- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

Have you seen the latest South Park episode? Once again, Matt and Trey made fun of the blockchain industry, with a sprinkle of critique of regulatory agencies. 🎬

Let’s dive into what else moved the markets this week! From XPL booming 🚀, traders liquidating $1.5B 💥, to exponential stablecoin prediction, The Crypto Minute has it all. 🗞️

⤵️ Today’s Agenda:

South Park roasted Polymarket and gave prediction markets a mainstream moment.

Plasma’s XPL launch started with $2B liquidity and has traders watching closely.

The UK and US teamed up on a joint task force to shape crypto regulation.

$1.5B in leveraged positions got wiped out as the market flipped late in the week.

Citi raised its stablecoin forecast to $4T by 2030, calling them the rails of future finance.

And more…

📊 Market Snapshot

| $110,248BTC−4.55% | $4,041.84ETH−9.90% | $3.89TCrypto Market Cap−6.02% | 37 (Fear)Fear & Greed Index−12 from last week |

📅 Crypto Events You Don’t Want to Miss

📌 Tuesday, Sep 30th:

US JOLTS Job Openings: Key gauge of labor demand, showing how many positions employers are looking to fill.

📌 Wednesday, Oct 1st:

US ISM Manufacturing PMI: A Measure of factory output and business conditions, closely watched for signs of economic momentum.

📌 Friday, Oct 3rd:

US Average Hourly Earnings m/m: Tracks wage growth, an important signal for inflation trends.

US Non-Farm Employment Change: Monthly snapshot of job creation across most industries, excluding farming.

US Unemployment Rate: Headline measure of the overall health of the labor market. Probably the most important this week.

US ISM Services PMI: Gauge of service-sector activity, reflecting demand and business outlook.

🐋Smart Money Tracker

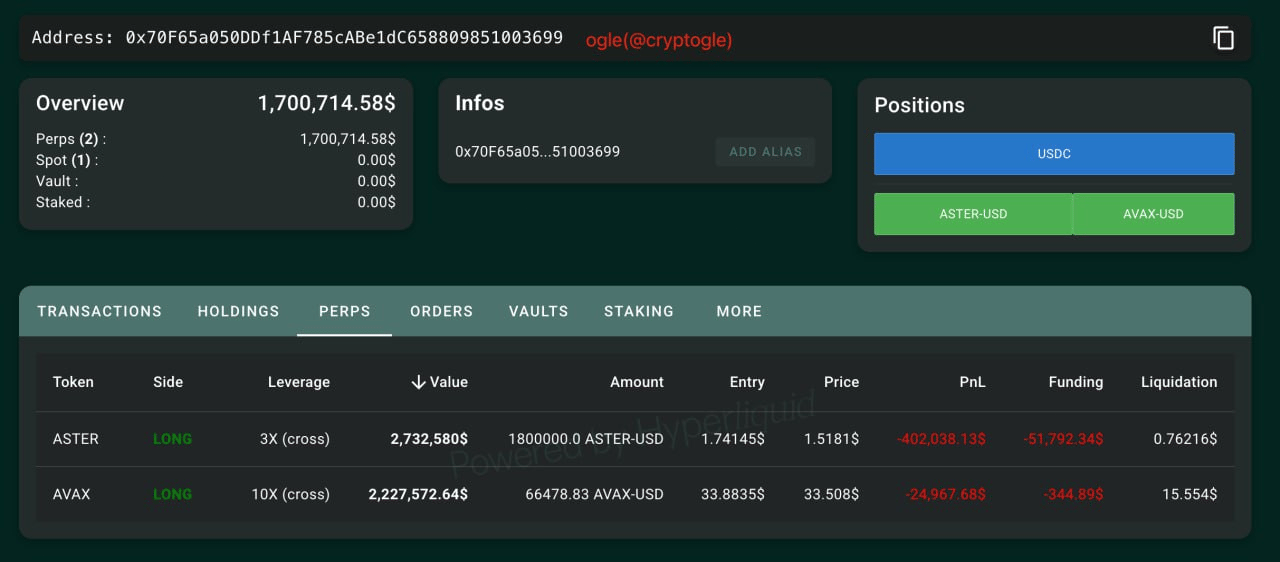

Monday, Sep 22nd: MrBeast scooped up 538,384 $ASTER ($990K) after dropping 1M $USDT across two wallets. His average buy-in was about $1.87.

Tuesday, Sep 23rd: Whales are loading up on $AVAX. 0xb2ca’s 5x long worth $17.2M is already up $920K, while another fresh 10x long added $2.2M more exposure.

