- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

Another Crypto Minute is here! Next week will bring plenty of important events, so make sure to check the event calendar. 🗓️

👉 On top of that, we’ll cover the Hyperliquid wallet breach, the new G7 stablecoin plans 🚀, and how Trump’s tariffs shook crypto sentiment. 👀

⤵️ Today’s Agenda:

The U.S. government shutdown continues, freezing data releases and slowing regulatory work.

A trader lost $21M in a Hyperliquid wallet breach, highlighting ongoing security risks.

Major banks are exploring stablecoins tied to G7 currencies as TradFi moves closer to blockchain.

Market sentiment turned fearful after Trump’s 100% tariff on China sent Bitcoin lower.

And more…

📊 Market Snapshot

| $111,860BTC−9.2% | $3,820ETH−15.9% | $3.74TCrypto Market Cap−11.4% | 24 (Extreme Fear)Fear & Greed Index−50 from last week |

📅 Crypto Events You Don’t Want to Miss

Keep in mind that some might not be released due to the shutdown.

📌 Tuesday, Oct 14th:

US Fed Chair Powell Speaks. Traders hold their breath as Powell’s words can move markets faster than any algorithm.

📌 Wednesday, Oct 15th:

US Core CPI m/m: Traders zoom in on the “core” number to gauge real inflation pressure without food and energy noise.

US CPI m/m: A hotter print could reignite rate hike fears, while a cool one might fuel the next risk rally.

US CPI y/y: The big picture figure that sets the tone for everything from Fed talk to crypto sentiment.

📌 Thursday, Oct 16th:

US Core PPI m/m. A surprise dip hints that producer costs are easing, music to the Fed’s ears.

US PPI m/m. The broad gauge of inflation from the factory floor that often foreshadows consumer price trends.

📌 Friday, Oct 17th:

US Average Hourly Earnings m/m. Wage growth stays steady, keeping both inflation watchers and employers on edge.

US Non-Farm Employment Change. A soft jobs print could hint at cooling momentum, while a surprise surge might shake the rate-cut hopes.

US Unemployment Rate. The single number that decides whether the market celebrates or panics before the weekend.

🐋Smart Money Tracker

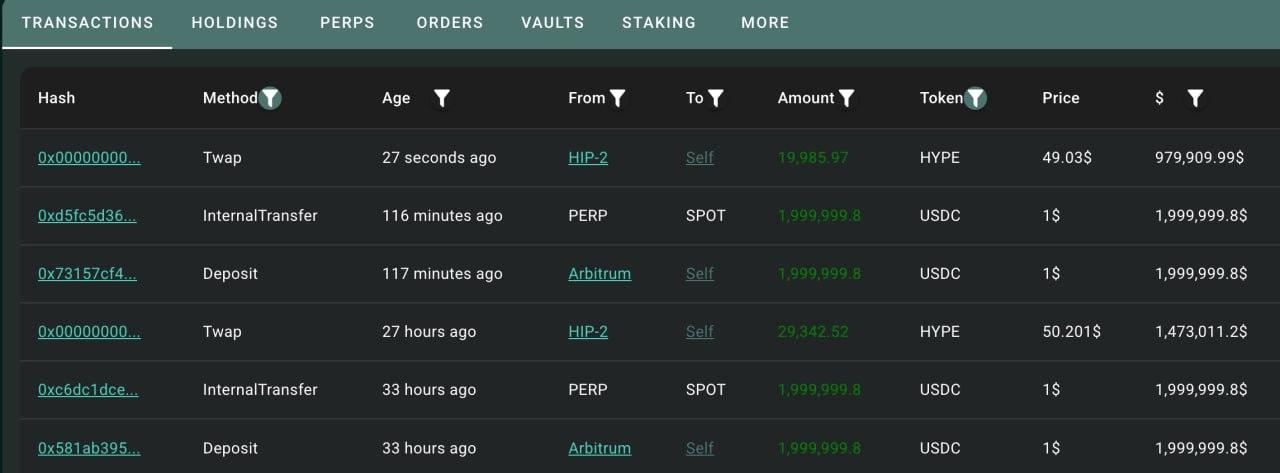

Monday, Oct 6th: A whale opened a fresh wallet and dropped 4M $USDC into Hyperliquid to scoop up $HYPE for $2.89M.

