- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

Each week is getting crazier than the last, those files must be insane. 📂 This time, the big fight was over pressure on the Fed to cut rates. 🏛️📉 We look at how that could weaken the US economy and why it might hurt crypto long-term. ⚠️

Also, the White House insider is back with more bets, this time on Iran. 🎯

⤵️ Today’s Agenda:

The Crypto Fear & Greed Index FINALLY flipped back to “greed” as $BTC pushed toward a two-month high and signs of retail capitulation started showing up.

Zcash caught a rare regulatory break after the SEC closed its 2023 probe, easing one of the biggest headline risks hanging over privacy coins.

A top-500 short squeeze wiped out crowded bearish positioning across perps and futures, with $BTC and $ETH doing most of the damage as the mood turned risk-on.

Powell’s clash with Trump escalated into a Fed independence crisis narrative, raising the stakes for rates, dollar credibility, and how $BTC trades macro in 2026.

Scam Sniffer is the kind of boring tool that saves real money. We look at why you should use it.

And more…

📊 Market Snapshot

| $95,258.34BTC+4.9% | $3,337.20ETH+7.0% | $3.23TCrypto Market Cap+4.2% | 49 (Neutral)Fear & Greed Index+20 from last week |

📰 News Recap (Jan 12 to Jan 18)

Fear & Greed FINALLY Flips Back to Greed 🧭

On Thursday, the Crypto Fear & Greed Index printed 61, its first “greed” read since the October wipeout that flushed about $19B of liquidations and sent everyone sprinting out of alts. 😵💫 It was 48 just a day earlier.

$BTC helped push the mood. It climbed from about $89,799 to $97,704 over the last 7 days as of writing, tagging a two-month high. 📈 The funny part is $BTC was last above $97K on Nov 14 while the index was still screaming “extreme fear”.

This index is a vibes dashboard, not a prophecy. It blends things like volatility, volume and momentum, Google search interest, and social sentiment. 🧠

Santiment also pointed out that non-empty $BTC wallets dropped by about 47,244 over the week, basically retail tapping out from FUD and impatience. 🫠

They also flagged exchange supply near a seven-month low around 1.18M $BTC, which usually reads as less instant sell pressure. 🏦 Are we back? 🤔

Zcash Gets A Rare SEC W ✅🔒

Zcash ($ZEC) has been on fire in recent months, with an over 800% jump in price and a huge bump in mining activity. 📈 There was still one issue, though… the SEC was not happy about the privacy it provided. 🥲

Now, the Zcash Foundation says the SEC has closed its 2023 investigation and will not pursue enforcement, ending a probe that began after an SEC subpoena in August 2023. 🔍

👉 For $ZEC, that is the big deal. A lot of the “privacy coin” discount is just regulatory overhang, and this removes one major headline risk.

Do not overread it as a blanket blessing for every privacy token, but it does show the SEC can look at a privacy-focused project and still decide to walk away. 🔐

Meanwhile, US lawmakers are still trying to draw clearer lines on who regulates what. 💡

The Senate Banking Committee’s CLARITY Act markup was on the schedule, then got canceled/delayed after pushback, so the rules fight is very much still live. 🏛️