Wednesday, Sep 24th: $ASTER is still going wild. A fresh wallet picked up 6.72M $ASTER ($13.97M) straight out of Bybit today.

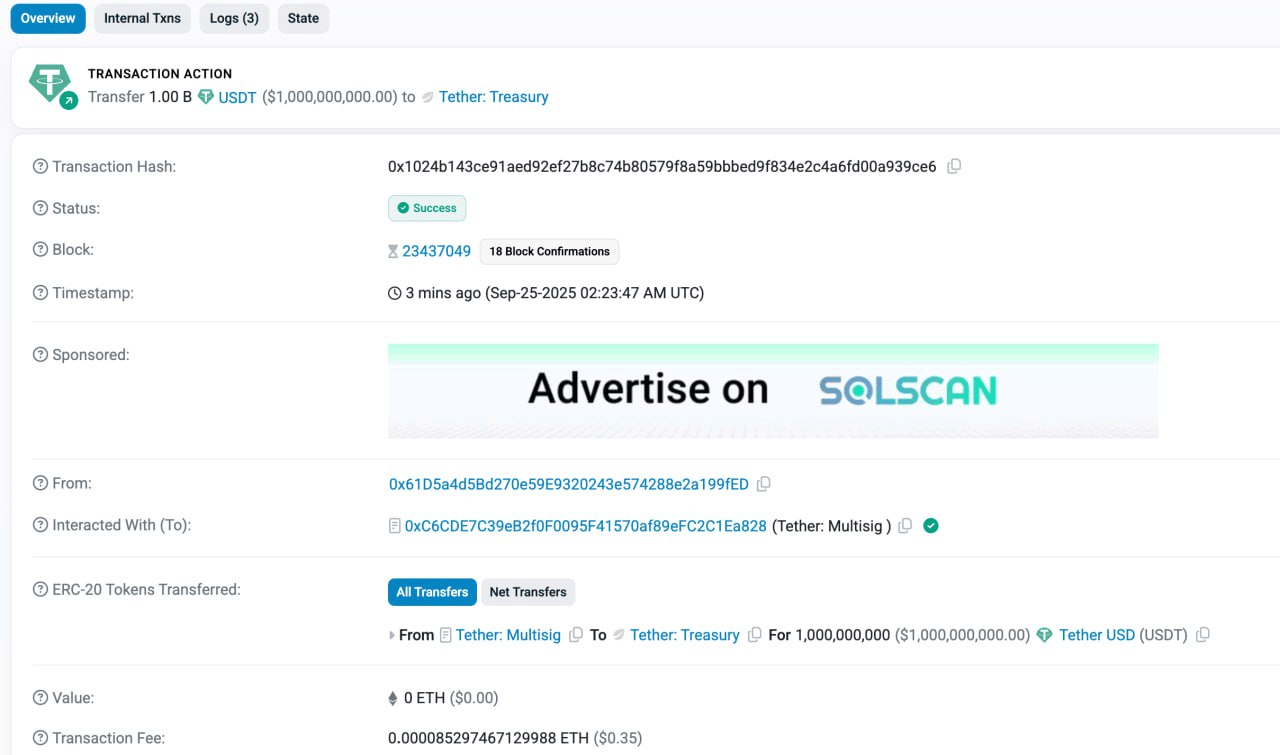

Thursday, Sep 25th: Tether fired up the printers again with a fresh 1B $USDT mint.

Friday, Sep 26th: Whales keep accumulating $ETH. 15 wallets scooped up 406,117 $ETH ($1.6B) coming from Kraken, Galaxy Digital, BitGo, and FalconX.

