- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

It has been seven years since the last US government shutdown. Not only Disney, Trump loves remakes of his shows too!

A ton has happened this week. 💥 New Bitcoin growth forecasts, a stablecoin market in rocket mode 🚀, and fresh tokenization projects making headlines. 📰

⤵️ Today’s Agenda:

The US government entered a shutdown, freezing data releases but leaving markets steady.

TOKEN2049 made headlines after a sanctioned sponsor was removed and debates over stablecoins dominated.

World Liberty Financial revealed a crypto debit card and plans to tokenize Trump-linked real estate.

Standard Chartered raised its Bitcoin target to $135K, citing strong ETF inflows.

Stablecoins added a record $46B in Q3 as demand and policy clarity grew.

And more…

📊 Market Snapshot

| $122,902BTC+12.0% | $4,536ETH+12.9% | $4.28TCrypto Market Cap+7.9% | 74 (Greed)Fear & Greed Index+37 from last week |

📅 Crypto Events You Don’t Want to Miss

Another season of the “Government Shutdown” series is here! Some reports might be delayed.

📌 Wednesday, Oct 8th:

US FOMC Meeting Minutes: The Fed’s diary drop. Markets scan every line like it’s a hidden treasure map for future rate moves.

📌 Friday, Oct 10th:

US Prelim UoM Consumer Sentiment: A mood check on US shoppers. Happy consumers = stronger economy.

US Prelim UoM Inflation Expectations: What people think prices will do next.