Short Squeeze Tor ch-Wipes Top-500 Crypto Shorts 💥

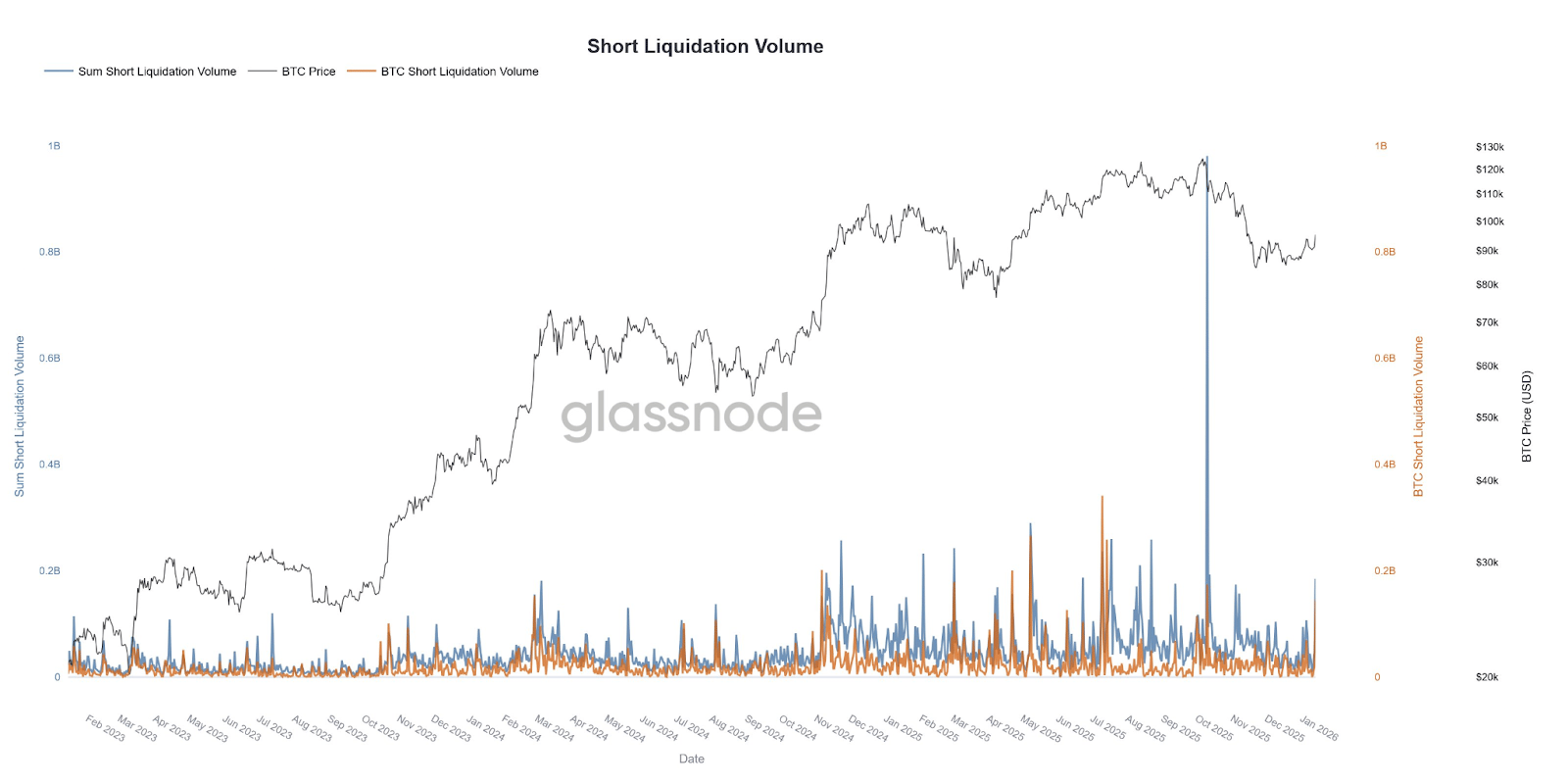

Bears got squeezed hard. 😄 About $200M in short positions across futures and perps were liquidated on Wednesday, the biggest short-wipe since the early October selloff. 😵

What happened? 🔄 Prices bounced, shorts had to buy back to stop the bleeding, and that buying turned into more upside.

