- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

First of all, everyone at CoinBrain wishes you a Merry Christmas if you celebrate, and a Happy New Year. 🎄 Let’s hope our portfolios pick up steam next year. Welcome to another edition of The Crypto Minute, and enjoy! 🚀

⤵️ Today’s Agenda:

The FCA just kicked off a full-on UK crypto rulebook build, shifting from patchwork oversight to real market structure.

Sniping and coordinated wallet clusters can wreck “fair launch” narratives fast and turn late buyers into exit liquidity.

Some pumps are pure rotation: the real tell is whether the move holds when the broader market turns up. $ZEC situation explained.

Quantum is probably “not soon,” but the storyline hits confidence and can steer flows until there’s a credible contingency plan.

We’re focusing on RWA tokens, tokenized real-world yield/assets and the onchain rails that pull TradFi cashflows into crypto markets.

And more…

📊 Market Snapshot

| $88,662.52BTC-1.9% | $2,996.76ETH-3.8% | $3TCrypto Market Cap-2.6% | 20 (Extreme Fear)Fear & Greed Index-1 from last week |

📰 News Recap (Dec 15 to Dec 21)

UK Crypto Rules Incoming: FCA Hits “Publish” 🏛️

The FCA just dropped a massive consultation that’s basically the blueprint for how the UK wants crypto to behave, from exchanges and lending to staking and even parts of DeFi. 🧾🔍

Until now it’s been a messy patchwork, mostly AML plus “don’t market like a degen” rules. 📅 This feels more like a full market structure play, with a clear runway toward an Oct 25, 2027 go-live. ⏳

Big themes: tighter exchange oversight, smoother access to global liquidity, and a UK-specific take on staking with its own tailored requirements. ⚙️🌍

If the rules land well, the UK could become the middle path between US chaos and EU MiCA rigidity. If not, builders ship elsewhere. 😅 Can London stay a top financial hub?

Solana AI Token Ava Allegedly Got Sniped 😬

Bubblemaps says $AVA had a nasty launch: 23 wallets tied to the deployer allegedly scooped about 40% of supply right at genesis. 🤖

The wallets look “sybil-ish” too (More on this type of attack below in Scam Alert!), funded around the same time, similar sizes, same CEX routes, then instantly aped at launch. That’s the classic bot-snipe playbook. 🕵️♂️⚡

$AVA launched via Pump.fun with the whole “fair, community” vibe, but a single cluster owning that much supply is a huge red flag for dump risk. 🚩💀

Price-wise, the pain is all too real. $AVA later nuked around 96% from the peak. 📉 It’s the classic crypto story, really.

Raoul Pal: $ZEC Might Be Rotation, Not A Trend 🧠

$ZEC has been ripping, but Raoul Pal (Real Vision’s CEO and a macro investor) says the pump looks more like capital rotating into a new narrative than the start of a durable trend. 👀

🔎 He asks, when the whole market pushes up, does $ZEC keep climbing or does it fade?

He wants to see it build a real base and then grind higher again. Until that happens, he’s not chasing, he’d rather look for entries on the next down cycle. 🧱😅