🐋Smart Money Tracker

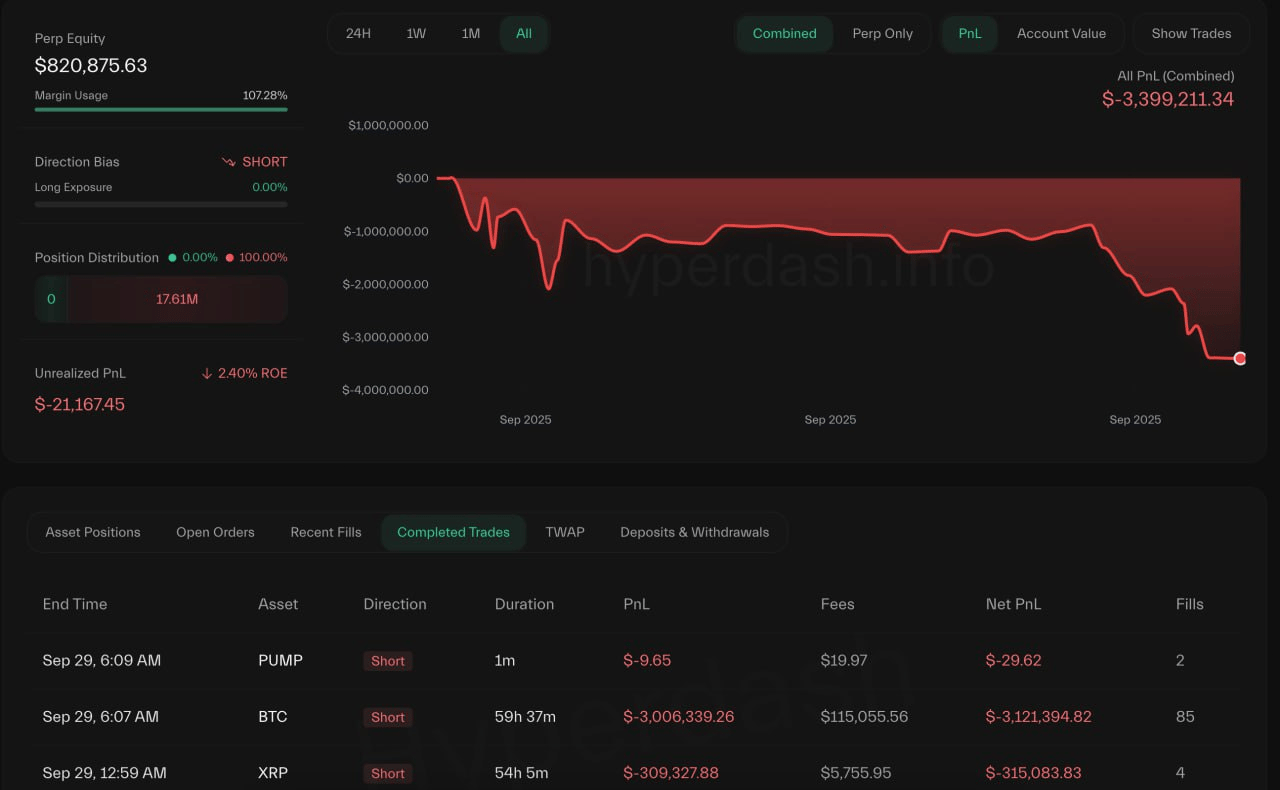

Monday, Sep 29th: A gambler got hit with a $3.4M loss on $BTC and $XRP shorts, then went straight back in with a 20x short on 6.17M $XRP ($17.6M).

Tuesday, Sep 30th: Fresh wallets loaded up with $ETH, one grabbed 25,369 $ETH ($106.7M) from FalconX while another pulled 4,985 $ETH ($21M) out of OKX.

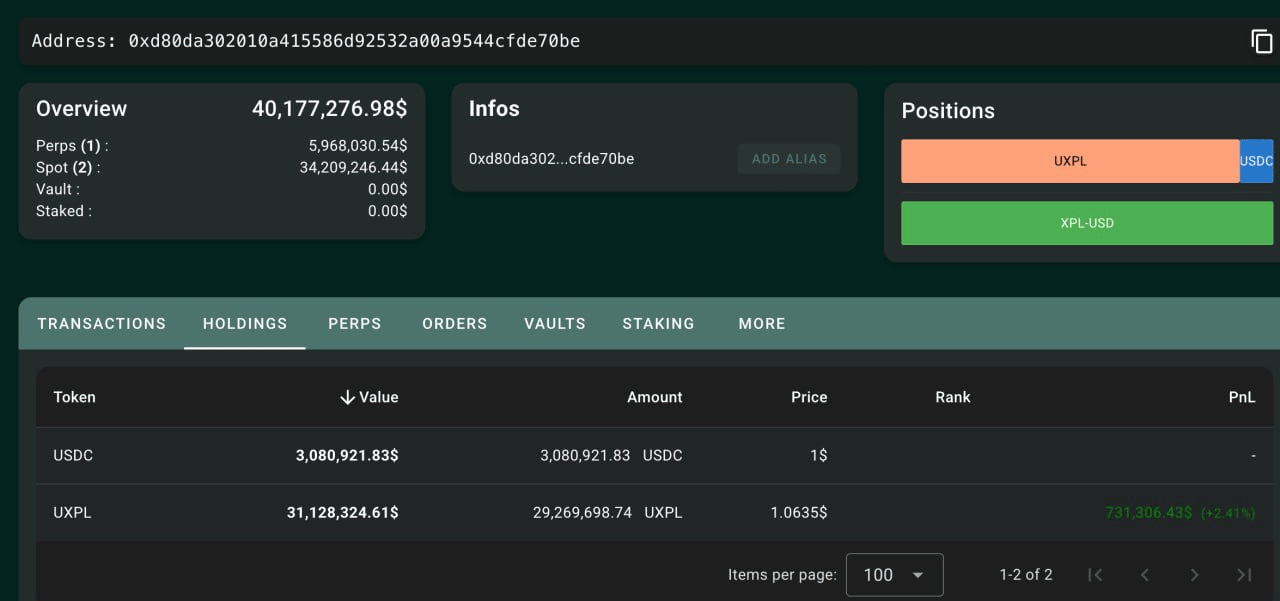

Wednesday, Oct 1st: A mysterious whale sent 31.52M $USDC into Hyperliquid and scooped up 29.27M $XPL ($31.1M).

