- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

Crypto tripped this weekend, with prices falling pretty much across the board. 📉

You know who didn’t? Us, because another Crypto Minute is here! ⏰

Justin Sun is crying 😢, Polymarket is back in the US, and we zoom in on why blockchain cities keep failing so badly. 🏙️💀

⤵️ Today’s Agenda:

Justin Sun said his World Liberty tokens worth around $75M were frozen, sparking new drama.

Polymarket received long-awaited CFTC approval to re-enter the US market.

Blockchain lender Figure Technologies filed for a US IPO targeting a valuation of up to $4.1B.

Several high-profile blockchain city projects collapsed under regulation, costs, and lack of delivery, with Liberstad in Norway standing out as a rare success.

The SEC introduced a new agenda that signals a friendlier stance toward digital assets.

And more…

📊 Market Snapshot

| $111,244BTC+0.48 % | $4,305.95ETH+0.28 % | $3.92 TCrypto Market Cap+0.4 % | 44 (Fear)Fear & Greed IndexFear |

📅 Crypto Events You Don’t Want to Miss

📌 Wednesday, Sep 10th:

The US Core Producer Price Index (PPI) tracks wholesale prices minus food and energy, a gauge of core inflation. Markets see it as a lead indicator for CPI and Fed moves.

The US Producer Price Index (PPI): Measures average changes in prices received by producers, serving as an early read on inflation pressures.

📌 Thursday, Sep 11th: The US Core Consumer Price Index (CPI)

The US Core Consumer Price Index (CPI): Core CPI strips out food and energy and is one of the Fed’s most watched inflation signals.

The US Consumer Price Index (CPI): It shows the overall pace of consumer inflation across the economy.

The yearly US Consumer Price Index (CPI): It reflects how much consumer prices have risen compared to a year ago.