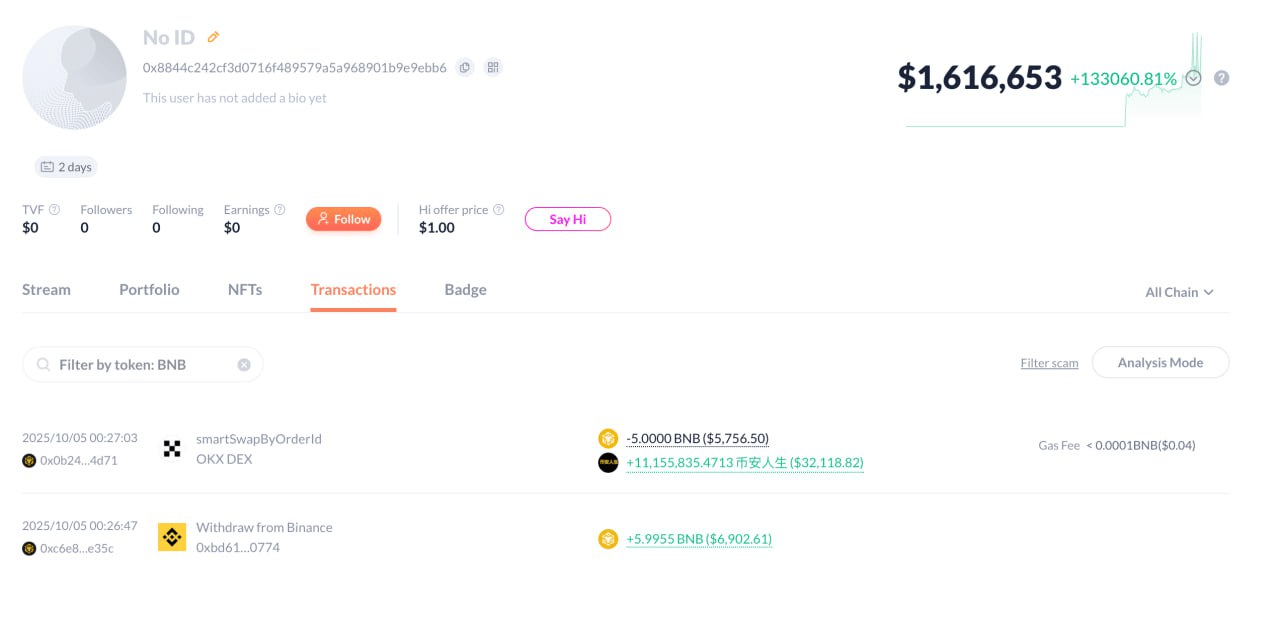

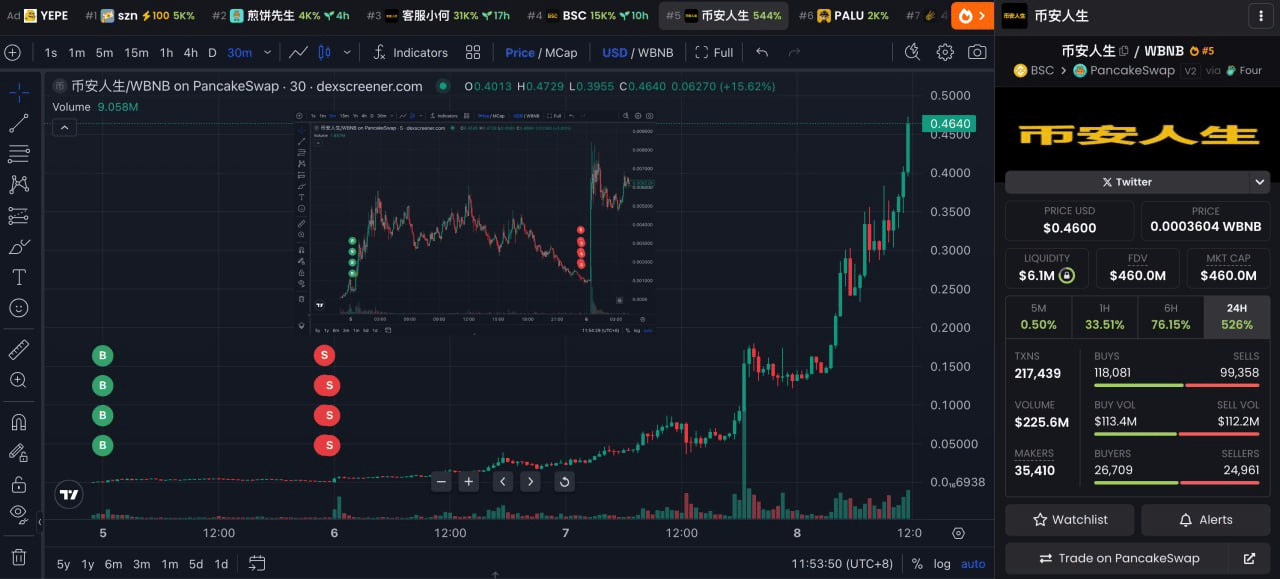

Tuesday, Oct 7th: Trader 0x8844 flipped 5 $BNB ($5,756) into $1.6M in just two days, a wild 280x run on 11.15M 币安人生 tokens.

Wednesday, Oct 8th: An unlucky trader sold 22.1M 币安人生 