- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

Good day, frens 👋

🟩 After recent rallies, I hope that looking at your portfolio brings you much joy (don’t forget to take profits tho!)

This week, we have some interesting policy developments as well as a hefty dose of crypto drama 🎭️

Hold on to your handrails, this is The Crypto Minute by CoinBrain 🧠

⤵️ Today’s Agenda:

Trump signs an executive order allowing cryptocurrency, private equity, and alternative assets in 401 (k) retirement plans.

Coinbase’s Base network experiences a 30-minute shutdown due to "unsafe head delay".

SEC decided that cryptocurrency Liquid-staked derivatives do not count as securities, paving the way for more institutional adoption.

The Liquid staking provider Lido cuts 15% of its workforce due to “cost reasons“.

And more…

📊 Market Snapshot

| $120,599BTC+5.4% | $4,204ETH+18.2% | $4.09 TCrypto Market Cap+8.1% | 62 (Greed)Fear & Greed Index+10 from last week |

📅 Crypto Events You don’t want to Miss

📌 Tuesday, Aug 12th:

US Core CPI (monthly) – Inflation measure excluding food & energy; key for Fed policy.

US CPI (monthly & yearly) – Overall inflation snapshot; can move markets.

Delysium Cross-Chain Solution Agent release – A Tool to simplify cross-chain transactions.

📌 Thursday, Aug 14th:

US Core PPI (monthly) – Wholesale inflation without food & energy.

US PPI (monthly) – Tracks producer prices; early signal for CPI trends.

Solana Ecosystem Call (3:00 PM GMT+1) – Network updates & project showcases.

Lido Tokenholder Update Call – Governance, roadmap, and LDO token strategy.

📌 Friday, Aug 15th:

US Core Retail Sales (monthly) – Consumer spending minus autos.

US Retail Sales (monthly) – Overall consumer spending trend.

US Prelim UoM Consumer Sentiment – Gauge of consumer confidence.

US Prelim UoM Inflation Expectations – Public outlook on inflation.