🐋Smart Money Tracker

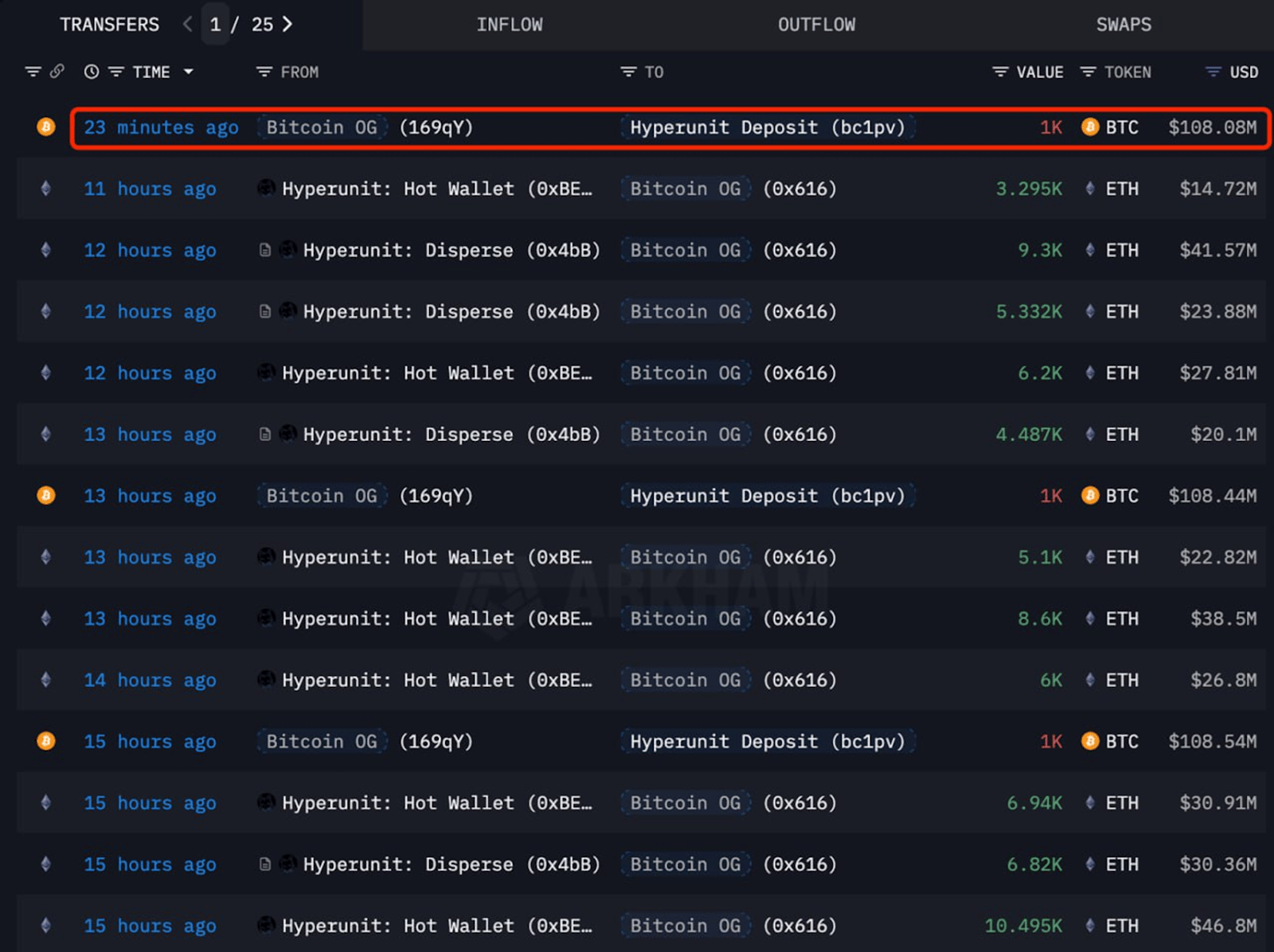

Monday, Sep 1st: Bitcoin OG who scooped 837,429 $ETH ($3.85B) is active again. On Monday, he sent 1,000 $BTC ($108.08M) to Hyperliquid to dump BTC and buy ETH spot.

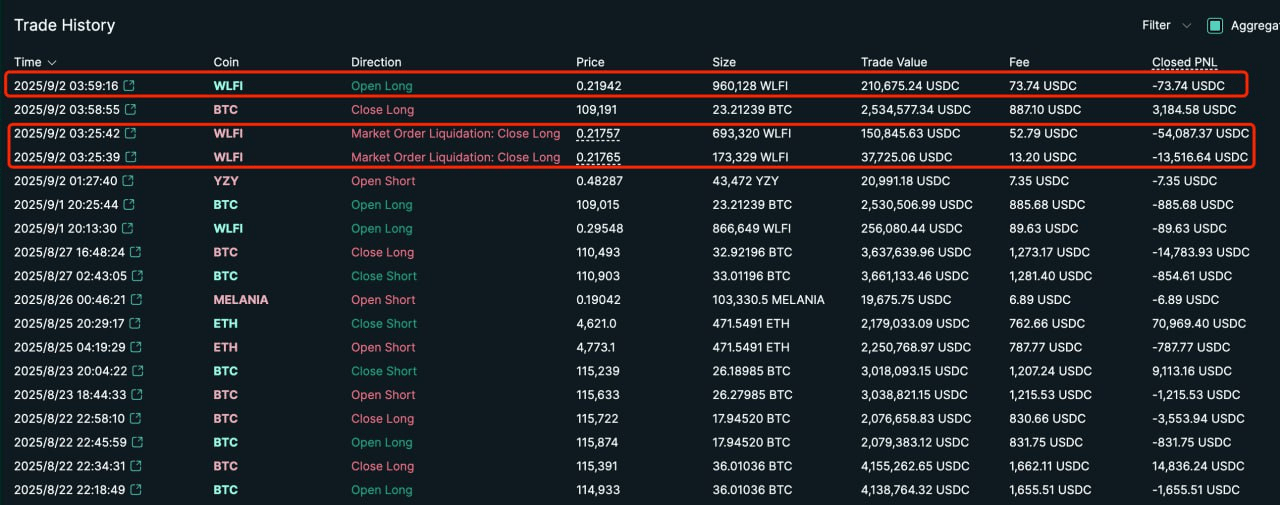

Tuesday, Sep 2nd: Andrew Tate got liquidated on his $WLFI long for a $67.5K loss, then instantly reopened another long.

