binance.US listed $USD1, the stablecoin tied to Trump’s own crypto company. What a coincidence, isn’t it? 👀

Senator Chris Murphy was certainly curious about it. 🤔💭 He called it “corruption in plain sight” and claimed Binance was “promoting Trump crypto.”

👉 Binance.US replied that $USD1 had been approved long before the pardon and that politics had nothing to do with it. Still, lawmakers now want a probe into Trump’s crypto ties.

The case has already sparked new calls in Congress for tighter rules on political use of digital assets. 💥

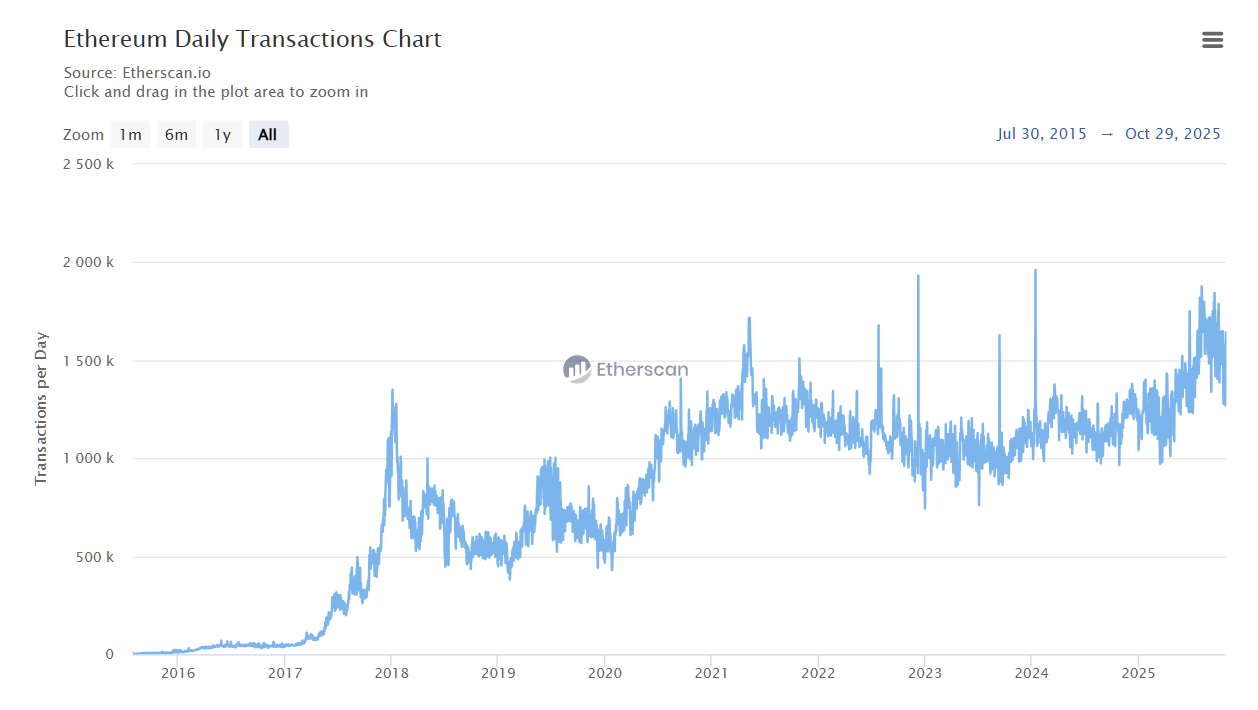

Ethereum Fees Drop to Just Pennies 💪

Ethereum is busier than ever! Yet transactions now cost less than a cent. Gone are the times of $50 transactions. 😅

📊 Gas fees sit around 0.16 gwei ($0.01) per transaction, even with daily activity topping 1.6 million. Token swaps cost about $0.15, NFT trades around $0.27. 🎨

Upgrades like Dencun and Pectra are finally paying off, doubling Layer-2 capacity and cutting costs by up to 95%. ⚙️