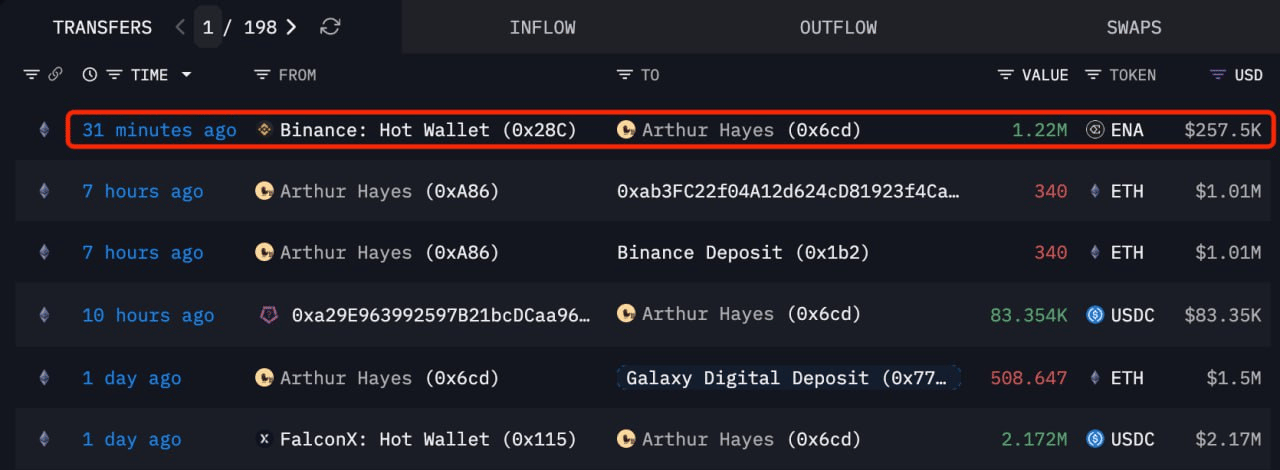

Narrative fuel is still there though: Arthur Hayes tossed out the $10,000 target, and Grayscale filed to convert its Zcash Trust into a spot ETF. 🔥🏛️

🌍️ Story of the Week: Anxiety Over Quantum Risk Is Weighing on Bitcoin’s Price

👉 Quantum FUD is back, and it’s doing what it always does: messing with flows.

Some execs say the real issue isn’t the tech, it’s the vibes. Investors want a plan, and they hate hearing “nothing to see here.” 💸

