- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

AI is shaking up the blockchain world, and soon it’ll be almost impossible to tell what’s real and what’s fake. 🤖😵💫 If your grandma on Facebook is already confused, a blockchain seal of approval might be exactly what we need. ✅

⤵️ Today’s Agenda:

AI-era internet: can blockchain still prove what’s real in a feed drowning in AI slop and deepfakes?

Tokenized commodities creeping toward $4B and what that says about the next wave of RWAs.

Was 2025 the real Bitcoin bear before a decade-long bull, or is 2026 just getting started with the pain.

How memecoins and NFTs went from Christmas euphoria to full risk-off mode and ghost-town volumes.

Alpha Leak on points meta, this week’s biggest token unlocks, and a futures tool to check before you send size into perps.

And more…

📊 Market Snapshot

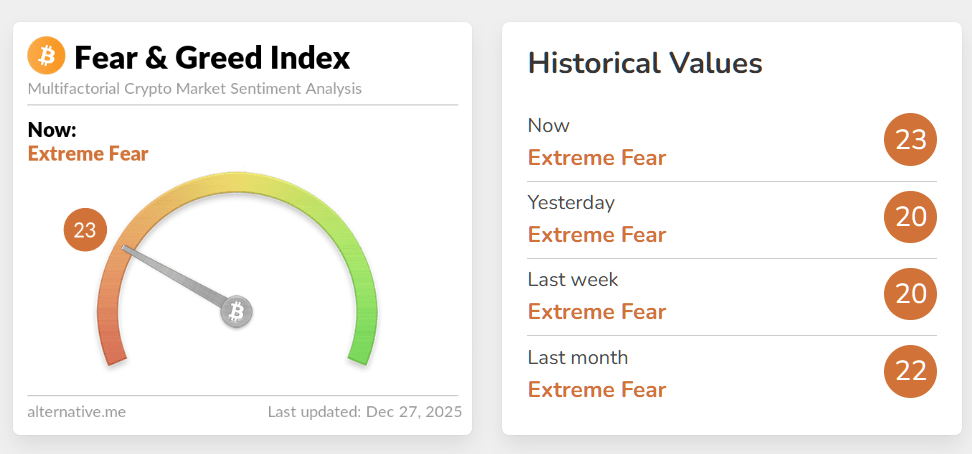

| $87,831BTC-0.6% | $2,939ETH-1.3% | $2.97TCrypto Market Cap-0.7% | 24 (Extreme Fear)Fear & Greed Index+4 from last week |

📰 News Recap (Dec 22 to Dec 28)