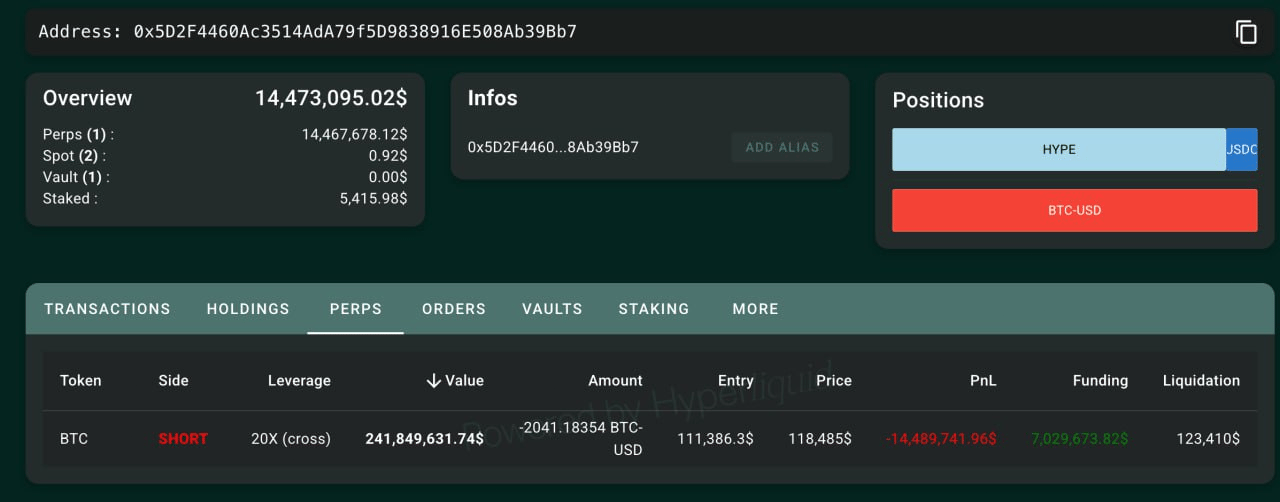

Thursday, Oct 2nd: A whale shorting 2,041 $BTC ($241.8M) dropped 12M $USDC into Hyperliquid to dodge liquidation.

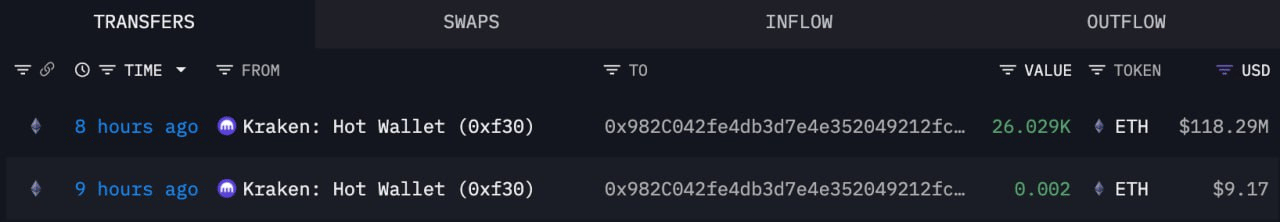

Saturday, Oct 4th: Fresh whale wallets loaded up again, pulling 26,029 $ETH ($118M) from Kraken and 620 $BTC ($76M) from Binance.

Source: Lookonchain

📰 News Recap (Sep 29–Oct 5)