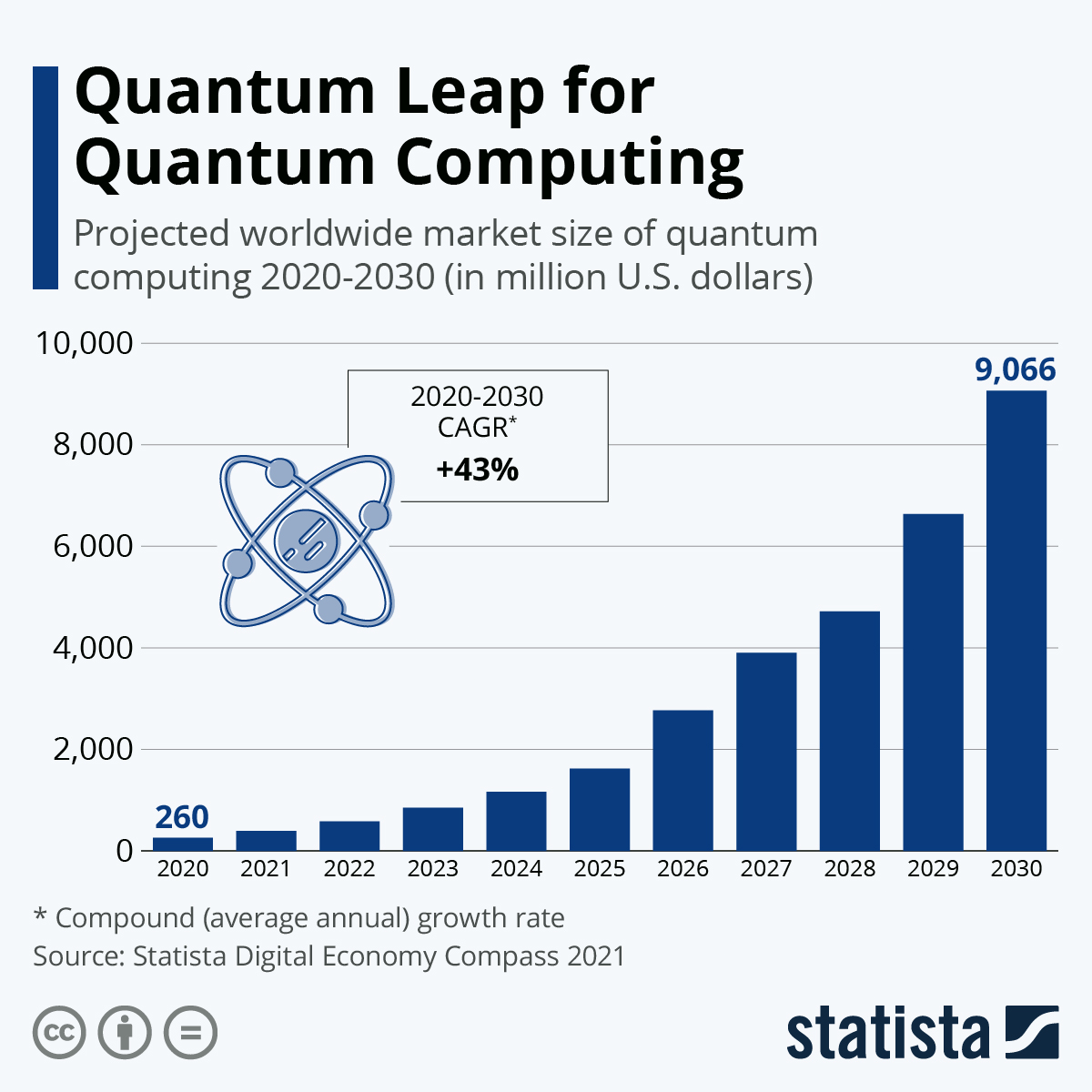

Chart showing projected growth in the quantum computing industry.

Adam Back (Blockstream co-founder, long-time Bitcoin OG, and my personal pick for Satoshi Nakamoto) says $BTC should be “quantum-ready,” but the threat is still way out on the horizon.

In Adam’s view, quantum computing is still early-stage and not something that should break Bitcoin anytime soon. 🧪⏳

Others aren’t buying the shrug. 👀 Nic Carter (Castle Island Ventures) called it bearish that influential dev voices downplay quantum risk, because capital is clearly thinking about worst-case scenarios and wants credible mitigation, not dismissal. 📉

Craig Warmke (Bitcoin Policy Institute) echoed the gap: even if retail explains it clumsily, the concern is real in the market, and that perceived risk can push big holders to diversify or hesitate on adds. 🐳🤷♂️

There’s already serious hardware behind quantum computing: this is a dilution-refrigerator cryostat, commonly made by vendors like Bluefors.

What This Means for Traders 🧩

Quantum might be “not soon,” but narratives trade now. ⚠️ The clean path forward is boring but bullish: acknowledge the risk, communicate clearly, and converge on contingency upgrades so holders feel safe holding size. 🔧

Also, if quantum ever gets scary, banks and governments are probably first on the hit list. 🔍 But $BTC is priced on confidence, so watch the messaging as much as the math. ⚡

Alpha Leak 👉 RWA Tokens

This massive trend has been mentioned on The Crypto Minute many times. RWA, or real-world assets, are gaining serious momentum by connecting TradFi and blockchain. 📈

The idea: real-world yield and real-world assets are getting wrapped into onchain rails, so capital can move faster, settle cleaner, and trade 24/7. 🧾 Think tokenized T-bills, funds, credit, and other cashflow stuff that doesn’t need memes to work.

The bigger regulatory clarity gets, the more TradFi feels comfortable dipping its toes in. And once that door opens, liquidity follows big time. 🌍💰

Still, not all RWA is the same lane, so know what you’re buying: infra, credit, or tokenized yield products. 📚🛠️

Projects to watch 👇

Ondo Finance ($ONDO): tokenized yield products, often tied to US treasuries and TradFi style exposure.

Centrifuge ($CFG): infra that brings real world cashflows into DeFi via onchain financing.

Maple ($SYRUP): onchain credit markets, focused on institutional style lending.

Goldfinch ($GFI): private credit rails connecting onchain capital to real world borrowers.

Clearpool ($CPOOL): decentralized credit marketplace for institutional borrowing.

Polymesh ($POLYX): L1 built for regulated assets and security token style issuance.