🐋Smart Money Tracker

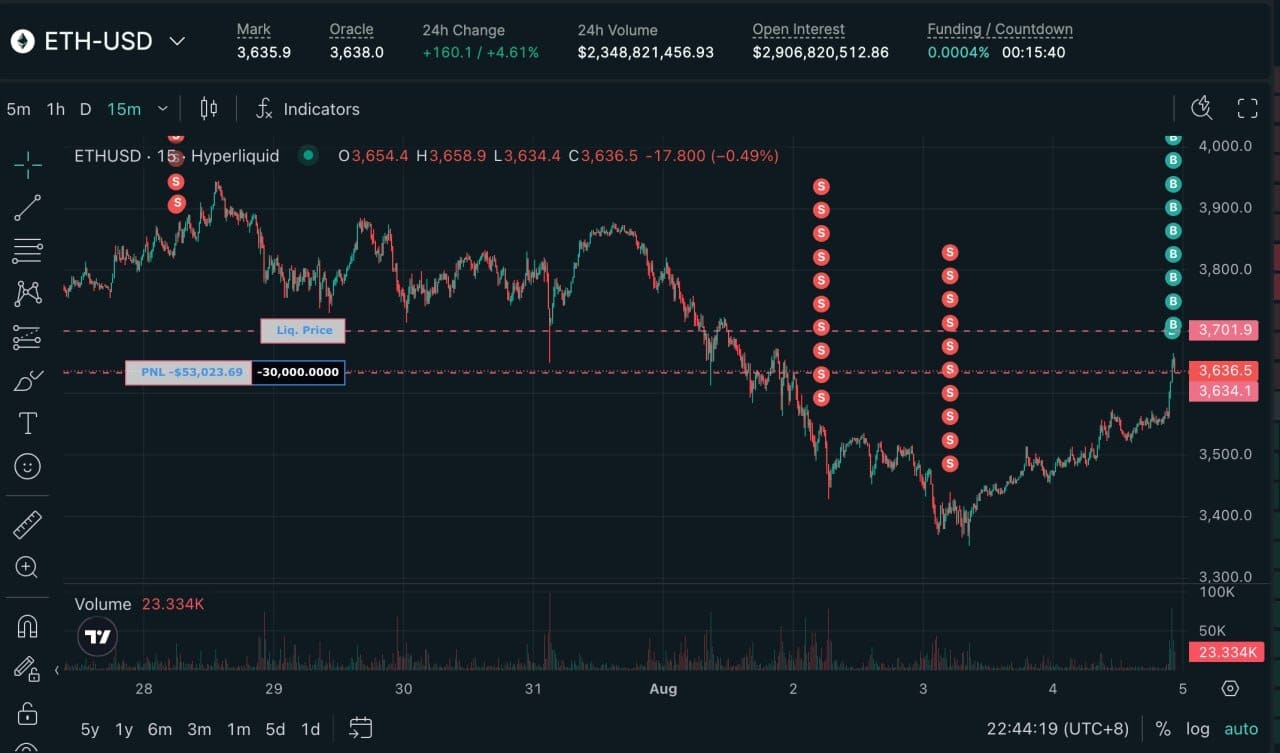

Monday, Aug 4th: Smart trader 0xcB92C had over $11M in unrealized profits yesterday but didn't take profit.

On this day, as $ETH bounced above $3,660, they cut their losses — now sitting on a $1.7M loss.

Tuesday, Aug 5th: This trader spent $22.8K to buy 27.86M $TROLL 3 months ago, sold 1.28M for $16.2K and still holds 26.57M $TROLL($2.48M).

With $TROLL’s recent surge, their position has flipped over 100x — nearly $2.48M in profit!

Wednesday, Aug 6th: Someone fell victim to a phishing attack, signed a malicious transfer, and lost 3.05M $USDT! 🪦

Thursday, Aug 7th: Trader 0xcB92 is no longer smart.

Once again, they didn’t take profits when they were up $4.25M — and are now on the edge of liquidation.

They have wiped out all the gains from their first 3 $ETH trades… and are now $2.34M in the red on principal.

Friday, Aug 8th: As $ETH broke through $4,000, whale 0xaf6c just bought 1,390 $WETH($5.56M) at $4,000.

They then deposited this 1,390 $WETH into Aave, borrowed 52.83 $WBTC($6.17M) from Aave, and swapped it for 1,539 $WETH($6.17M).

Saturday, Aug 9th: After $ETH broke above $4,200, previously smart trader 0xcB92 was fully liquidated, with total losses exceeding $15.85M.