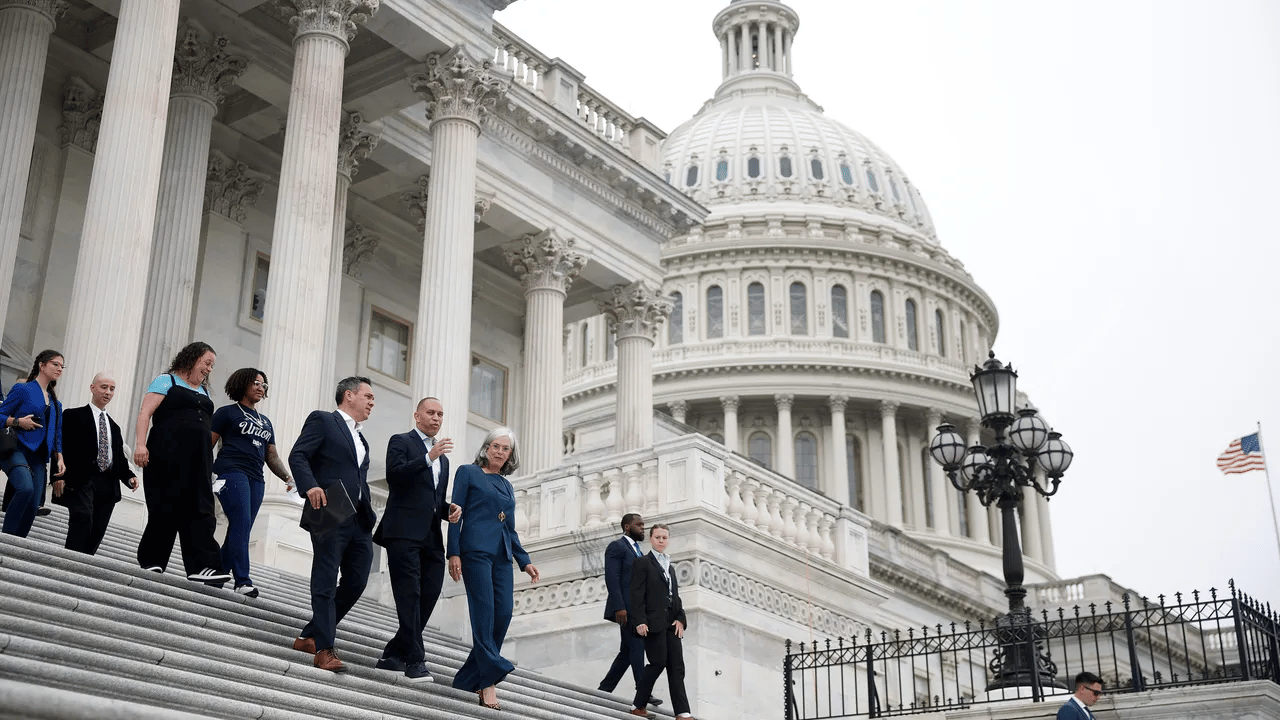

Government Shutdown Begins 🏛️

😬 Washington finally pulled the trigger. The US government officially entered a shutdown on October 1 after lawmakers failed to agree on a new funding bill.

Federal agencies are now running on skeleton crews, and most economic data releases are paused. 💀

💡 Markets didn’t panic but remain uncertain. For now, the world’s largest economy is on a forced coffee break. ☕