for just $23K, one hour before the massive pump. That bag is now worth over $10M.

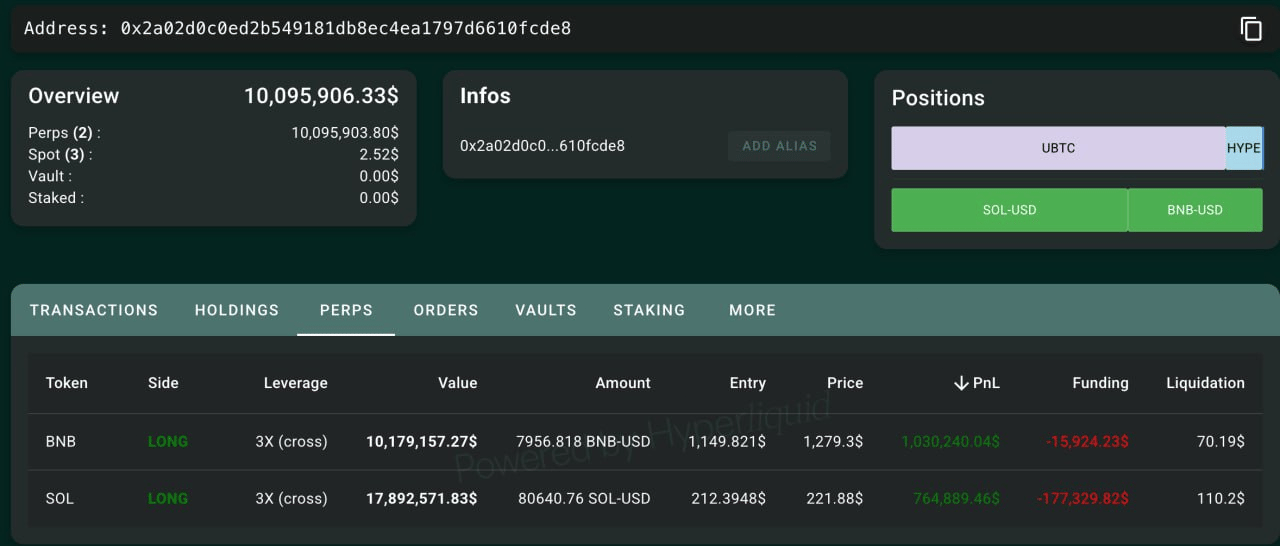

Thursday, Oct 9th: Five days after opening a 3x long on 7,957 $BNB ($10.13M), whale 0x2a02 is cruising with more than $1M in paper gains.