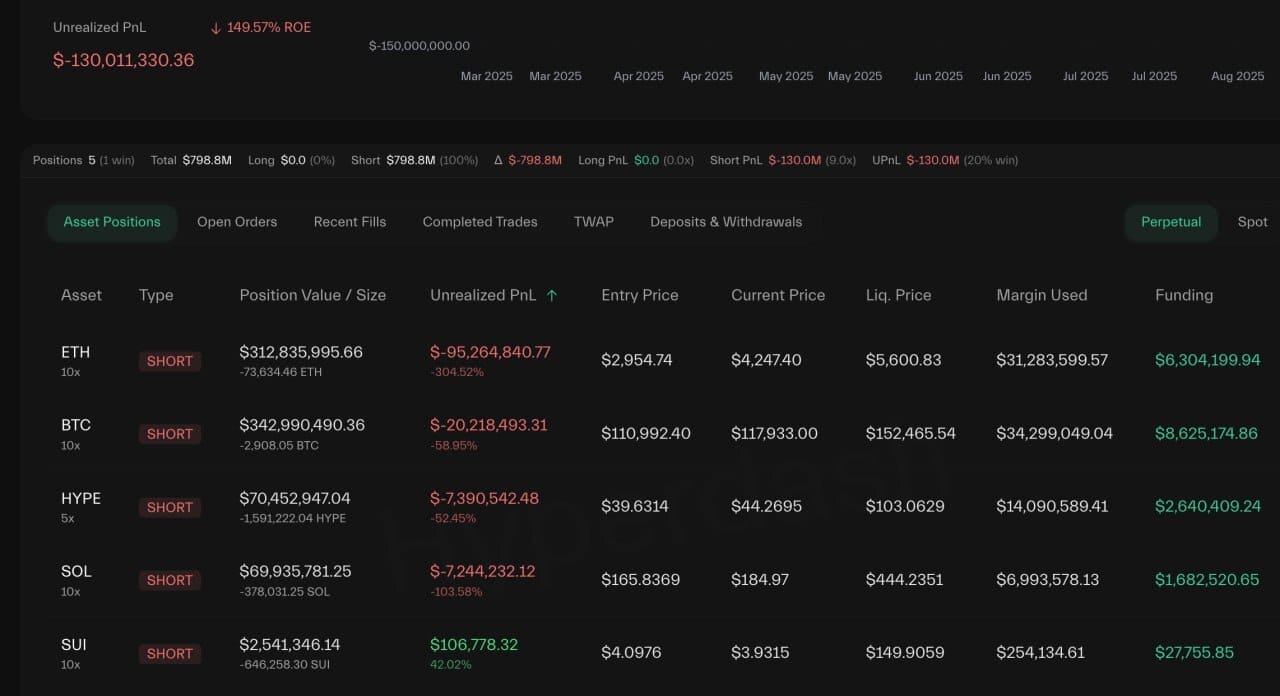

Sunday, Aug 10th: Abraxas Capital's 2 accounts are shorting $ETH, $BTC, $SOL, $HYPE, and $SUI as a hedge against spot holdings, with total unrealized losses exceeding $190M!

They're holding 113,819 $ETH ($483M) in shorts — down more than $144M.

Source: Lookonchain

📰 News Recap (Aug 4th to Aug 10th)

🚨 Base Takes a 30-Minute Coffee Break ☕

Oops! Coinbase's Base network decided to take an unexpected 29-minute nap on Monday morning, halting block production from 06:15 to 06:44 UTC 😴

The culprit? An "unsafe head delay" during an automated system switch - though engineers quickly identified and fixed the issue.

Base status page

This marks only Base's second major outage since launching in 2023 (the first was a 45-minute pause back in September).

The timing is interesting since it came just weeks after Base launched their flashy new "Flashblocks" feature for near-instant transaction updates.

Back to business as usual! 🔄

🎉 SEC Gives Liquid Staking the Green Light! ✅

The SEC just dropped some major clarity on liquid staking, saying certain forms are not securities when they're "ministerial or administrative" rather than entrepreneurial ventures 📋

This is HUGE for institutional adoption - think pension funds and asset managers now being able to earn 5-15% staking rewards.

All while keeping their capital liquid through tradeable receipt tokens.

Industry leaders are calling it a "watershed moment" that legitimizes institutional treasury strategies. 💼

📉 Lido Tightens the Belt with 15% Layoffs

Lido, the liquid staking protocol sitting on $31 billion in TVL, just announced a 15% workforce reduction across its teams 💼✂️

Co-founder Vasiliy Shapovalov was quick to clarify: "This decision was about costs — not performance."

As part of efforts to ensure long-term sustainability, Lido Labs, Lido Ecosystem, and Lido Alliance have made the hard decision to reduce the size of their contributor teams, impacting around 15% of the workforce.

This decision was about costs — not performance. It affects

— Vasiliy Shapovalov (@_vshapovalov)

8:02 AM • Aug 1, 2025

The move is all about long-term sustainability and keeping LDO tokenholders happy, even as the market heats up.