Tokenized Commodities Closing In On $4B As Gold Moons 🪙

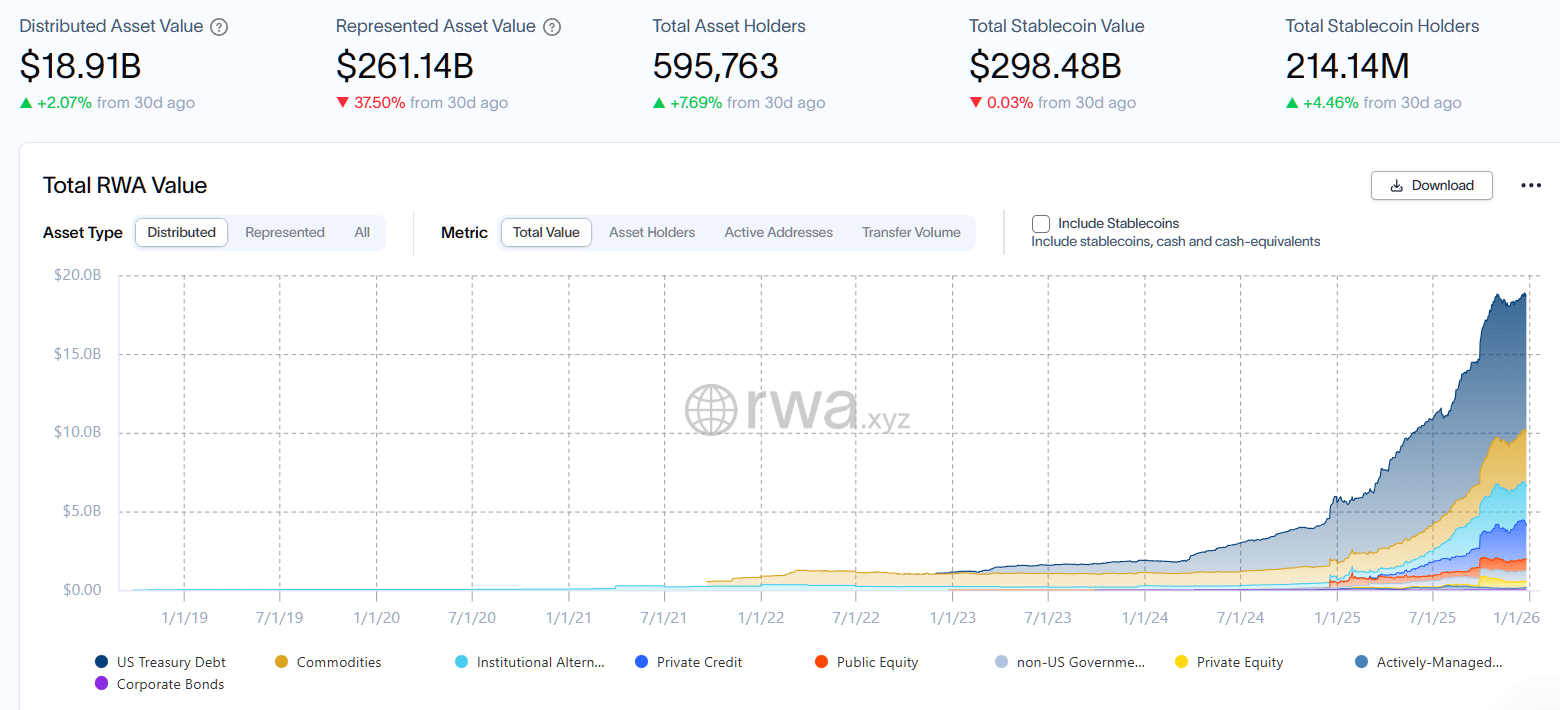

👉 Tokenized commodities are quietly grinding higher, now around $3.93B and creeping toward the $4B mark as gold, silver and platinum hit fresh all-time highs.

Spot gold ripped to about $4,530 per ounce and silver briefly tagged ~$74.5, with onchain exposure riding that move through $XAUT and $PAXG as the dominant plays.

$XAUT sits at roughly $1.74B and $PAXG around $1.61B, giving traders 24/7 onchain exposure while pricing and redemption still live in old-school TradFi land. ⏱️

Zooming out, tokenized commodities are just one slice of the broader RWA game we’ve talked about many times before, with Standard Chartered calling for up to $2T in tokenized RWAs by 2028 and around $250B flowing into less liquid stuff like private equity and commodities. 📈

Most of the RWA action is still on Ethereum with around 65% of the value (~$12.7B), while BNB Chain trails at about 10.5% (~$1.85B). 🌐

Bitcoin: Was 2025 The Bear Market Before A Decade Bull Run? 🐻➡️🐂

Jan3’s Samson Mow is calling 2025 the real bear market for $BTC and says we could be at the start of a “decade long bull run” stretching into 2035, with PlanC backing that view.

Not everyone agrees: some analysts think the October ATH around $125K was the cycle top and see 2026 as bear territory, with calls for $BTC to revisit the $60K–$65K zone.

Price action isn’t helping sentiment much either. $BTC is down on the year, the Fear & Greed Index is stuck in “extreme fear,” and the market feels like it’s been chopping traders up for months. 😬

On the other side, guys like Phong Le and Matt Hougan still expect 2026 to be an “up year” for Bitcoin, betting that strong fundamentals outlast this late-cycle doom and gloom. 🚀

Memecoins Go From Christmas Euphoria To Cold Reality 🎄

🔎 Memecoins are limping into year-end near their lows, down about 65% from last Christmas with sector caps sliding from roughly $100B to around $35–36B.

Trading volume got nuked too, dropping 72% over the year to about $3.05T as retail rotated away from pure casino plays into slightly less suicidal trades. 🎲

For years, memecoins were the cleanest read on retail risk appetite, and this sector-wide rug basically screams “risk-off” as fresh capital gets harder to attract.

Politics poured gasoline on the fire in 2024, with election memes and politician-themed tokens ripping to new highs before brutal dumps, insider games and failed launches turned that hype into deep skepticism. 🗳️

Of course, if you read The Crypto Minute regularly, you know that NFTs didn’t escape either: sector caps slid to around $2.5B and weekly sellers dropped below 100K for the first time since 2021. 😶🌫️

No risk in my market! 😂 Below, you’ll find the market cap for memecoins.