Ethereum might have just proven it can scale without breaking wallets. 🔥

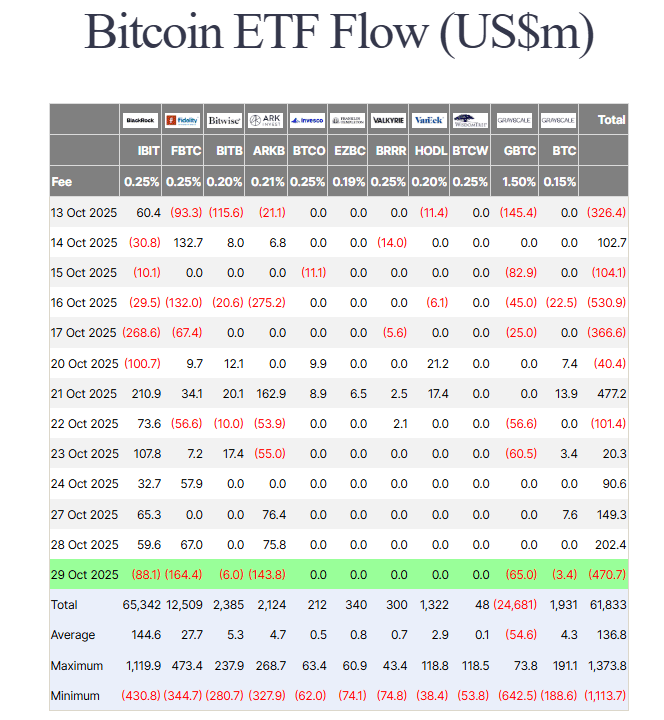

Bitcoin ETFs See $470M Outflows After Fed Cut 💸

Bitcoin ETFs had their worst day since the mid-October crash! 📉 They bled $470M right after the Fed trimmed rates by 0.25%.

🔎 Fidelity’s FBTC led with $164M out, followed by ARKB with $143M and BlackRock’s IBIT with $88M. Even Grayscale’s GBTC wasn’t spared, losing another $65M.

Traders sold the news as Fed Chair Powell warned that more cuts aren’t guaranteed, leaving markets uneasy. 😨

It seems the move signaled that the easing cycle might be shorter than investors hoped, so profit-taking kicked in. 💰