Sometimes you gotta trim the fat to stay lean and mean! 💪

LDO token saw a 4.3% bump despite the news, though it's still down 21.6% for the week.

⚖️ Tornado Cash Verdict: Guilty on One, Deadlocked on Others

The Tornado Cash co-founder was found guilty of operating an unlicensed money transmitter, but the jury couldn't reach a decision on money laundering and sanctions charges🌪️

Storm's defense argued he didn't want hackers using the platform and "dropped F-bombs" when he found out North Koreans were using it.

Judge: Let me see it...

Deputy: Mr. Foreperson, Count 1, how do you find?

Foreperson: Not unanimous.

Deputy 2: Count 2?

Foreperson: Guilty.

Deputy: Count 3, IEEPA?

Foreperson: Not guilty.— Inner City Press (@innercitypress)

4:32 PM • Aug 6, 2025

Prosecutors claimed the mixer facilitated over $1 billion in dirty money for groups like North Korea's Lazarus Group.

The crypto community, including Vitalik Buterin, rallied behind Storm with support, but this case highlights the ongoing battle over developer liability in DeFi protocols⚡

🌍️ Story of the Week: Trump Signs Crypto 401(k)

President Trump just signed another crypto-related executive order on Thursday 📜

The target? Cryptocurrency, private equity, and alternative assets in 401(k) retirement plans.

We're not talking small change here - this could unlock $12.5 trillion in retirement accounts! 🤯

⚡ What's Actually Happening?

Key agencies getting marching orders:

🏛️ Labor Department - Clear the regulatory path

🛡️ SEC - Facilitate alternative asset access

💰 Treasury - Coordinate rule changes

Translation for your wallet: Your future 401(k) could include Bitcoin ETFs alongside boring index funds! 🚀

The SEC must "consider ways to facilitate access to investments in alternative assets" - including revisions to accredited investor rules.

💬 Industry Reactions

Gerry O'Shea (Hashdex): "Sign that Trump is serious about giving investors digital asset access"

The pioneer: Fidelity became first major provider offering BTC in workplace plans (2022) - they saw this coming! 💼

The mood: Companies have been quietly waiting for exactly this moment.

🌊 The Bigger Picture

Trump's crypto strategy so far:

📌 Strategic Bitcoin reserve executive order

📌 168-page regulatory roadmap

📌 Multiple pro-crypto policy initiatives

📌 Now this 401(k) breakthrough

Potential impact: Billions flowing into crypto markets as everyday Americans get direct exposure through retirement accounts although higher centralization and bigger risks posed to the crypto ecosystem.

🔒 Major Token Unlocks of the Week

$DIMO - 2.5% of the total supply will enter circulation on August 12th, 2025.

$GFAL - 1.1% of the total supply will enter circulation on August 13th, 2025.

$BREED - 1.4% of the total supply will enter circulation on August 14th, 2025.

$APE - 2.0% of the total supply will enter circulation on August 17th, 2025.

Explore more unlocks with full vesting details.

💡 1 Minute Learning: Liquidation Cascades

Ever wonder why crypto prices sometimes plummet like an elevator with cut cables? Meet the fascinating phenomenon of liquidation cascades!

Here's how they work:

When traders use leverage (borrowing money to make bigger trades), they must maintain a certain collateral level.

If prices move against them, the exchange will forcibly sell their position — a "liquidation" — to prevent further losses.

But here's where it gets spicy 🌶️: One liquidation can trigger another!

As forced selling pushes prices lower, it triggers more liquidations, creating a domino effect that can send prices spiraling downward at dizzying speeds.

Example: In May 2021, over $8 billion in crypto positions were liquidated in just 24 hours, amplifying Bitcoin's drop from $47,000 to $30,000!

💡 Trading Tip: During market volatility, keep an eye on "liquidation data" dashboards. A spike in liquidations might signal a potential cascade opportunity — either to protect yourself or (if you're brave) to hunt for the bottom!

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.