$BTC took the biggest hit with $71M in short liquidations in 24h, then $ETH at $43M, and $DASH with a wild $24M. 🧨

This also lined up with sentiment thawing out fast. 📊 As we already mentioned, fear flipped back to greed for the first time since early October, which is usually when crowded short positioning gets punished. 👀

Geopolitics are in the mix too. Traders are pointing to Fed independence drama and the Maduro capture headline as part of why $BTC is outperforming the dollar, with $BTC up 10.6% YTD versus 0.75% for DXY. 🌍

🌍️ Story of the Week: Bitcoin Pops After Powell Pushes Back on Trump’s Fed Attack

If you follow financial markets, you probably already know how dire the situation at the Fed is. 🏛️😬 It has the potential to seriously weaken the dollar over the next few years. But what does that mean for $BTC? 👀

What Happened? 🔎

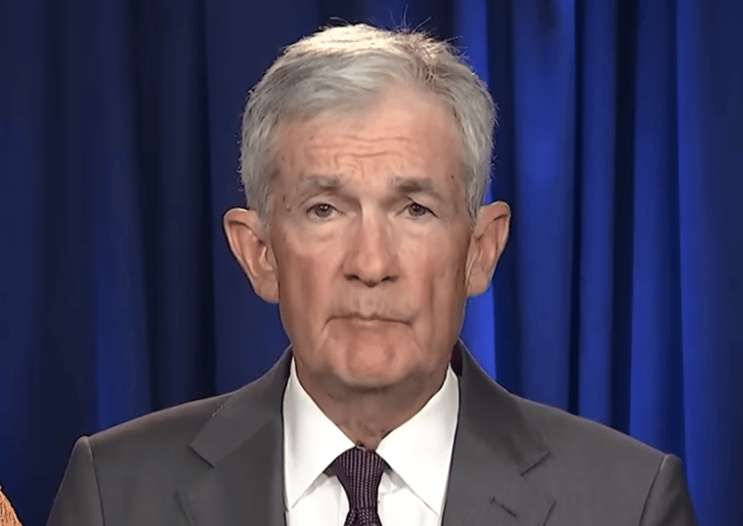

$BTC jumped about 2% on Sunday after Fed Chair Jerome Powell publicly vowed to hold the line against a fresh escalation from President Trump. 📈

The trigger is completely wild, even if it was overshadowed by Greenland. 👉 The Justice Department served the Fed with grand jury subpoenas and is threatening a criminal indictment tied to Powell’s June 2025 Senate testimony about Fed building renovations.

Powell’s response was basically: this is not about renovations, those are just the pretext. ⚠️

Powell’s term as Fed Chair ends May 15, 2026, and then Trump gets to pick the next Chair, pending Senate confirmation.

Keep in mind, this is not normal politics. 🚨 This is EXTREMELY dangerous for the US economy AND dollar dominance. So much that even some Republicans broke ranks.

The Fed is supposed to be insulated from the White House, and Powell framed the pressure as punishment for setting rates based on data, not the president’s preferences. Trump, meanwhile, has been pushing hard for deeper rate cuts. 🧨

Crypto cares because it’s rate-sensitive. Easier policy usually means more liquidity and more appetite for risk, which can lift $BTC and the whole “tech-style” crypto stack. 📈

🛎️ But if the US economy actually weakens long-term, that is not a free win, it can mean tighter financial conditions later, nastier volatility, and risk-off waves that hit everything. 🪙

What Would “Capturing the Fed” Mean for Crypto? 💡

Faster rate cuts could pump risk assets in the short term, including $BTC, but it can turn into a sugar high. 🚀

Fed credibility gets hit, which can weaken the dollar narrative and make $BTC look more like a hedge, but also raises overall volatility. 🌪️

Bond markets may freak out, pushing yields up anyway, which can offset the “rate cuts are bullish” story. 📉

Policy uncertainty spikes, and crypto tends to trade that like a leveraged headline machine. 📰

Liquidity regime matters more than vibes: if markets believe the Fed is politicized, every meeting becomes a drama trade. 🎭