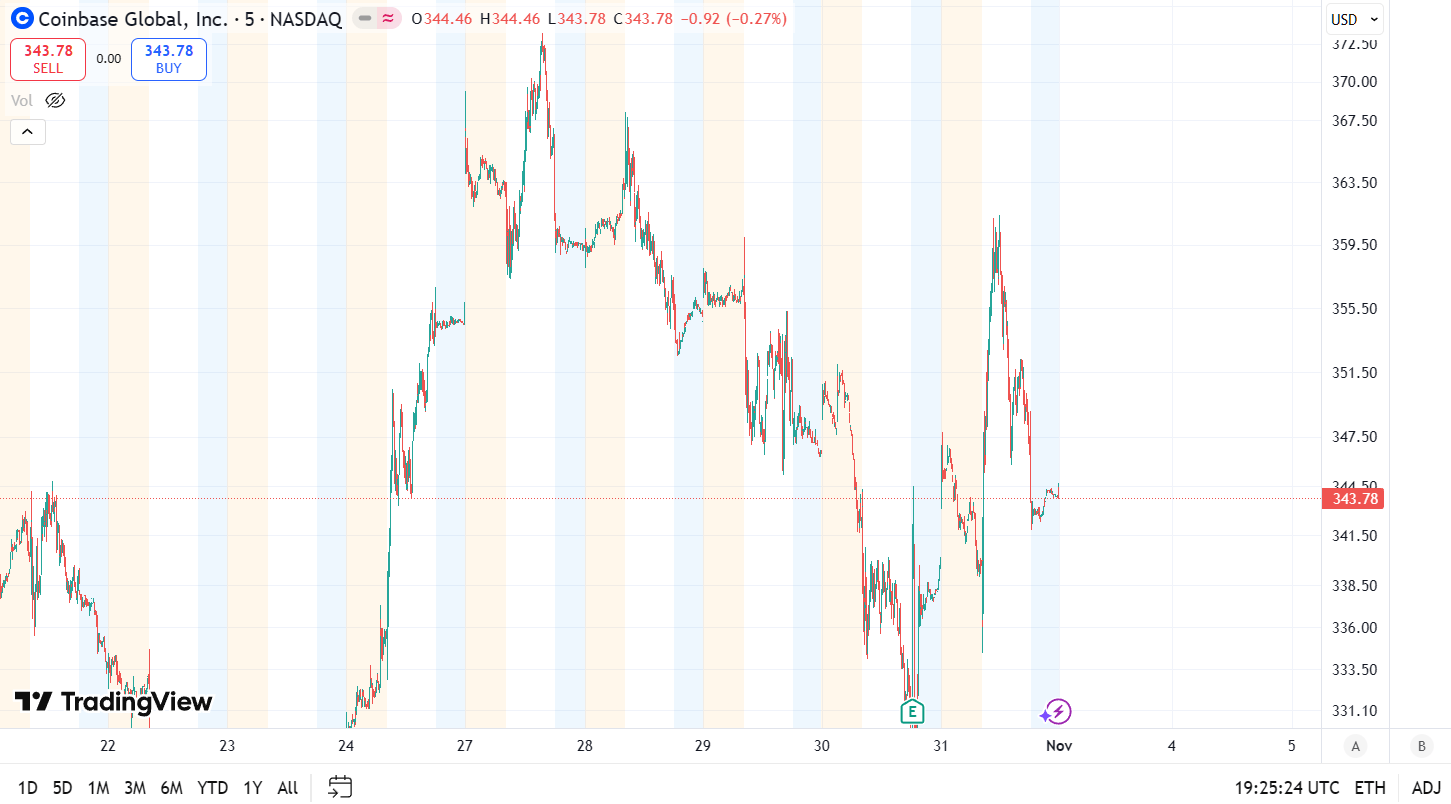

🌍️ Story of the Week: Coinbase Posts Strong Q3 Earnings and Armstrong Trolls

Third-quarter earnings just dropped and Coinbase delivered a clean beat. Revenue hit $1.9B (a crazy +55% YoY) and profits came in at $1.50 per share, smashing expectations. 🧨

👉 Transaction revenue alone hit $1B (+37%), while subs and services chipped in $747M. All that while expenses went down by 9%.

It’s overall great news for the crypto market when a publicly traded company blooms like this, making investment into the industry more likely. 🚀

The stock dipped during the day but started climbing after hours. It’s still up 32% for 2025, even after a rocky summer. The earnings call marked a turning point. Source: TradingView

What makes this especially notable is the weak last quarter’s call, which led to a 17% dump of COIN. 👎

What’s the Math Behind The Strong Call?

Higher trading volumes: Traders aped right in, boosting overall platform activity. 💎

Strong take rates: Coinbase keeps a solid cut from each transaction. 📈

Derivatives revenue coming soon: The $2.9B Deribit acquisition is set to unlock a new income stream. 👩🚀

That sweet S&P 500 status: Inclusion attracts institutional investors and adds long-term credibility. 🚀

Lit CEO Comments

Armstrong did a little trolling. 😅 He kicked off the call by admitting he was distracted by watching a prediction market on what he might say during the call.

To play along, he ended the call by spamming keywords like “Bitcoin,” “Ethereum,” “blockchain,” “staking,” and “Web3.” 🎯

The joke? 💡 Traders on Polymarket and Kalshi had placed bets on which words he’d mention. A total of $84,000 worth of bets had been placed that he would say those words, trolling Kalshi and Polymarket. 😏

Prediction platforms are about to feel this one, lol. 🔥

Brian Armstrong, Coinbase's CEO.

🔒 Major Token Unlocks of the Week

$ZEUS - 3.48% of the total supply will enter circulation on Nov 4, 2025.

$AIN - 2.31% of the total supply will enter circulation on Nov 5, 2025.

$MAVIA - 4.19% of the total supply will enter circulation on Nov 6, 2025.

$MYX - 1.50% of the total supply will enter circulation on Nov 6, 2025.

$FPS - 5.16% of the total supply will enter circulation on Nov 7, 2025.

Explore more unlocks with full vesting details.

💡 1 Minute Learning: Flash Loans

Ever seen someone borrow millions without collateral and repay it in the same block? That’s called a flash loan, one of the wildest (and maybe riskiest) innovations in DeFi. ✨

🔎 Flash loans let anyone borrow massive amounts of crypto instantly, as long as the money is returned before the transaction ends. No collateral, no waiting. Sounds impossible?

Here’s how it works ⚙️

A trader borrows assets from a lending pool. 💰

Uses them for arbitrage, liquidations, or yield farming. 🐄

Returns everything in a single transaction. If they fail, the whole process is canceled as if nothing happened. 🚀

It’s a clever system, but also a dangerous one. 👇

Hackers often use flash loans to manipulate token prices or exploit vulnerable smart contracts. ⚠️ Because it all happens in one block, there’s almost no time to react.

Still, flash loans can be used for good. 💼 They enable risk-free arbitrage, quick refinancing, and efficient capital use. One could say that in DeFi, the same tools that create value can also cause chaos.

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.