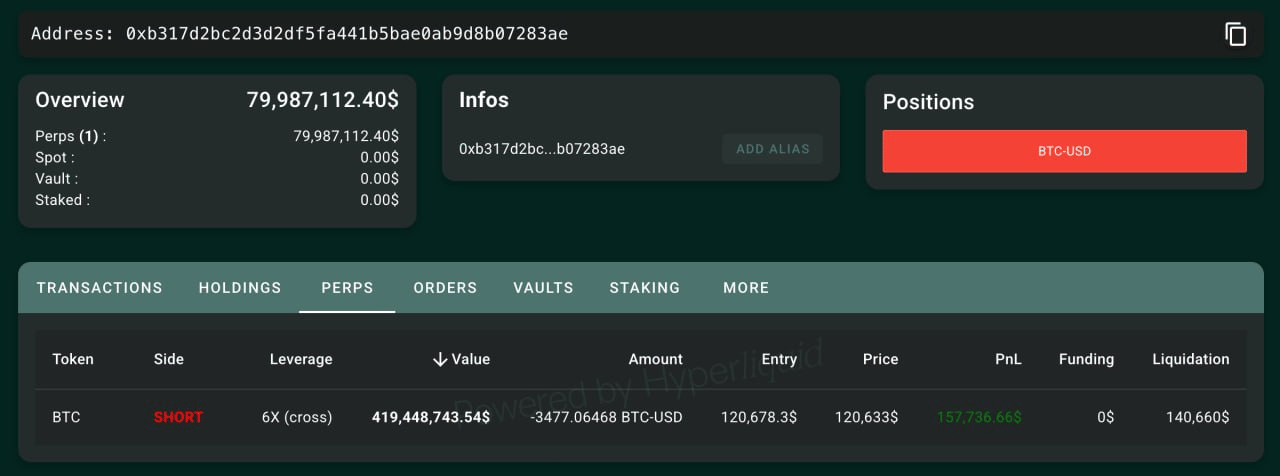

Friday, Oct 10th: A veteran Bitcoin whale sold 3,000 $BTC ($364M) earlier this week and just opened a 6x short on 3,477 $BTC ($419M)

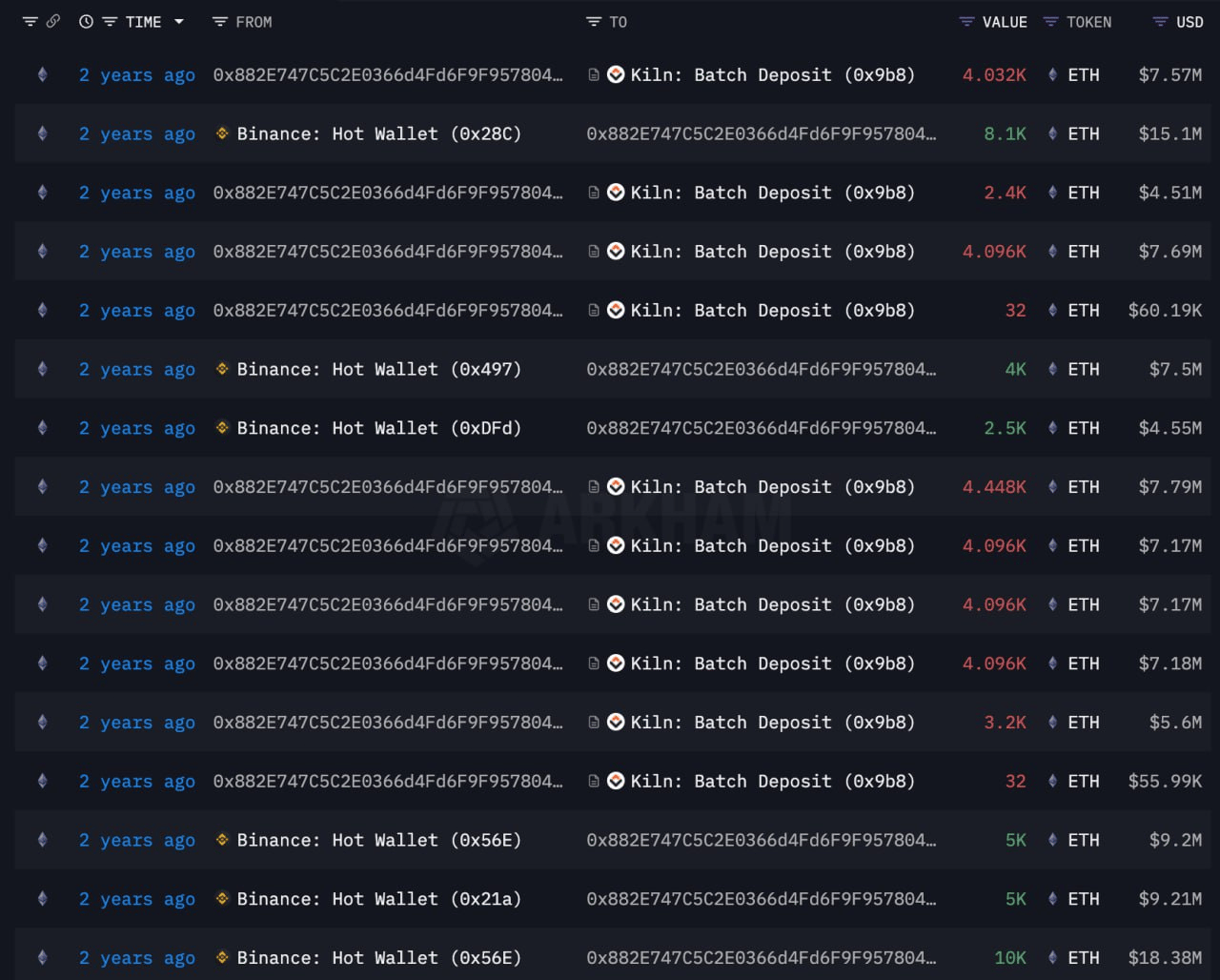

Saturday, Oct 11th: Whale 0x882E sent another 14,275 $ETH ($62.48M) to Binance, likely gearing up for a major sell or portfolio reshuffle.