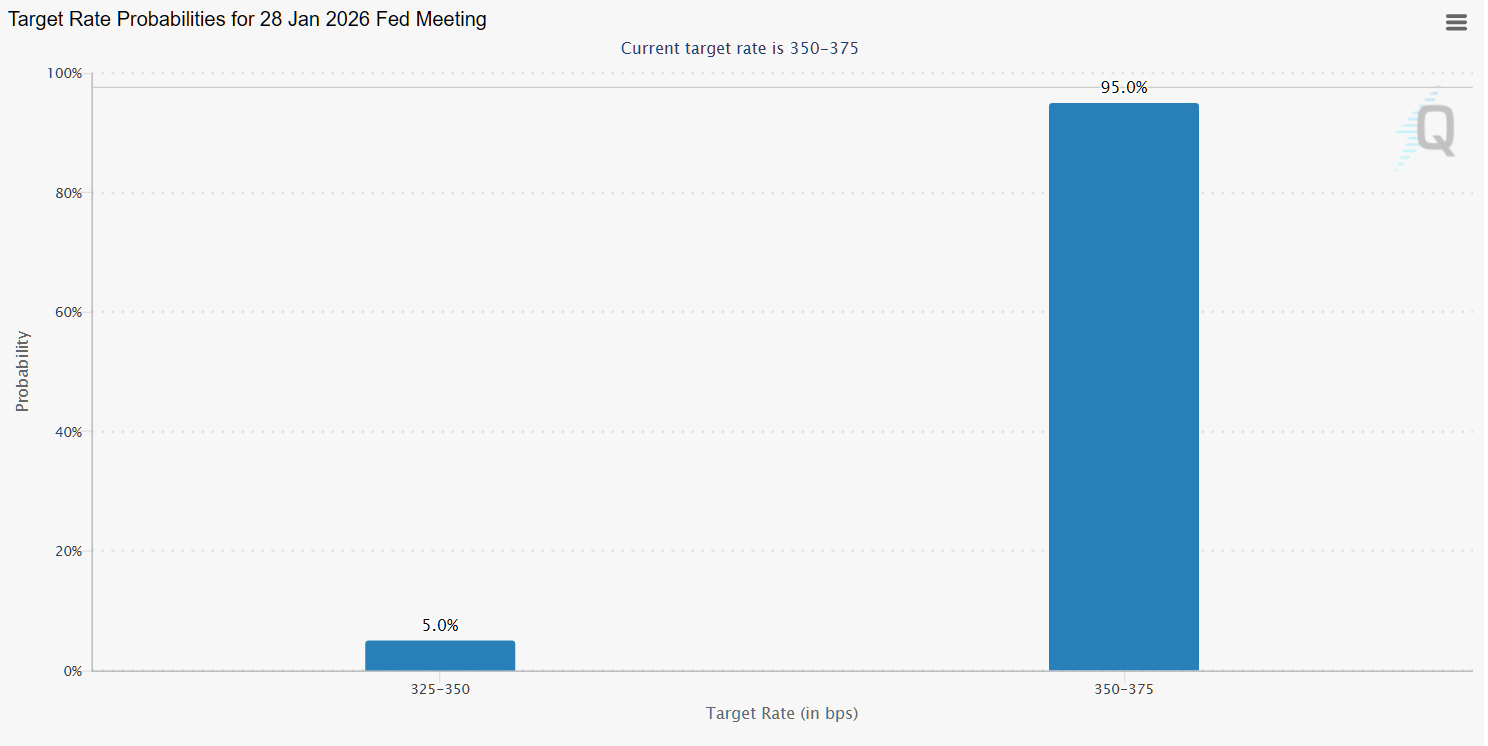

For the near term, FedWatch still points to the Fed holding rates steady at the Jan 28 meeting, so the bigger story is the institutional clash and what it does to confidence, not an instant pivot. ⏳

FedWatch is pricing a 95% chance the Fed holds at 3.50%–3.75% on Jan 28. Lower rates would be a clear political win for Trump.