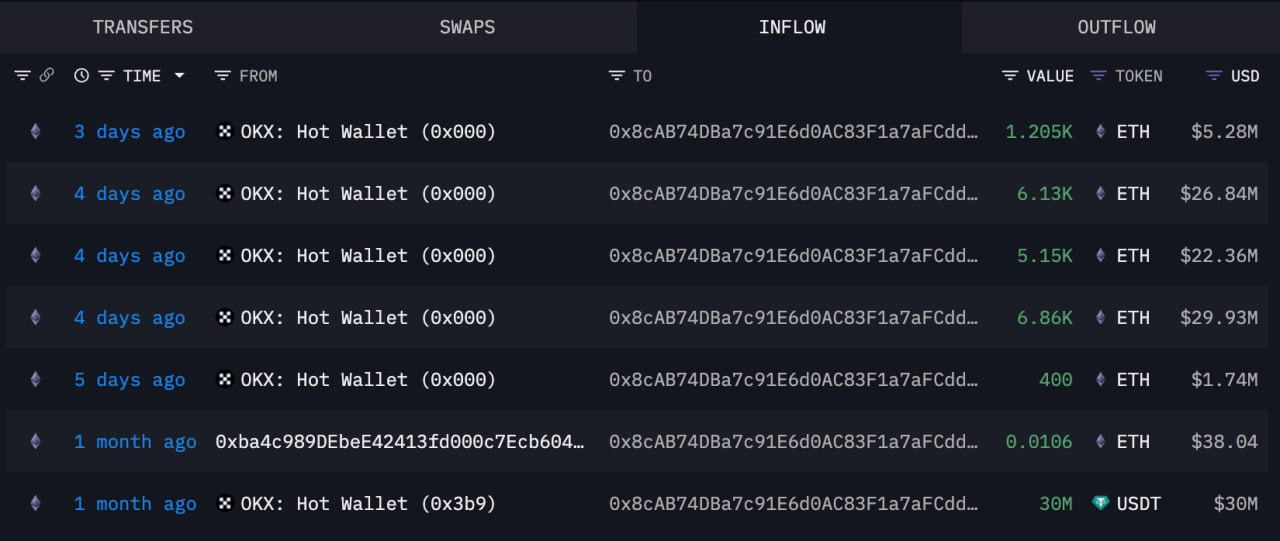

Wednesday, Sep 3rd: A whale pulled 5,100 $ETH ($22.02M) off OKX. Across three wallets, the same player has withdrawn 42,681 $ETH ($185M) in the past five days.

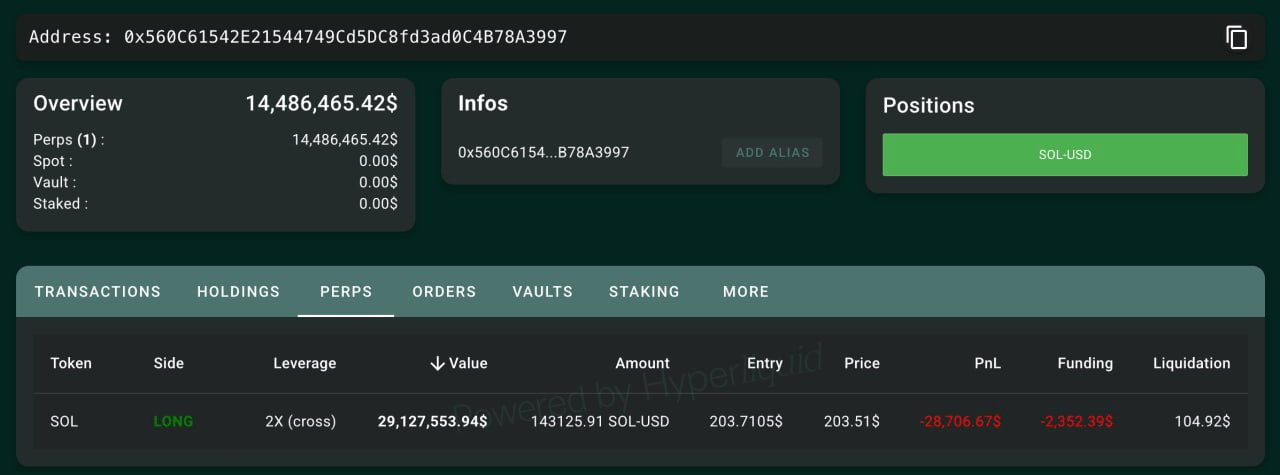

Thursday, Sep 4th: Institutions are stacking $ETH, with Bitmine getting 14,665 $ETH ($65.3M) from Galaxy Digital and three fresh wallets receiving 65,662 $ETH ($293M) from FalconX.

Friday, Sep 5th: A fresh wallet sent 701K $USDC to Hyperliquid and opened 10x longs on $PEPE and $WIF — holding 258M $kPEPE ($2.5M) and 2.47M $WIF ($2M).