Source: Lookonchain

📰 News Recap (Oct 6–Oct 12)

Government Shutdown Deepens 🙃

📰 As we mentioned last week, Washington is stuck in a budget deadlock.

Thousands of federal workers are staying home, freezing key data releases and slowing SEC and CFTC workflows. Only about 5% of employees are still working. 💼

The shutdown means missing economic data and slower regulation across traditional markets. Crypto feels the pressure too, as both sectors have become closely connected. 🔗

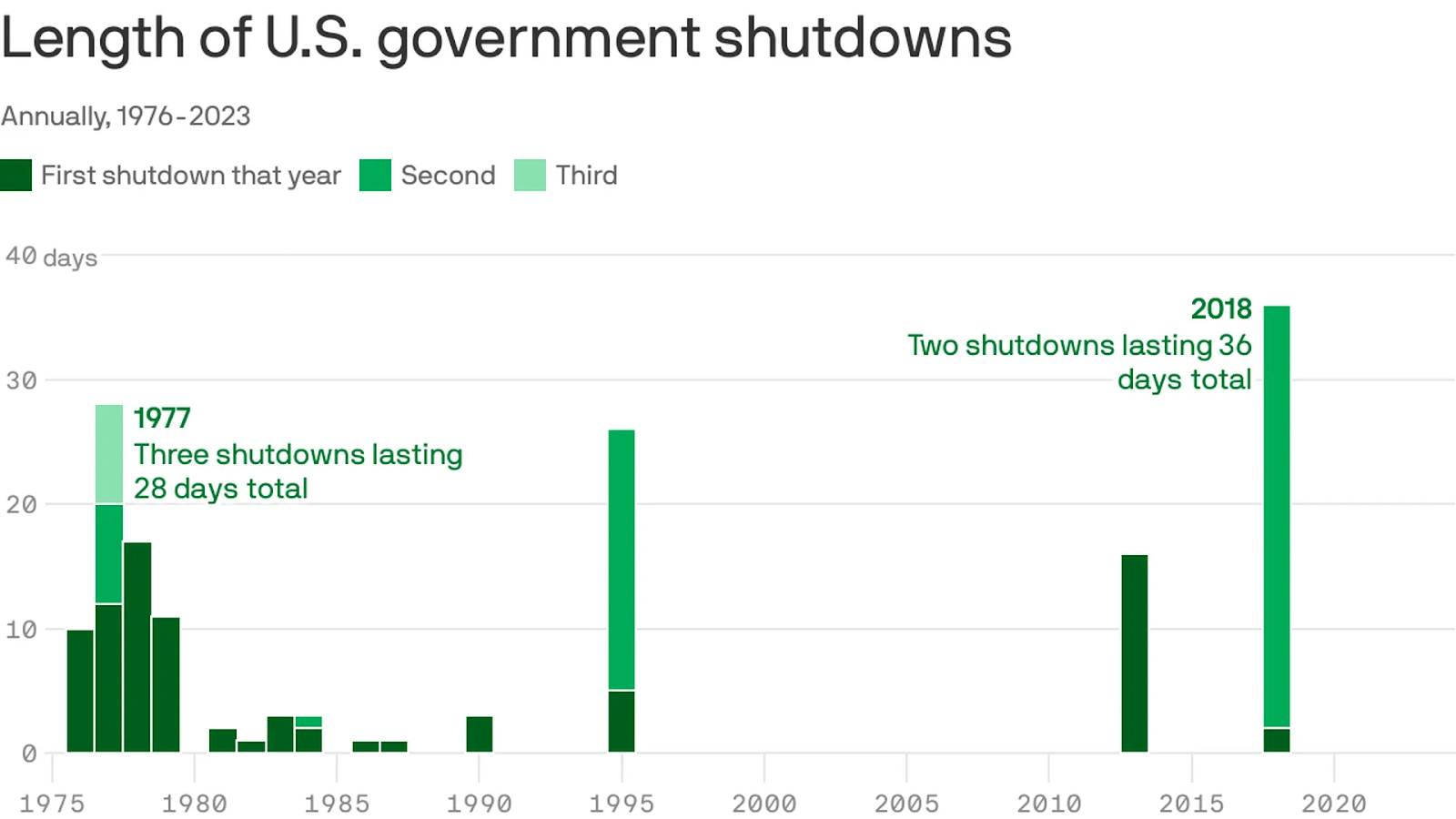

It’s likely to last for weeks, just like Trump’s last shutdown in 2018. ⏳

Source: Axios

Hyperliquid Wallet Breach 💥

A trader on Hyperliquid lost $21M after a private key leak. The attacker moved the funds to Ethereum and swapped them into stablecoins within minutes. 🪦

🚨 The platform itself wasn’t hacked. It was a user error. This shows how careful you need to be, especially when dealing with that kind of money.

🔎 Many users pulled their funds, and the whole DeFi ecosystem was rattled. The incident is still being investigated.