🐋Smart Money Tracker

Monday, Dec 15th: As the market dipped, the 66kETHBorrow whale is back accumulating $ETH, after previously buying 489,696 $ETH ($1.5B).

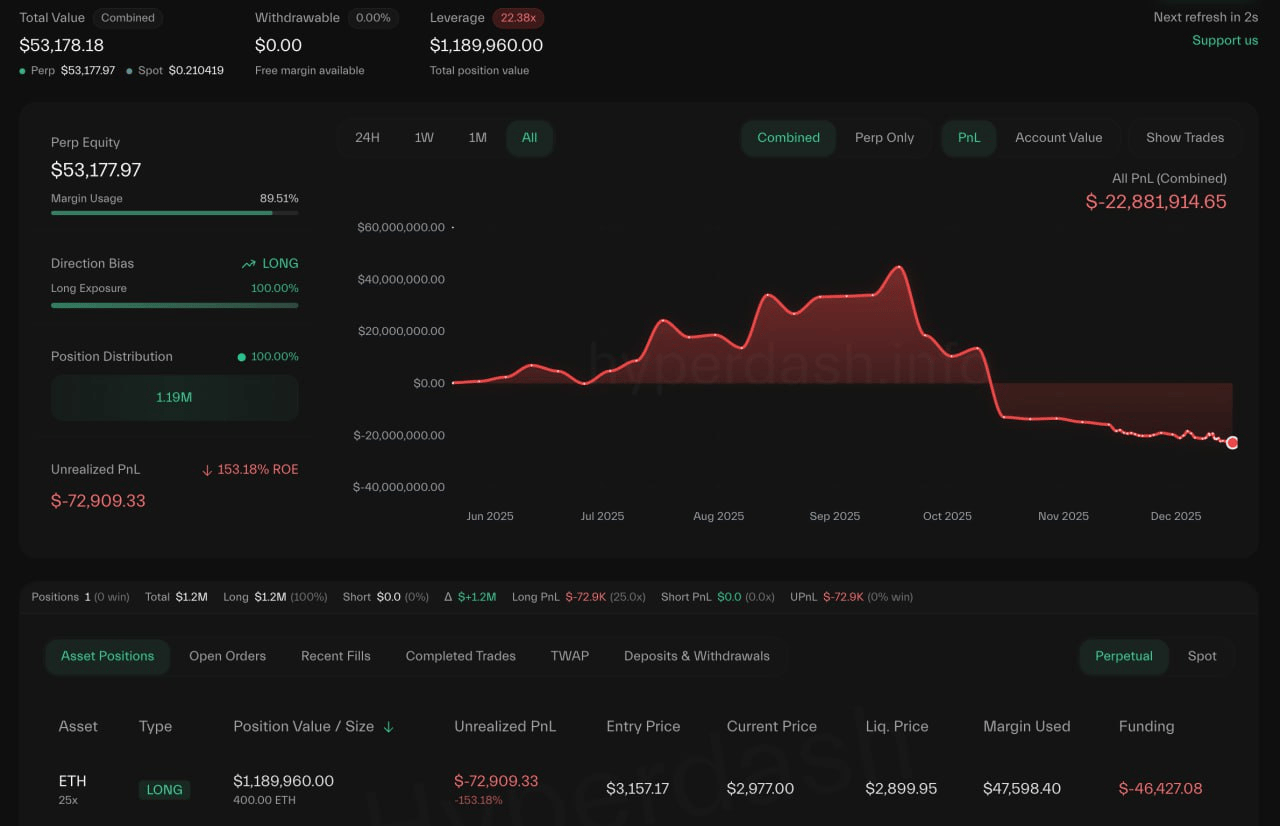

Tuesday, Dec 16th: The crypto influencer Machi is still the liquidation champ: 10 more liquidations, 200 since the Oct 11 crash, and losses topping $22.88M. RIP bozo.