Source: Lookonchain

📰 News Recap (Sep 1 to 7)

⚖️ SEC flips the script on crypto

The SEC unveiled a new agenda to revamp digital asset rules. The move would let crypto trade more easily on regulated exchanges while trimming disclosure demands for Wall Street. 📑

It’s a sharp turn from years of crackdowns, signaling a more open stance toward the industry. For institutions waiting on clarity, this could be the green light they wanted. 🚦

🚫 Justin Sun cries foul over frozen WLFI tokens

Trump ally and crypto mogul Justin Sun said his World Liberty tokens (WLFI) had been “unreasonably” frozen. ❄️

He claims to have poured around $75M into the project, only to see his holdings locked away 💰

The freeze adds fresh drama to Trump’s flagship crypto venture, just days after its shaky launch.

For Sun, it’s a public fight to unlock assets he insists are rightfully his. 🔓

💼 Figure aims high with $4.1B IPO bid

Blockchain lender Figure Technologies filed for a U.S. IPO, targeting a valuation of up to $4.13B. 📈

Backed by Goldman Sachs, Jefferies, and BofA, the company plans to list under the ticker FIGR on Nasdaq.

There is momentum: revenue jumped 22% to $191M in the first half of 2025, while profits swung to $29M from a $13M loss a year earlier. 🔄

🔮 Polymarket makes its U.S. comeback

On September 3rd, Polymarket scored CFTC approval to return to the American market after three years away. ✅

The green light followed its $112M purchase of QCEX, a regulated derivatives exchange.

With the no-action letter in hand, the world’s largest prediction market can finally operate under U.S. rules. 🎯

🌍️ Story of the Week: Why Blockchain Cities Always Fail

Crypto visionaries have tried to build cities powered by blockchain. They promised new ways of living, free from the old system. 💸

But… most of these projects ended before they even began.

Big promises, bigger problems ⚠️

Regulation is the first wall. Running a city means zoning rules, water rights, and endless paperwork. These hurdles are harder than any smart contract. 🏛

Money is another problem. Investors lose interest when hype cools. Bills for land, fuel, or construction keep climbing.

There was even a cruise ship meant to be a Bitcoin haven which collapsed under $12,000 per day fuel costs. 🚢🔥

CityDAO in Wyoming raised millions to buy land. But zoning allowed just one single-family home.

Akon City in Senegal promised skyscrapers and hospitals. After the pandemic, only a half-finished welcome center was left. 🏗️

Instead of a futuristic city, we ended up with a modern-looking abandoned shell.

Even with funding, many projects misjudged the reality. Tech alone cannot replace governance. Communities need services, rules, and cooperation. 🌍

A rare exception 🌱

Liberstad in Norway tells a different story. It owns land and hosts permanent residents. The city runs on its own token, City Coin, since 2019. It is small, but it works. 🏡

Liberstad in the Norwegian wilderness is a small but functional community.

The lesson is clear. Blockchain cannot skip the real world. Without solid foundations, these projects stay fantasies.

Only those that combine ideals with practical steps have a chance to survive. 🌐✨

🔒 Major Token Unlocks of the Week

$GMT - 1.13% of the total supply will enter circulation on Sep 9, 2025.

$ALPHA - 1.30% of the total supply will enter circulation on Sep 10, 2025.

$CARV - 1.87% of the total supply will enter circulation on Sep 10, 2025.

$WAI - 8.31% of the total supply will enter circulation on Sep 12, 2025.

$C - 1.14% of the total supply will enter circulation on Sep 14, 2025.

Explore more unlocks with full vesting details.

💡 1 Minute Learning: Slashing in Proof of Stake

When you stake tokens, you lock them to secure the network. If a validator misbehaves, part of that stake can be cut. This is called slashing. ⚔️

It happens when a validator cheats, double-signs, or simply stays offline too long. 👎

👉 The penalty can be small, but sometimes it burns a big chunk of tokens, permanently reducing supply.

Why is it an important part of the ecosystem? 🔗

It forces validators to stay honest

It discourages downtime

It helps stop attacks on the chain

What are the downsides? 📉

Bugs or misconfigurations can slash even good actors

Delegators share the same risk as their validator

Strict rules might scare away new participants

Slashing is the price tag on PoS rewards. 🏷️ The yield looks passive, but every validator mistake can bite into your bag. And recovery isn’t possible once tokens are burned. 🪓

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.