Alpha Leak 👉 Crypto Index Baskets

The times are changing, bro. Alt season has been weird, so a lot of people are doing the laziest smart thing: buying baskets instead of marrying one ticker. 🧠📦 A crypto index is basically a prebuilt portfolio that tracks a theme or slice of the market, then rebalances over time. 📊

The tradable edge is rotation. 🔄 When a narrative catches a bid, you often see it in the basket before you pick the “right” single coin. If a DeFi or L2 basket moves while $BTC chills, that is a clean signal risk is rotating. 👀⚡

Common Index Plays 👇

21Shares Crypto Basket Index ETP, top five crypto basket ETP, issued by 21Shares. 🏛️

Bitwise 10: top 10 large caps, Bitwise (index funds). 🔟

Nasdaq Crypto Index (NCI): large cap benchmark basket, Nasdaq. 🧾

S&P Cryptocurrency Indices: broad market and sector style crypto indices, S&P Dow Jones Indices. 📈

GMCI Indices: broad and thematic crypto indices, GMCI (thematic baskets). 🧺

Just watch what you are actually buying. 🕵️ Some “theme” indexes are basically the same majors with a new label, rebalancing can create funky flows, and fees add up if you trade them like a meme. 💸

If you want exposure without getting chopped every day, the basket meta is underrated. ✅

🐋Smart Money Tracker

Monday, Jan 12th: $ETH OG who loaded 154,076 $ETH at a $517 average sent the last 26,000 $ETH (about $80.88M) to Bitstamp. Locked in roughly $274M in profit (+344%).

Tuesday, Jan 13th: Former NYC mayor Eric Adams launched the $NYC memecoin and yanked liquidity near the top, pulling about 3.18M $USDC from the pool, and the dump was brutal, one trader (Dr6s2o) got clipped for roughly $473.5K (−63.5%) in under 20 minutes. Someone got rugged by an ex-politician…

Wednesday, Jan 14th: As the market bounced, 1011short’s $845M longs across $BTC, $ETH, and $SOL flipped back into the green, printing over $51M in profit in the last 24 hours.

Thursday, Jan 14th: Whale 0x218A is down over $6.37M on 10× leveraged $BTC and $ETH shorts, so he just topped up 4.8M $USDC on Hyperliquid to dodge liquidation.