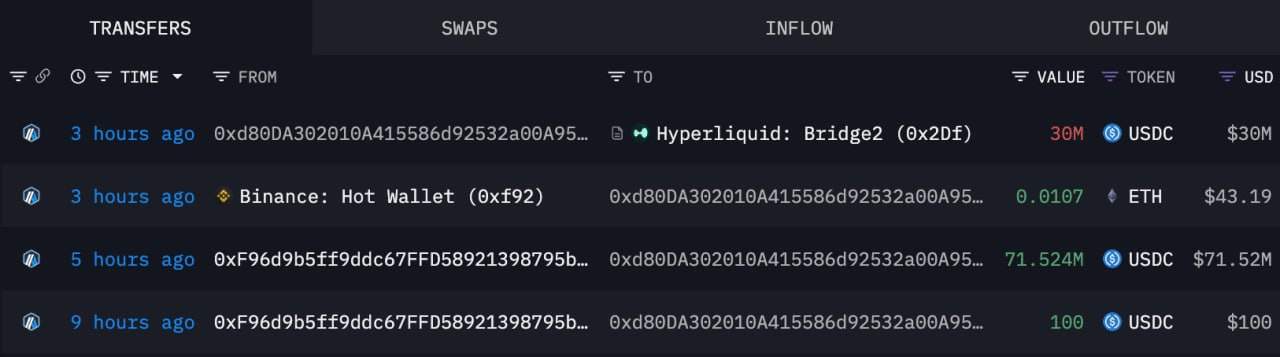

Saturday, Sep 27th: A mysterious whale set up a fresh wallet with 71.5M $USDC ready for $XPL. So far 30M $USDC has been moved into Hyperliquid to grab 12.91M $XPL ($17.4M).

Source: Lookonchain

📰 News Recap (Sep 22 to 28)

South Park bets on Polymarket 🎭

Last week, we mentioned that betting app Polymarket is back in the US. 👉 This week, South Park gave Polymarket the full spotlight.

The latest episode turned prediction markets into comedy gold, showing how people will bet on literally anything. 🎬

It also made fun of the conflict of interest with Donald Trump Jr. becoming its Strategic Advisor.

For Polymarket, it’s free publicity and a push straight into the mainstream. More eyes are on prediction markets than ever before. 🚀