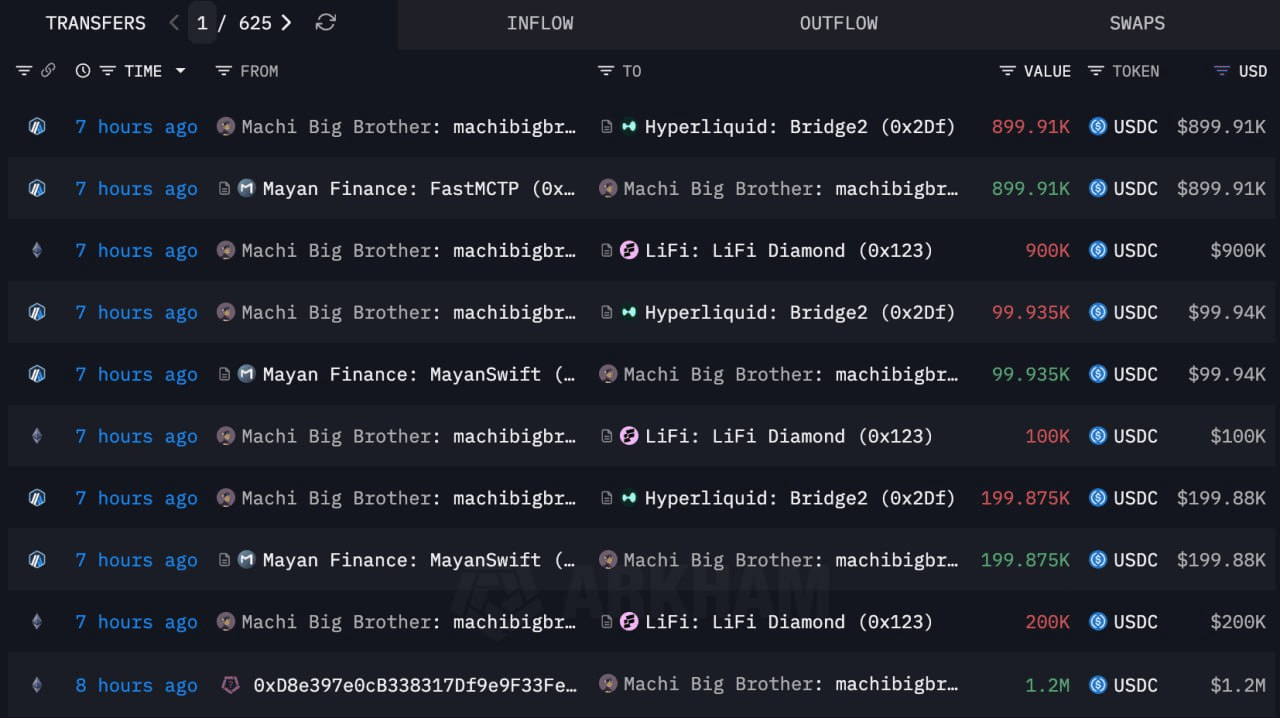

Wednesday, Dec 17th: Machi just topped up the war chest: he sent another 1.2M $USDC to Hyperliquid and opened a fresh 25x long on 4,100 $ETH ($12.08M). More liquidations to come!