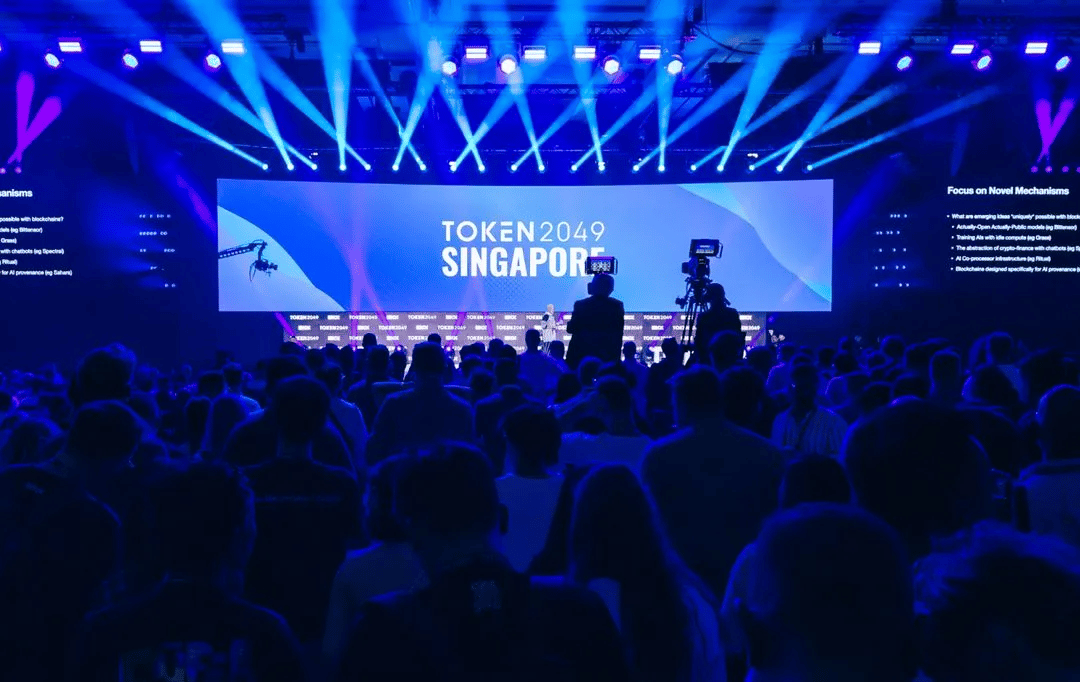

TOKEN2049 took over Singapore this week ✨

Two most notable things:

A rouble-backed stablecoin called A7A5, under US and UK sanctions, somehow showed up as a platinum sponsor before getting quietly removed after public pressure. 💰

World Liberty Financial used the spotlight to tease its new crypto debit card and plans to tokenize real estate, including Trump Tower. 🏦

On top of that, the whole event was a spectacle: DJs, ziplines, Trump Jr., and endless debates about stablecoins and regulation. 🎉

World Liberty Financial puts big ideas on stage 💡

As we mentioned above, at TOKEN2049, World Liberty Financial presented its upcoming crypto debit card that aims to connect digital assets with everyday spending. 💳

The pilot should launch next quarter, with a full rollout expected in late 2025 or early 2026.

🏠 The company also teased plans to tokenize real estate, oil, gas, cotton, and timber, including properties linked to the Trump family such as Trump Tower Dubai.

Add in their $USD1 stablecoin and $WLFI token, and it’s clear they want a full crypto-finance ecosystem. 🤔

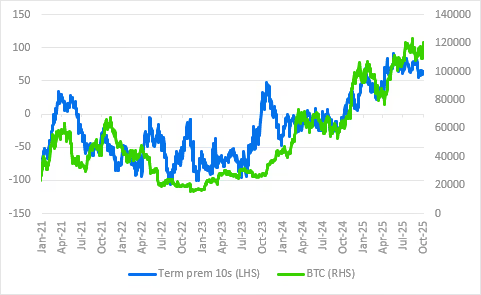

💰 Standard Chartered goes ultra bullish on Bitcoin

🚀 The bank raised its $BTC target to $135,000 and hinted it could hit $200,000 if ETF inflows keep up.

Analysts say the recent rally shows growing institutional demand, especially as spot Bitcoin ETFs continue to attract massive capital. 📈

For once, the banks are more bullish than the traders. 😎

In the picture, you can see Bitcoin’s price vs. the U.S. 10-year Treasury term premium. 👇

