- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

Did you know Binance plans to offer tokenized stocks again? 👀 The latest changelog hints at it. The platform is turning into an omni-trading hub. Whales are betting on $ETH, and much more in today’s The Crypto Minute! 🔥🪙

⤵️ Today’s Agenda:

Ripple expands in Europe with AMINA, RLUSD keeps spreading, regulated rails narrative is back.

Binance hints at stock perps via new API endpoints, TradFi perps agreement and session based trading vibes.

Do Kwon gets 15 years, TerraUSD and LUNA death spiral recap, a reminder that fraud cases do not fade.

Fed cuts 25 bps, Powell stays mixed, $BTC risk on move cools while 2026 expectations get priced.

Wallet drainers via signatures and approvals, fake airdrops and claims, unlimited approvals that empty wallets.

And more…

📊 Market Snapshot

| $89,275BTC-1.3% | $3,093ETH+1.0% | $3.04TCrypto Market Cap-1.0% | 21 (Extreme Fear)Fear & Greed Index+1 from last week |

📰 News Recap (Dec 8 to Dec 14)

Binance hints at stock perps via new API endpoints 👀

This week, Binance added new Futures API endpoints that look like prep for stock linked perpetual contracts. One endpoint is literally POST /fapi/v1/stock/contract to sign a TradFi Perps agreement. Even more ways to lose money for me and my fellow degens. 😅

⚠️ Binance already tried tokenized stocks in 2021, but shut the rollout down a few months later after regulatory pressure.

Two other endpoints reference trading session schedules and current session info. That hints at fixed market hours, not crypto style 24/7. 🕒

This also fits the tokenized equities race heating up again, with regulators watching closely after earlier tokenized stock attempts drew scrutiny. 🔥

Do Kwon sentenced to 15 years over the Terraform collapse 😬

Terraform co-founder Do Kwon just got a 15 year US prison sentence after pleading guilty to wire fraud and conspiracy to defraud, tied to the TerraUSD and LUNA blowup. ⚖️

🔎 Terraform’s TerraUSD (UST) was an algorithmic stablecoin meant to hold $1 via a mint and burn loop with LUNA, but when UST broke its peg in May 2022 it triggered a death spiral that nuked LUNA and wiped roughly $40B from the market 😬

The judge heard victim statements and went above the 12 years prosecutors asked for. Kwon took a brutal L, but a deserved one. 💀

👉 He could still face more legal heat in South Korea later.

Stay safe out there, fellas. ❤️

Fed Cuts Rates, But the Forward Guidance Is Muddy 🏦

The Fed cut rates by 25 bps to a 3.5% to 3.75% target range. That is the headline, but the tone was not pure risk on. 📉

Powell basically framed it as a tough spot. Inflation risks still lean up, employment risks lean down. No easy path. 😶

That mixed guidance cooled the vibe for BTC. Analysts say the rally may stay capped until the cutting cycle looks clearer in 2026. 🪙 Markets are not pricing a straight line down. Only about 24.4% of traders expect another cut at the January 2026 meeting. 🎯

Next year, eyes may shift to liquidity and the balance sheet. There was talk of Treasury bill purchases, but real QE is still seen as a “when things break” move, which usually means more volatility. ⚡

🌍️ Story of the Week: Ripple Expands in Europe With AMINA, and RLUSD Keeps Spreading

Ripple is one of the older cryptos, but it refuses to die, quite the contrary. It is back in the spotlight after a string of “regulated rails” wins. 📈

👉 RLUSD keeps getting cleared in new jurisdictions, Ripple expanded its licensed payments footprint in Singapore, and it even landed conditional approval for a US national trust bank charter via the OCC.

Europe Is the Next Target for the Ripple Network 🚀

Now the new move is Europe. 🔎 Ripple Payments partnered with Swiss crypto bank AMINA to plug Ripple’s fiat to stablecoin payment infrastructure into a FINMA regulated institution. 🏦

Ripple says the goal is faster and cheaper settlement with more transparency, without leaning fully on legacy payment infrastructure. This is basically the “stablecoin rails” pitch aimed at institutions. ⚙️

This is not their first touch. AMINA integrated RLUSD back in July, so the partnership is being widened from “support the stablecoin” to “use it for payments plumbing.” 🧐

🐂 Regulation is the whole point here. AMINA is FINMA regulated, and its Austrian subsidiary reportedly holds a MiCA license granted in October, which strengthens the EU compliance angle.