Please be careful with your private keys! 🔐

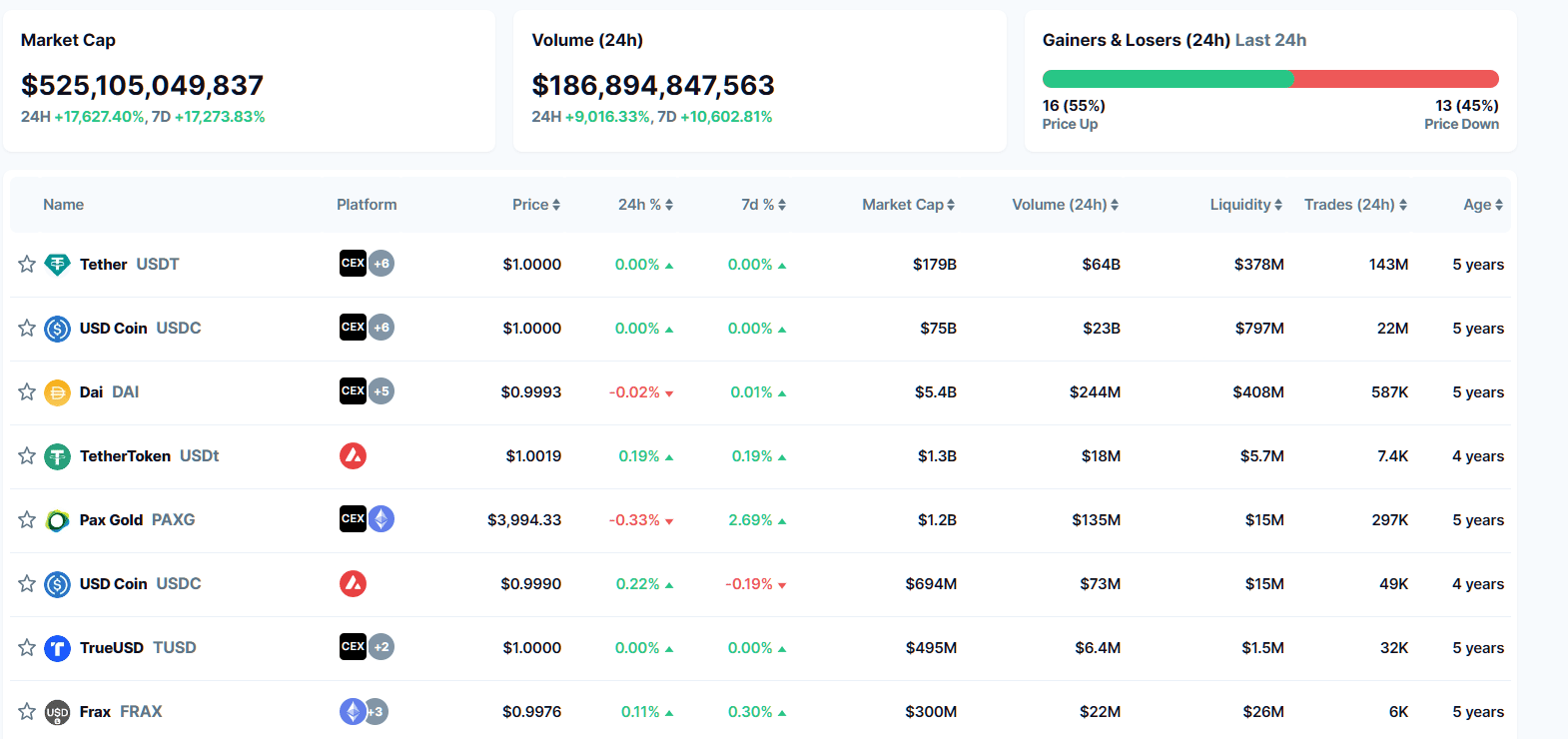

Major banks explore G7-pegged stablecoins 🏦

Banks like Goldman Sachs, UBS, and Bank of America are exploring the launch of stablecoins tied to G7 currencies.

Those include the U.S. dollar, euro, Japanese yen, British pound, Canadian dollar, Swiss franc, and Australian dollar. 💱

This could become the next bridge between traditional finance and blockchain, making stablecoins more trustworthy for institutional investors. 🌐