🌍️ Story of the Week: Stablecoins Saw Record $46B Inflows

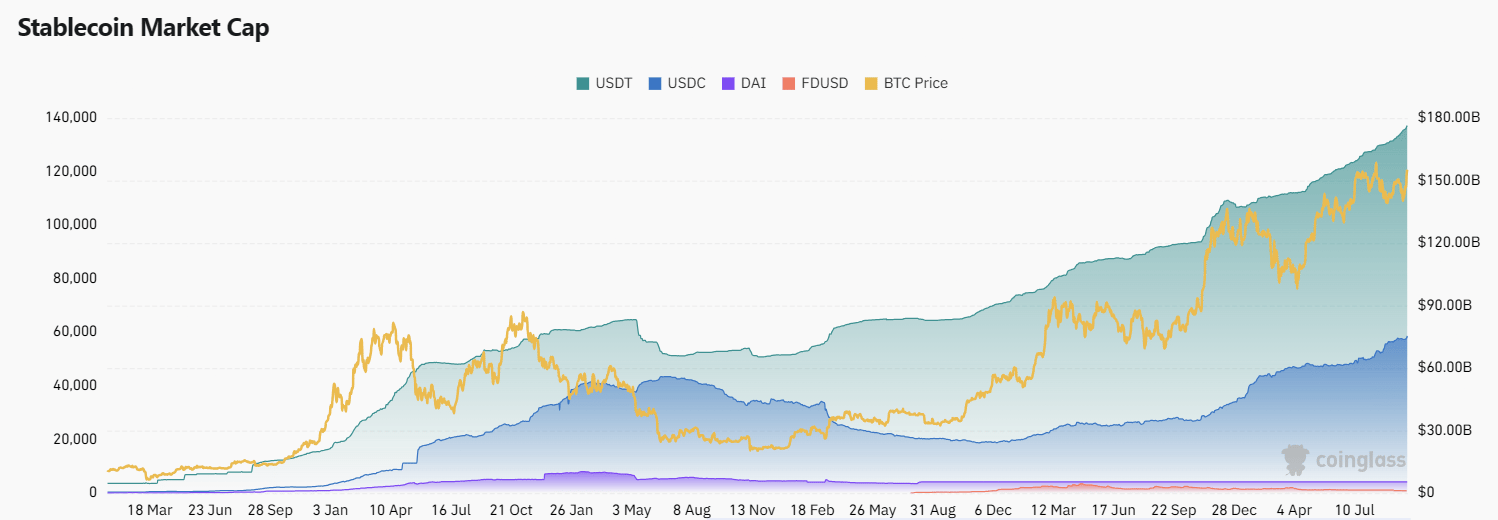

Stablecoins just had their biggest quarter ever. Nearly $46 billion in new supply was minted in Q3, marking a 324% jump from the previous quarter. 💰

Total stablecoin market cap. Source: CoinGlass

📊 Most of the growth came from Tether’s $USDT (+$19.6B), Circle’s $USDC (+$12.3B) and Ethena’s $USDe (+$9B), mixing the old giants with newer, yield-linked models.

The total stablecoin market now sits near $300 billion, fueling liquidity for DeFi, exchanges, and settlements across chains. 🐂

What’s behind the boom?

Clearer policy under the GENIUS Act, the rise of tokenized Treasurys, and smoother networks on Ethereum, Tron, and Solana all helped. 👇