🌍️ Story of the Week: AI-Era Internet: Can Blockchain Still Prove What’s Real?

AI is now spitting out more content than humans, and it shows. 😵💫 Your feed is full of AI images, AI music, AI threads that all kind of feel the same, and people are getting tired of it. 🤖

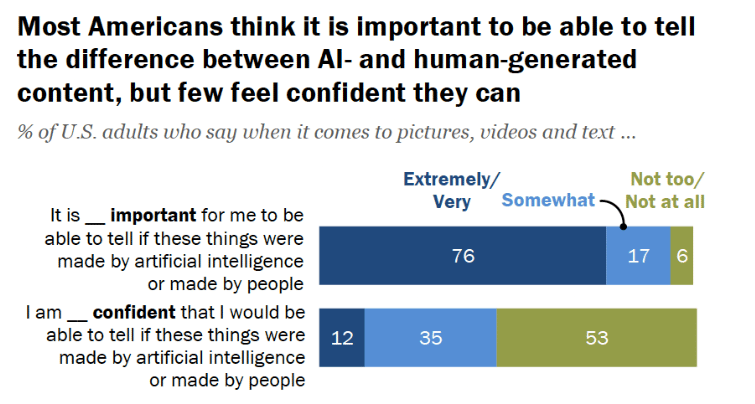

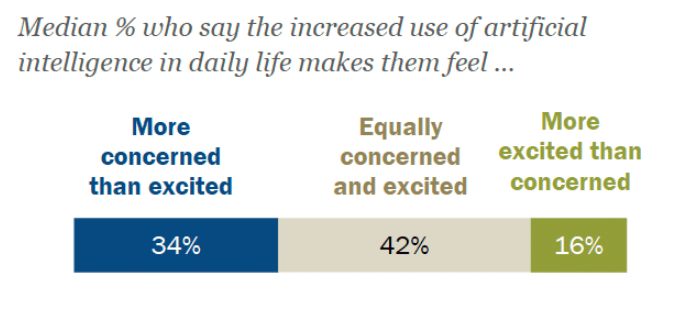

Surveys are starting to reflect that mood. 📊 More people say they are worried than excited about AI, and almost everyone agrees that spotting AI content actually matters. The problem is that less than half feel confident they can really do it. Be honest, can you? 💭

Researchers are all over AI because it can transform the way we live and consume.

That is where it gets messy. Some people still fall for deepfakes and fake screenshots. 🎭 Others react the opposite way and just decide that nothing is real anymore. It becomes very easy to dismiss anything uncomfortable as “probably AI.” 🙃

One idea that is gaining traction flips the problem on its head. 🔄 Instead of trying to detect every fake after the fact, you certify what is real at the moment it is created. Think of it like stamping content with a cryptographic birth certificate. 🧬

How Blockchain Fits Into This ⛓️

Blockchain is pretty good at one thing: keeping an immutable log of what happened and when. 🧾 If your camera, bodycam or drone signs every video and pushes a fingerprint onchain, you get a traceable proof of origin that is almost impossible to fake without leaving a mark. 🎯

Where Proof-of-Origin Actually Matters Most 🎥

Security and surveillance footage

Law enforcement and legal evidence

Corporate investigations and internal audits

High-stakes journalism and public-interest reporting

In those environments, being able to prove “this clip is real” matters more than endlessly arguing about whether something might be fake. ✅

For now, most of this lives far away from your timeline. 😵 The big social platforms are slow to add tools that filter AI content out or highlight human-made media by default. Users have almost no control, even though they are the ones swimming in AI slop every day. 💩

Fun fact: according to Merriam-Webster, “slop” is the word of the year!

The main risk is how AI is used and how easy it is to weaponize synthetic media at scale for scams, politics, or simple chaos. 🧨

If we wait for the first massive, undeniable disaster before caring about proof of origin, we are late. ⏰ The groundwork for authenticity, including blockchain-based fingerprints, has to be laid while the damage is still mostly reversible.