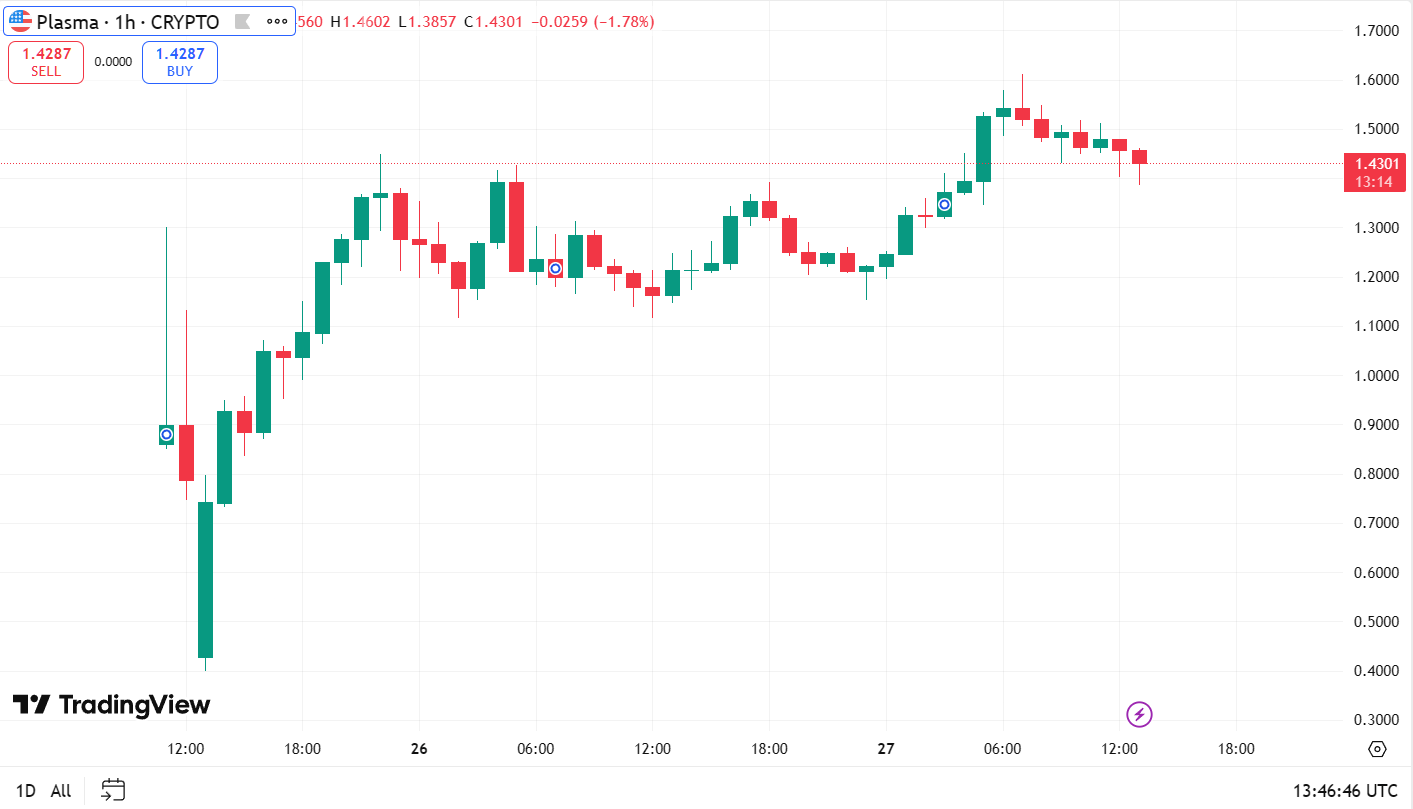

Plasma launches XPL with $2B liquidity 🚀

Plasma kicked off its TGE and dropped its native token XPL. The project started with over $2 billion in stablecoin liquidity on day one. 📈

The launch marks a big milestone for Plasma as it moves from concept to tradable asset. Early investors finally got their tokens.

🔎 Market attention is now on XPL liquidity and how the community will adopt it. This debut sets the stage for the project’s next growth phase.

Plasma is a new Layer-1 blockchain focused on stablecoins and high liquidity. 💸

UK and US launch joint task force on crypto regulation ⚖️

According to Reuters, the UK and the US announced a new initiative called “markets of the future.”

The task force aims to ease capital markets access and coordinate crypto rules between the two countries. 📑

Officials say the partnership will help foster innovation while keeping investor protections in place. 👇

This move signals growing cooperation on digital assets at the highest policy level.

Crypto markets hit by $1.5B liquidations 💥

Around $1.5 billion in leveraged positions were wiped out as selling pressure spiked. 📉

Bitcoin, Ethereum, and XRP all dropped as traders rushed to cover losses. This was the result of fading rate-cut optimism.

The sudden swing marked one of the largest liquidation events of the month, shaking confidence among short-term traders. 📊

🌍 Story of the Week: Citi Sees $4T Stablecoin Market by 2030

Citi analysts have raised their stablecoin forecast. The base case now sits at $1.9 trillion, while the bull case reaches $4 trillion by 2030. 📈

Recent strong growth in 2025 pushed them to upgrade the numbers.

Stablecoin market cap already passed $287 billion in September. Settlement volume has topped $18 trillion per year, surpassing Visa and Mastercard. 💳

Source: Delphi Digital

That alone shows how fast stablecoins are becoming a backbone of global payments. ✈️

Can Stablecoins Kill Banks? 🤔

Citi says stablecoins will not kill banks. Instead, they will help modernize finance alongside tokenized deposits. 🏦

👉 "We do not believe crypto will burn down the system. Rather, it is helping us reimagine it," analysts wrote.

The GENIUS Act in the US gave the sector a clear framework for stablecoin adoption to grow. 🌍

Even China reversed its stance. In August, officials began considering yuan-backed stablecoins for cross-border use. AnchorX launched the first offshore yuan stablecoin a few weeks ago.

To sum it up, stablecoins are shaping up to be the rails of the future financial system. 🚂

Even as emerging currencies gain attention, they still lag behind USD. Source: Delphi Digital

🔒 Major Token Unlocks of the Week

$REZ - 4.24% of the total supply will enter circulation on Sep 29, 2025.

$OGN - 2.04% of the total supply will enter circulation on Oct 1, 2025.

$MAV - 2.77% of the total supply will enter circulation on Oct 1, 2025.

$AI - 1.77% of the total supply will enter circulation on Oct 4, 2025.

$CUDIS - 1.22% of the total supply will enter circulation on Oct 5, 2025.

Explore more unlocks with full vesting details.

💡 1 Minute Learning: Hedging Impermanent Loss with Options

Impermanent loss (IL) is the nightmare of every liquidity provider. 😬 You earn trading fees, but when token prices diverge, your LP position is worth less than just holding the assets. 📉

A growing strategy is to hedge this risk with options. 🛡️ Traders can open positions on venues like Deribit to offset potential IL. For example:

If you provide ETH/USDC liquidity, buying ETH puts protects against ETH dropping. 🐻

If you fear ETH will pump, calls can balance the upside you miss in the pool. 🚀

This turns liquidity providing into a more predictable yield strategy. Instead of blindly accepting IL, you actively manage risk with options. 💡

🔍 Keep an eye on how pros mix options with LP positions. It’s becoming a real edge in DeFi.

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.