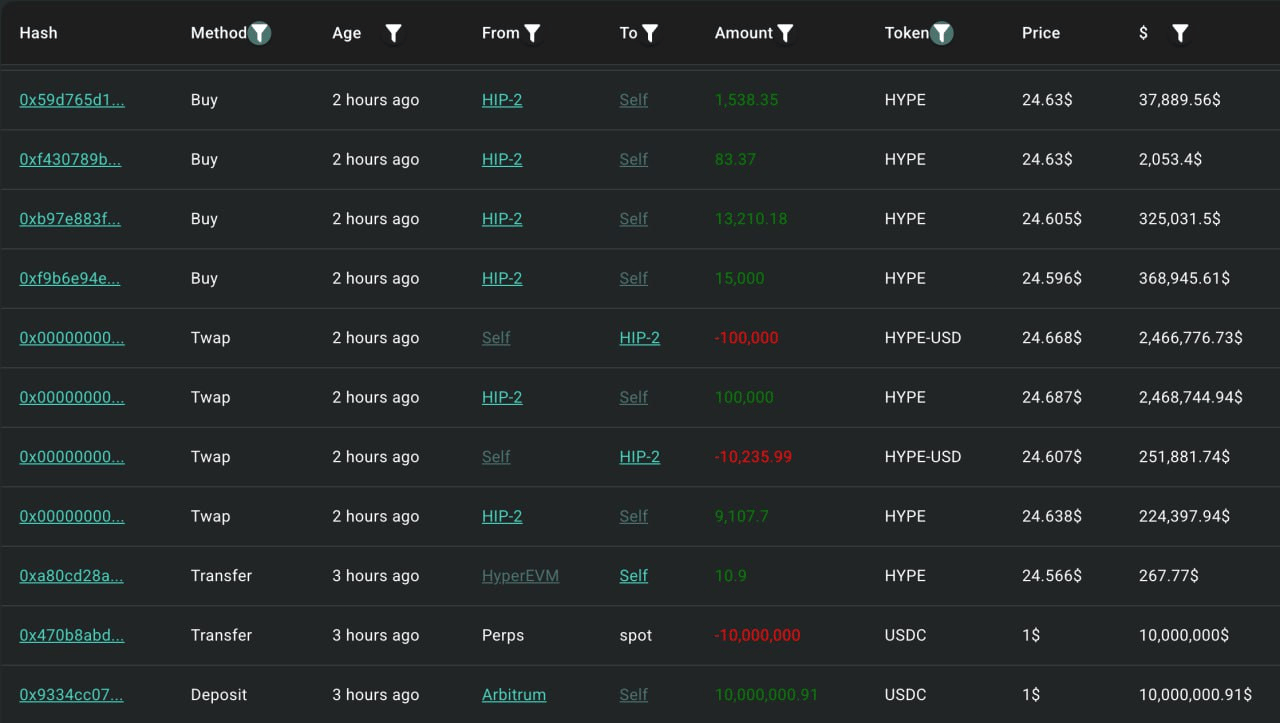

Thursday, Dec 18th: Whales are loading up on $HYPE: roughly $37M $USDC just hit Hyperliquid to scoop bids around $15-$25.6, with one wallet now holding 926,488 $HYPE ($22.4M).

Friday, Dec 19th: Vitalik Buterin just offloaded 29,500 $KNC (about $6K) plus 30.5M $STRAYDOG, cashing out 15,916 $USDC.

Source: Lookonchain

🔒 Major Token Unlocks of the Week

$0G - 1.23% of the locked supply will enter circulation on Dec 22, 2025.

$H - 1.05% of the locked supply will enter circulation on Dec 25, 2025.

$TAKE - 1.55% of the locked supply will enter circulation on Dec 25, 2025.

$AXL - 1.10% of the locked supply will enter circulation on Dec 27, 2025.

$EDU - 2.10% of the locked supply will enter circulation on Dec 28, 2025.

Explore more unlocks with full vesting details.

⚠️ Scam Alert: Sybil Attack

As promised, we explain the Sybil attack. 🔎 It occurs when one player spins up a bunch of wallets to look like “many different buyers,” but it’s really one coordinated entity behind the curtain. 🎭

In token launches, it’s often used to bypass limits, snipe supply faster, or fake organic demand and distribution. The chart pumps, CT screams, and the same cluster is already sitting on a bag. 🚀😬

Common fingerprints include fresh wallets with no history, similar funding amounts, funds arriving in the same tight time window, and copy-paste behavior right after launch. ⏱️

Why does it matter? 🤔

If a hidden cluster controls a big chunk of supply, they can dump into liquidity, crush price, or set up a slow bleed that nukes late buyers. 📉💀

How to protect yourself? Just check top holders, watch for new-wallet clusters, be extra cautious on “fair launches,” and avoid chasing the first candle unless you’re fine being exit liquidity. 🧯👀

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.