Otherwise, the default state of the internet becomes permanent doubt. 🧩💭

Alpha Leak 👉 Points Meta 2.0

Everyone is grinding points now. Zealy, quests, XP, “engagement scores” everywhere. Feels like playing an idle game with your actual time as the token. 🎮⏱️

The pitch: click buttons now, maybe get $ZRO, $ZK or some mystery token later. No guarantees, no clear math, just vibes and spreadsheets in random Notion docs. 🎁

For most people, it’s free labor. For teams, it’s cheap user acquisition disguised as “community”. The real winners are the ones farming early, multi-accounting hard and flipping day one unlocks on the slow exit liquidity. 🧪

Points meta is all about being early, not grinding blindly. ⏰ Follow the right guides, hit the missions before they go meta, and let the latecomers farm your leftovers. 📚

Anddd that’s why we made several guides about this meta. Check them out. 👇

🐋Smart Money Tracker

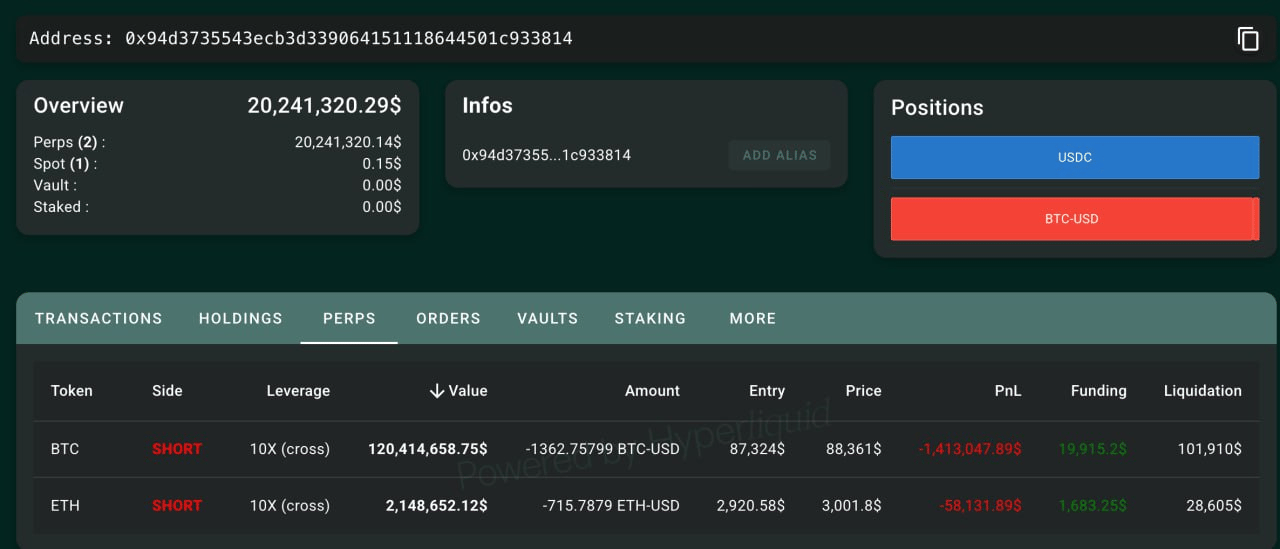

Monday, Dec 22nd: Whale 0x94d3 has doubled down on his bet against $BTC and $ETH, now holding shorts worth about $120.41M in $BTC and $2.15M in $ETH after dumping 255 $BTC earlier.