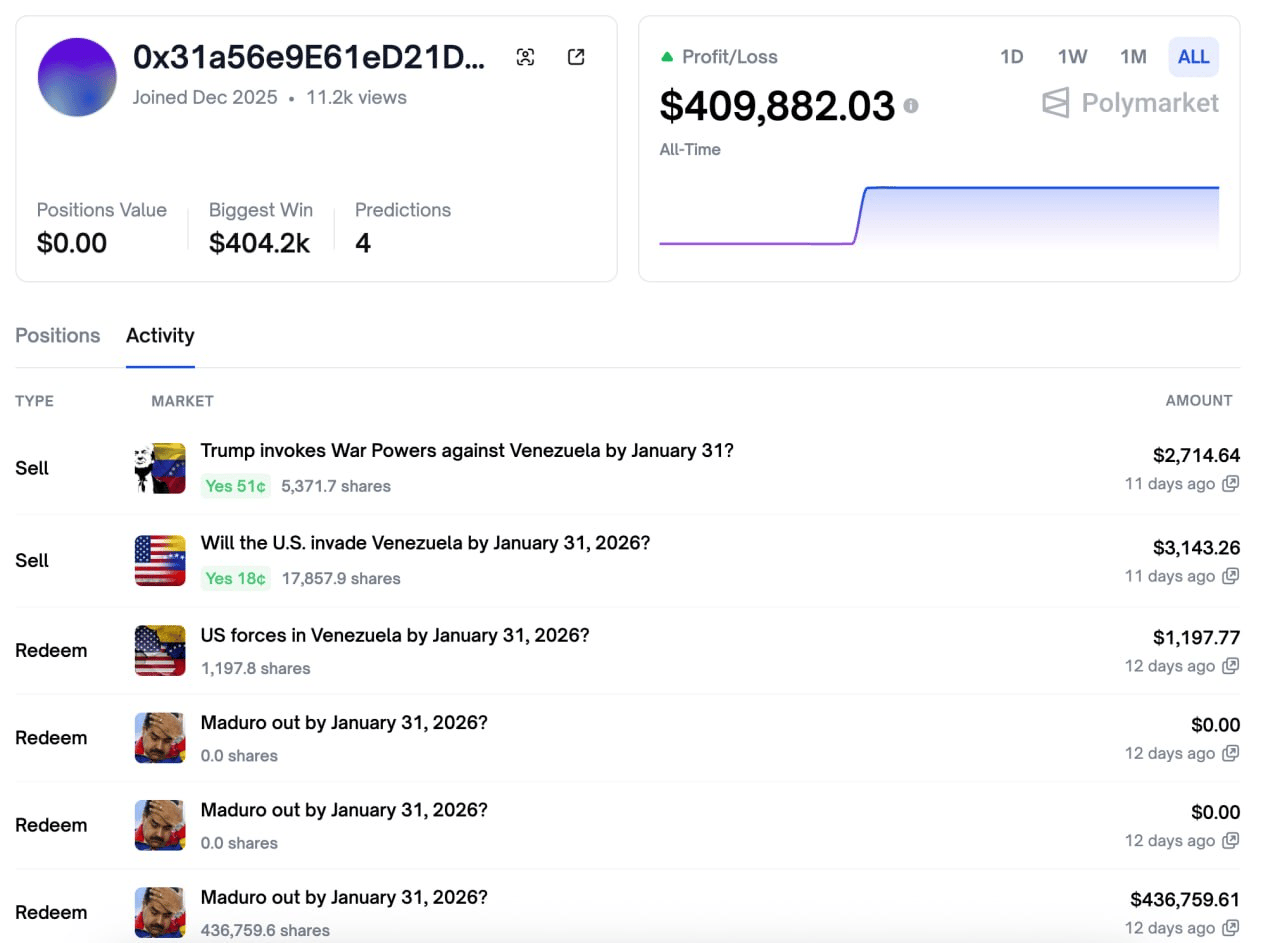

Friday, Jan 15th: Trump says the Venezuelan leaker is already in jail, and two of the three Maduro-bet winner wallets have gone quiet, while the remaining one (SBet365) is still placing fresh geopolitical bets. This time on Iran.

Saturday, Jan 16th: Wallet 0x8522 looped Aave borrowing, pulling 18.3M $USDe to buy 8,337 $XAUt (about $38.4M) over the last 20 days.

Source: Lookonchain

🔒 Major Token Unlocks of the Week

$MERL - 1.72% of the locked supply will enter circulation on Jan 19, 2026.

$ZRO - 3.26% of the locked supply will enter circulation on Jan 20, 2026.

$PLUME - 14.68% of the locked supply will enter circulation on Jan 21, 2026.

$MAMO - 2.75% of the locked supply will enter circulation on Jan 21, 2026.

$ALT - 1.95% of the locked supply will enter circulation on Jan 25, 2026.

Explore more unlocks with full vesting details.

💡 Tool for Traders: Scam Sniffer

Most “free money” losses still start with the same thing: a clean looking link that takes you to a fake claim page. One rushed connect, one bad signature, and your wallet is toast. 🪦

Scammers copy real brands perfectly now. Same UI, same docs, same fake support accounts, and URLs that are one letter off. 👀 You might think you’re too clever for this, but with a bit of FOMO, it’s over for you. 🚨

What Scam Sniffer Does?

🛡️ Scam Sniffer is a browser extension that flags known phishing domains and suspicious pages before you connect your wallet. Think of it as a seatbelt for degens who click fast.

How To Use It

Treat warnings as a hard stop, not a “maybe”. ⚠️

Still verify the URL manually, especially for claims and airdrops. 🔎

Use a fresh wallet for anything new, not your main stack. 🧪

Revoke approvals after sessions so old allowances do not linger. 🧹

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.