🌍️ Story of the Week: Tariffs Trigger Fear Across Crypto

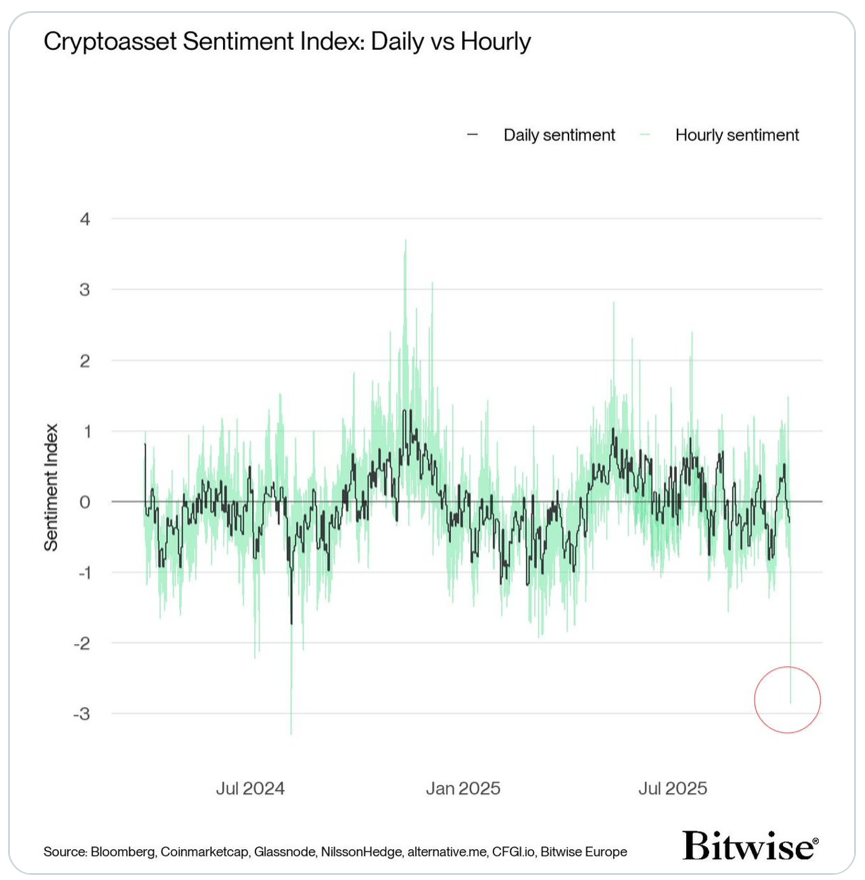

The market flipped fast after President Trump announced a 100% tariff on China, sending Bitcoin tumbling. 😬

👉 The shock hit both traditional and digital assets, wiping more than $19B in long and short positions as traders rushed to cut risk.

Bitwise’s real-time sentiment index.