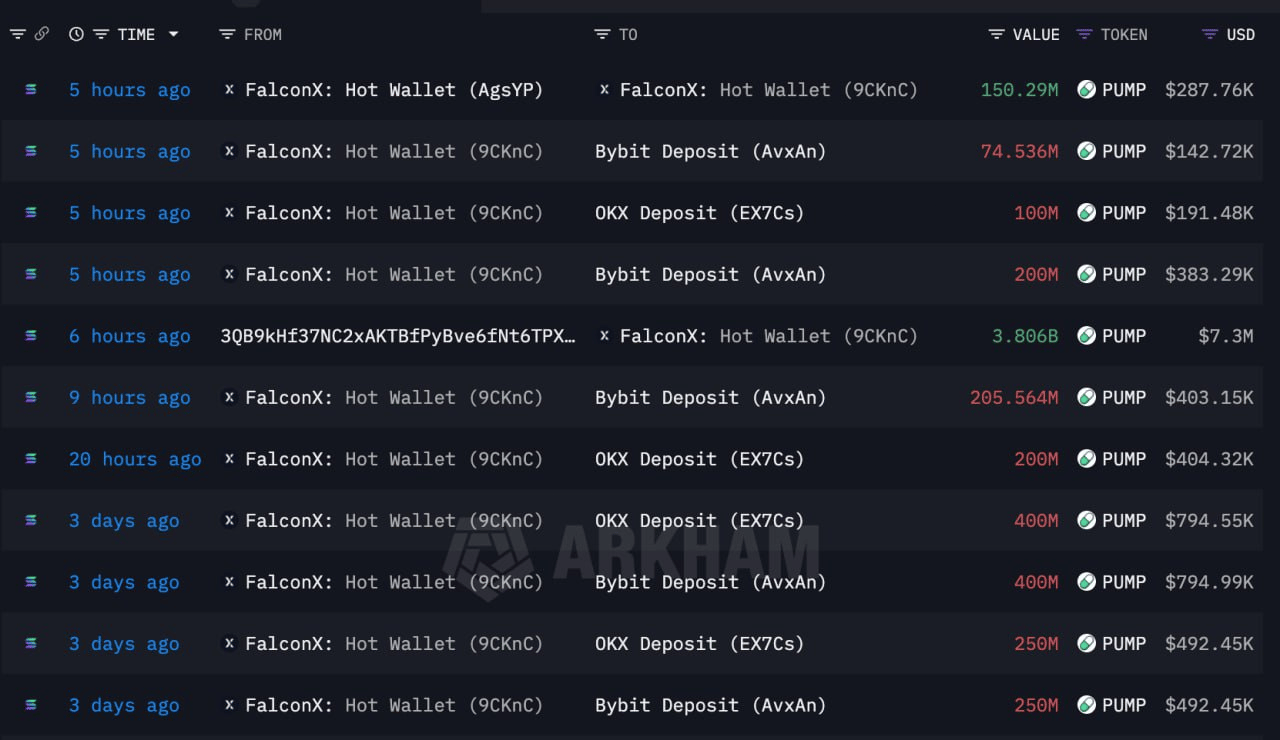

Tuesday, Dec 23rd: Whale 3QB9kH accumulated 3.806B $PUMP for about $19.5M and has now moved it all to FalconX to sell at roughly $7.3M, locking in around a 62% loss. RIP.