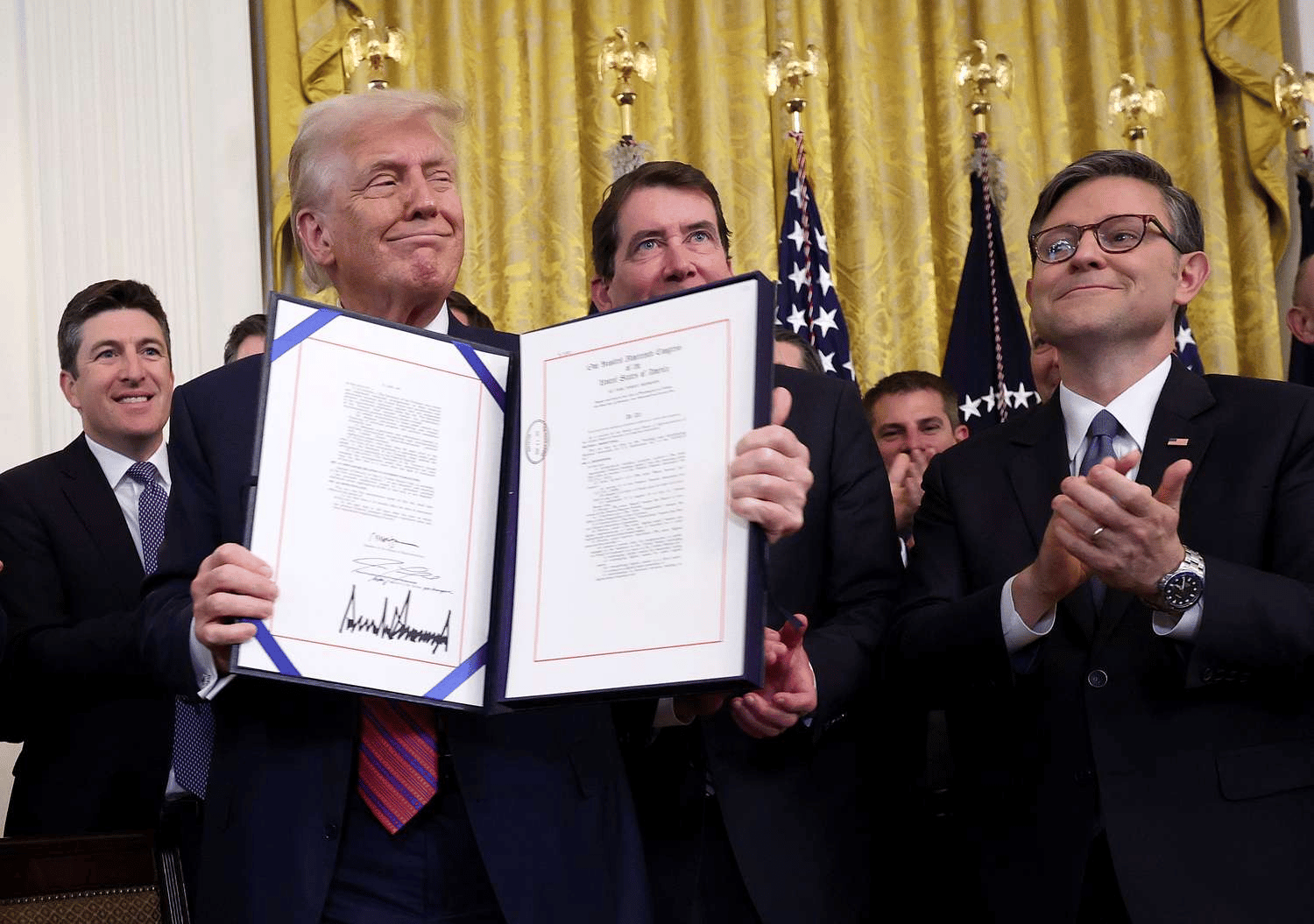

Trump enthusiastically signed the GENIUS Act in August 2025.

Yield and confidence are back, and stablecoins have become crypto’s version of a safe harbor. ⚓

🔎 Still, activity tells a different story. Active addresses fell roughly 23% last month, suggesting much of that new capital is sitting idle.

Simply put, the next test will be whether this $46B keeps moving or just stays parked. 👀

🔒 Major Token Unlocks of the Week

$STAR - 6.70% of the total supply will enter circulation on Oct 6, 2025.

$F - 2.00% of the total supply will enter circulation on Oct 6, 2025.

$ENS - 1.46% of the total supply will enter circulation on Oct 8, 2025.

$TNSR - 1.77% of the total supply will enter circulation on Oct 8, 2025.

$CARV - 4.71% of the total supply will enter circulation on Oct 10, 2025.

Explore more unlocks with full vesting details.

💡 1 Minute Learning: Social Tokens & Farcaster Channels

Social tokens are the new playground where communities, not companies, set the rules. Instead of liking a post, you can literally buy into it. 🎟️

On Farcaster, creators launch channels where tokens act like a VIP pass. Holding a few can get you access to private chats, drops, or even decision-making on how the channel runs. 👀

Example: a meme trader might issue a $MEME token for their Farcaster channel. If you hold it, you get early alpha, inside jokes, or airdrops. If they go viral, your tokens might pump too. 🚀

Why You Should Pay Attention

This blurs the line between content and investment. Followers become stakeholders. But it also means you’re speculating on vibes, not cash flow. So risk = spicy. 🌶️

As always, DYOR. 🔎 Social tokens might not replace your portfolio, but they’re a growing corner of crypto culture.

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.