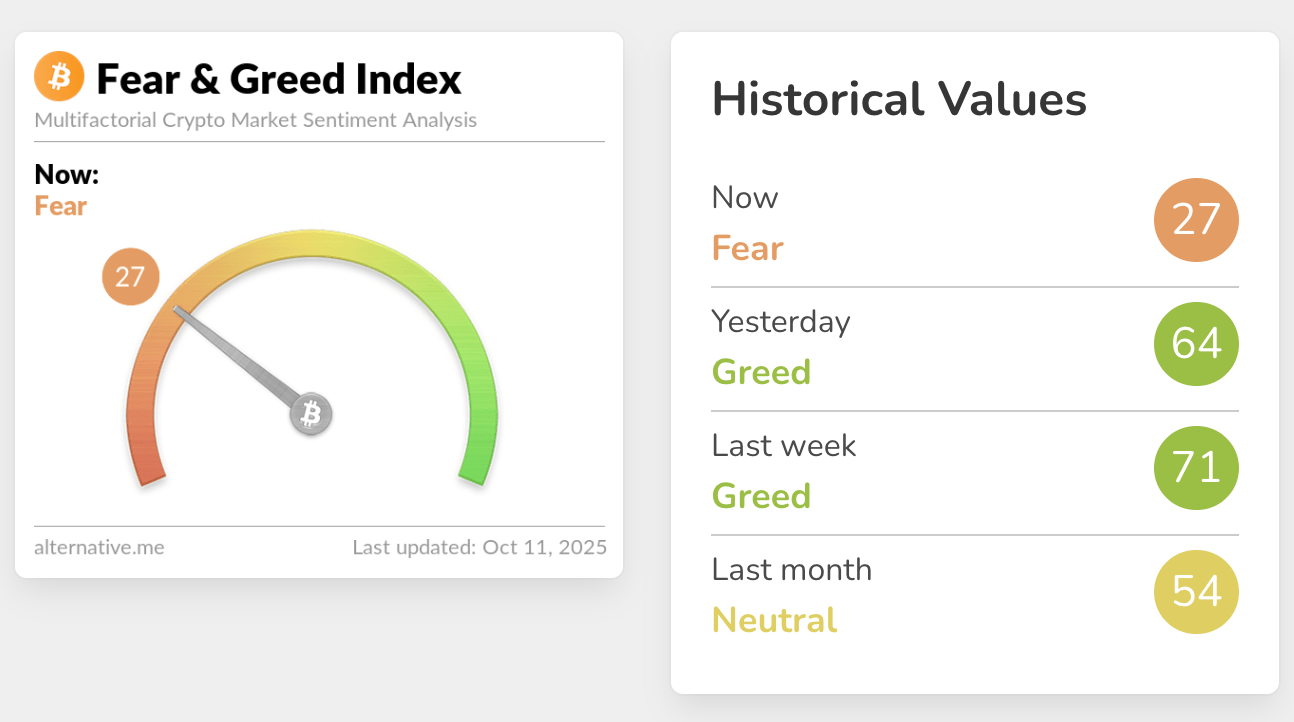

Crypto Fear & Greed Index

The Crypto Fear & Greed Index dropped from 64 in “Greed” territory to just 27, marking the lowest sentiment in six months. 🫣

🔎 Analysts at Bitwise say it could be a contrarian buy signal, similar to the summer 2024 “Yen Carry Trade” panic that preceded a rebound.

Despite Bitcoin setting new highs earlier this week, the mood stayed strangely quiet. 🔇 Analysts from Santiment noted that social media reactions were modest compared to past rallies.

The hype cycle seems to be cooling, even as prices remain elevated. 💭

The market is now nervous but not broken. The next few weeks will show which way it will go. 💡

🔒 Major Token Unlocks of the Week

$C - 4.14% of the total supply will enter circulation on Oct 14, 2025.

$PUFFER - 9.78% of the total supply will enter circulation on Oct 14, 2025.

$SEI - 1.21% of the total supply will enter circulation on Oct 15, 2025.

$EDEN - 23.73% of the total supply will enter circulation on Oct 15, 2025.

$APE - 1.54% of the total supply will enter circulation on Oct 17, 2025.

Explore more unlocks with full vesting details.

💡 1 Minute Learning: DataDAOs

Every click, scroll, and heartbeat is data. 📊 And for years, it’s been harvested by someone else.

DataDAOs flip the script by letting communities pool, govern, and monetize their own information together. 🧠

Some examples: Ocean Protocol tokenizes datasets for AI. DIMO turns car data into tradable assets. And Powerloom tracks real on-chain activity for analytics rewards.⚡

Your Data, Your Rules 🔐

👉 These groups act like collective data unions where contributors vote on how their info is used and get paid when it’s sold or licensed.

Instead of Big Tech pocketing billions, the rewards flow back to the people who actually generate the value. 💸

It’s crypto’s answer to the “you are the product” era. But remember, once your data hits the chain, it’s there forever. So share wisely! ⚔️

🚀 If DeFi made your money work for you, DataDAOs might just make your data work too.

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.