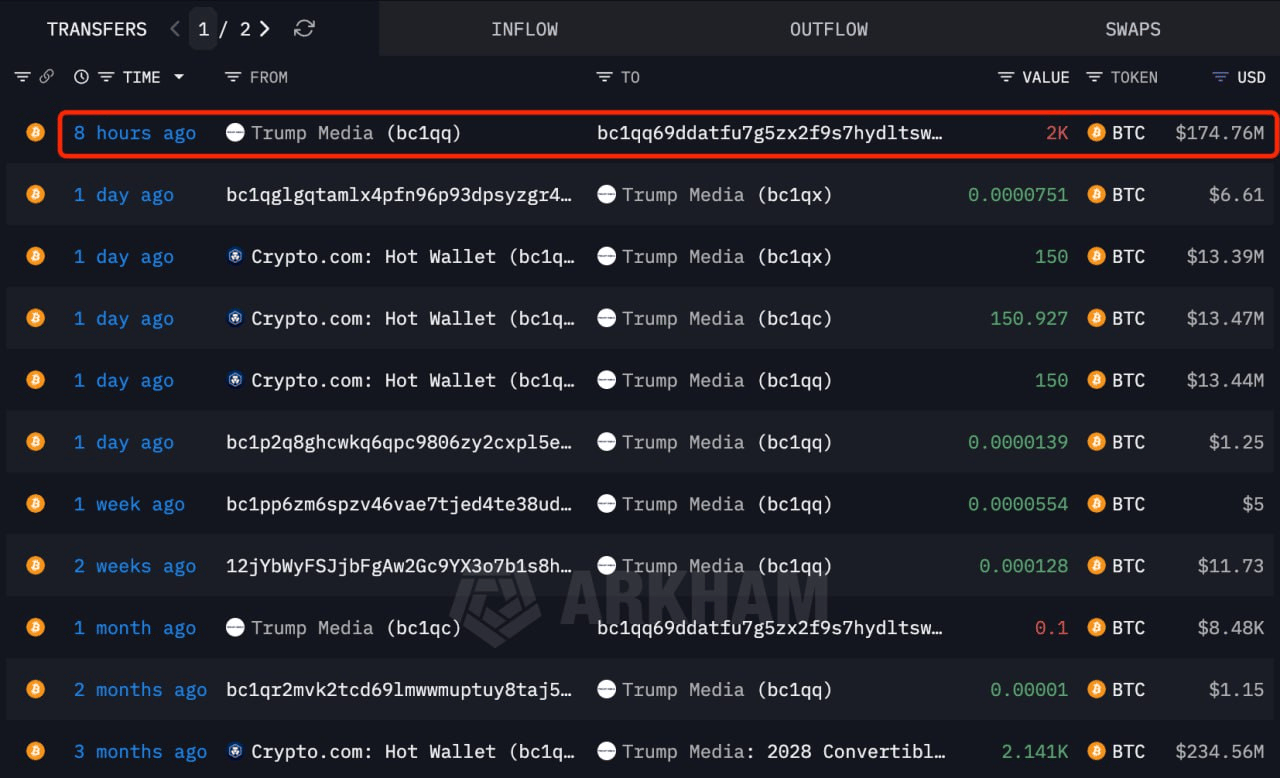

Wednesday, Dec 24th: On Christmas, Trump Media moved 2,000 $BTC worth about $175M out of their wallet.

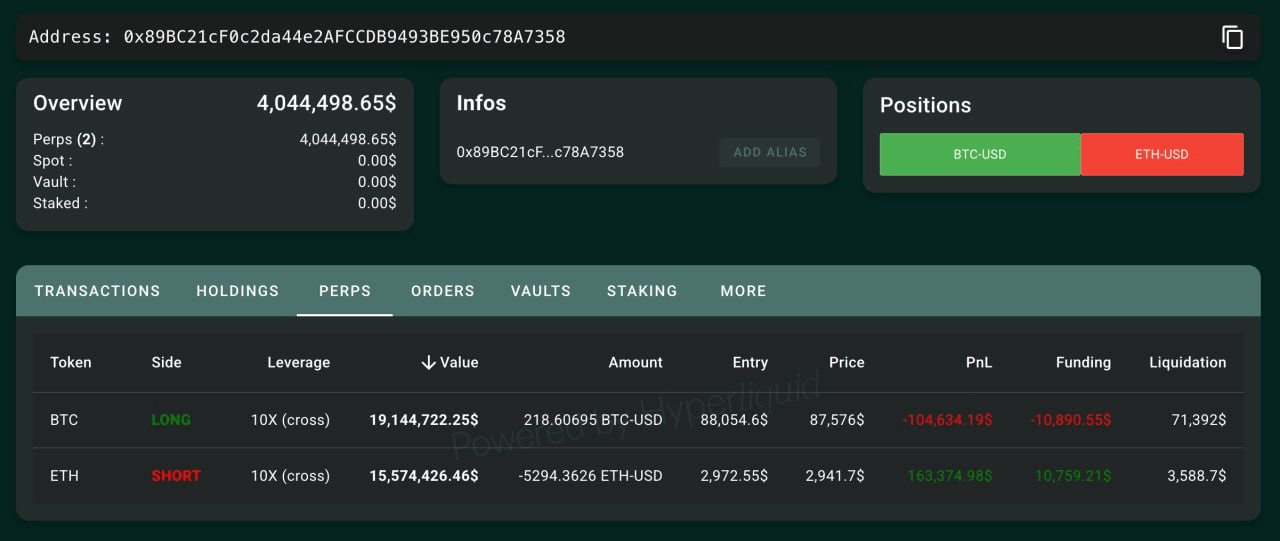

Thursday, Dec 25th: Fresh wallet 0x89BC funneled 4M $USDC into Hyperliquid to run a 10x long on 218.6 $BTC (~$19.2M) against a 10x short on 5,294 $ETH (~$15.6M).

Friday, Dec 26th: Whale FRvvqp moved 3M $TRUMP worth about $14.9M to Binance, crystallizing roughly a $7.8M loss after buying the stack at $7.56 two months ago.

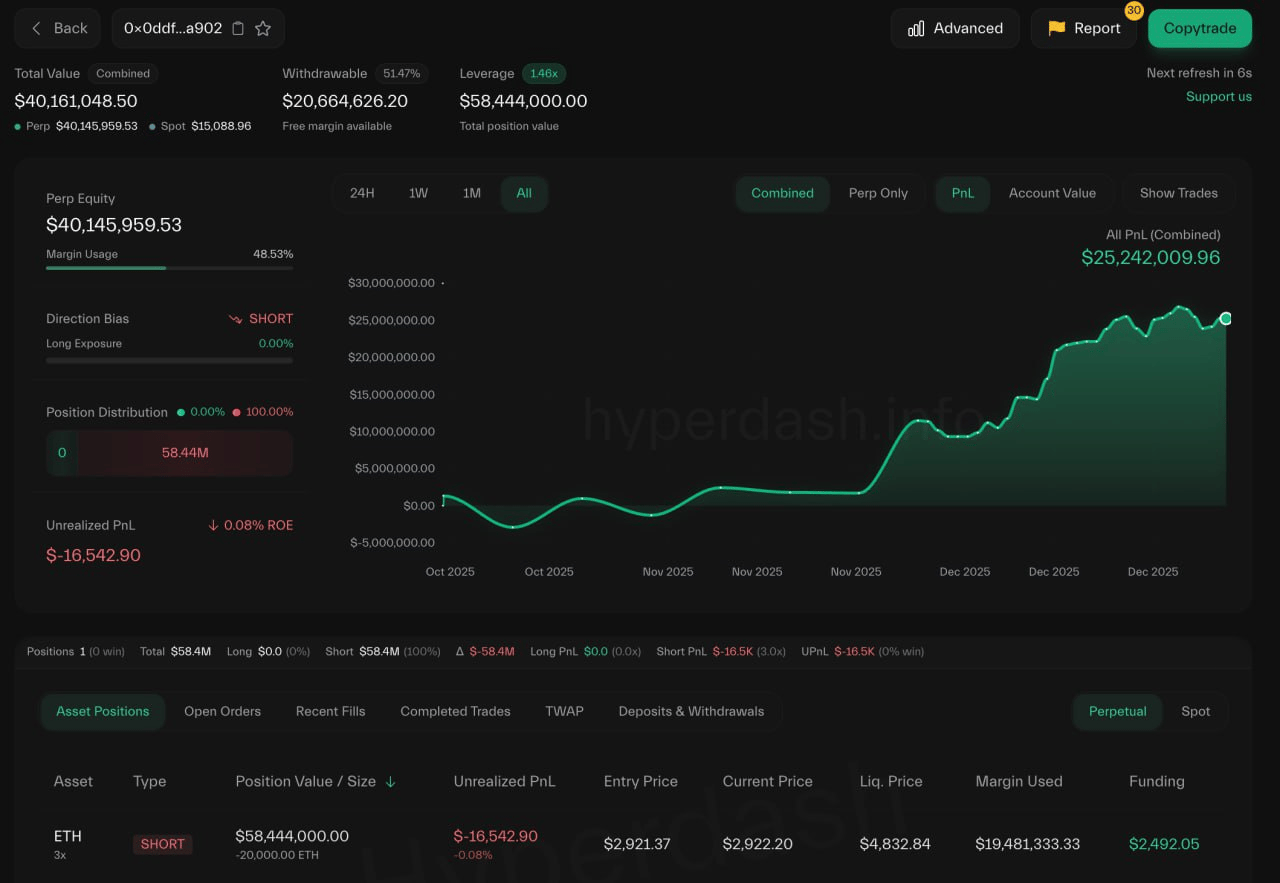

Saturday, Dec 27th: Trader pension-usdt.eth, up over $25M in profits, closed an $ETH long for a $278K gain and flipped into a 3x short on 20,000 $ETH (~$58.4M).

Source: Lookonchain

🔒 Major Token Unlocks of the Week

$GAIX - 3.37% of the locked supply will enter circulation on Dec 29, 2025.

$MAV - 2.77% of the locked supply will enter circulation on Jan 1, 2026.

$SMART - 24.80% of the locked supply will enter circulation on Jan 1, 2026.

$BEAT - 2.12% of the locked supply will enter circulation on Jan 1, 2026.

$Q - 4.10% of the locked supply will enter circulation on Jan 2, 2026.

Explore more unlocks with full vesting details.

💡 Tool for Traders: Coinalyze

Love trading futures? Coinalyze is like TradingView for futures addicts, but with extra toys for perp junkies. 📈

🔎 You get open interest, funding rates, liquidations, volume and long vs short ratios across a ton of exchanges in one screen, so you can see where the next squeeze is brewing. 💣

👉 Best use case: watch open interest and funding spike together, zoom into the liquidation map, and front run where overleveraged apes might get deleted next.

If you are trading perps without checking something like Coinalyze first, you are basically playing blindfolded roulette. 🎯

In my experience, it won’t save you from bad trades, but it definitely helps you make better decisions! 📊

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.