AMINA’s team also called out a real pain point: crypto native firms want infrastructure that can run fiat and stablecoin rails side by side, and traditional banks still add friction there, especially cross border. Ripple wants to be the bridge layer. 🧩

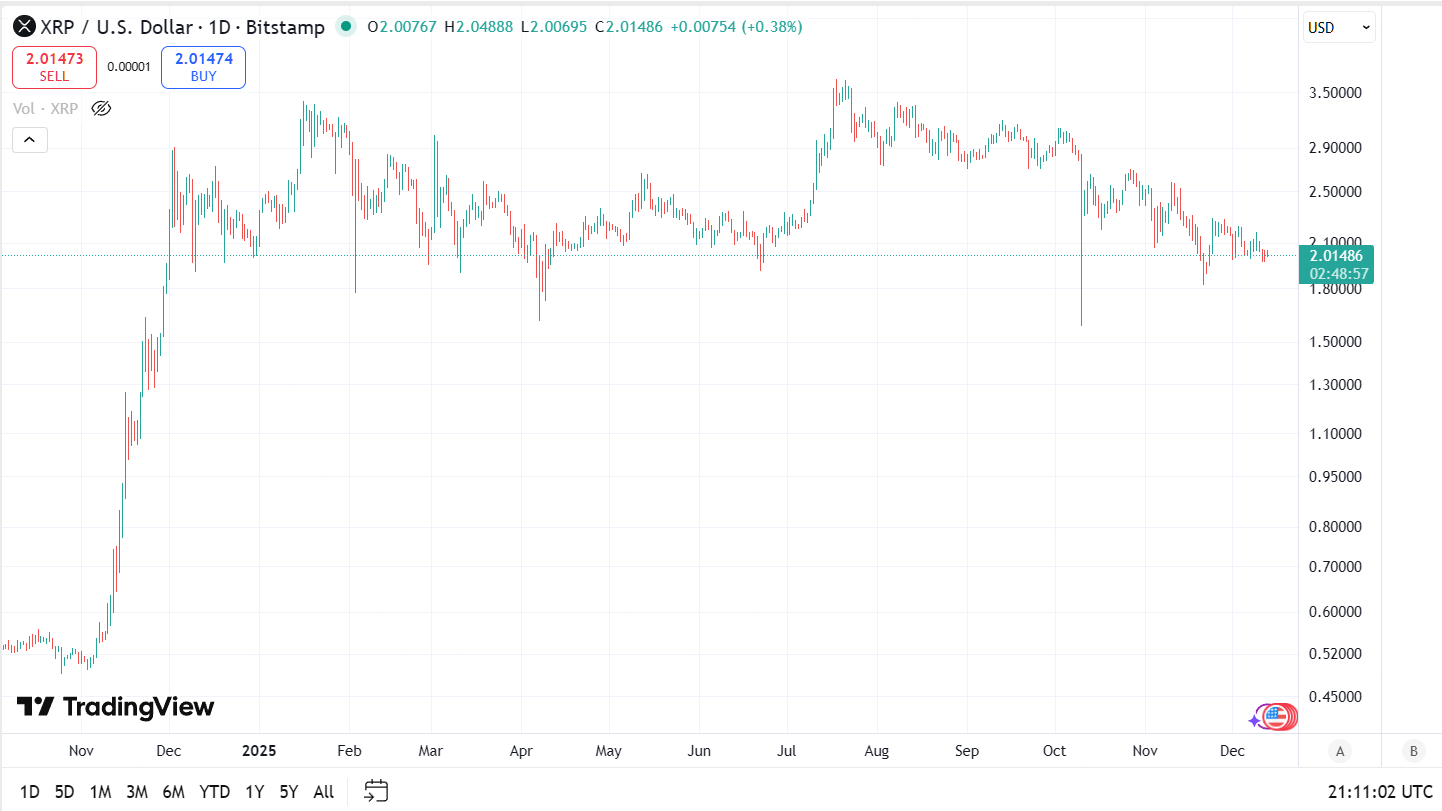

$XRP didn’t react to the news at the time of writing.

Alpha Leak 👉 Agent Tokens

AI agent tokens are pumping right now. 🤖🚀 Not “AI” per se, but tokens tied to autonomous agents that can actually do things on chain. Imagine that, AI actually doing stuff!

Agents are basically bots with a wallet and rules. 🔎 They can monitor data, decide, and execute transactions. That creates a clean token story around access, fees, staking, and coordination. 🤝

Fresh listings are flowing in, and a new narrative usually means brutal volatility. 📊 This early hype can be a great play if you got the balls to withstand the swings. 🏌️

Projects to watch 👇

Talus Network ($US)

Virtuals Protocol ($VIRTUAL)

aixbt by Virtuals ($AIXBT)

ai16z ($AI16Z)

Olas ($OLAS)

Zerebro ($ZEREBRO)

🐋Smart Money Tracker

Monday, Dec 8th: Strategy added 10,624 $BTC last week for about $962.7M, taking its stash to 660,624 $BTC.

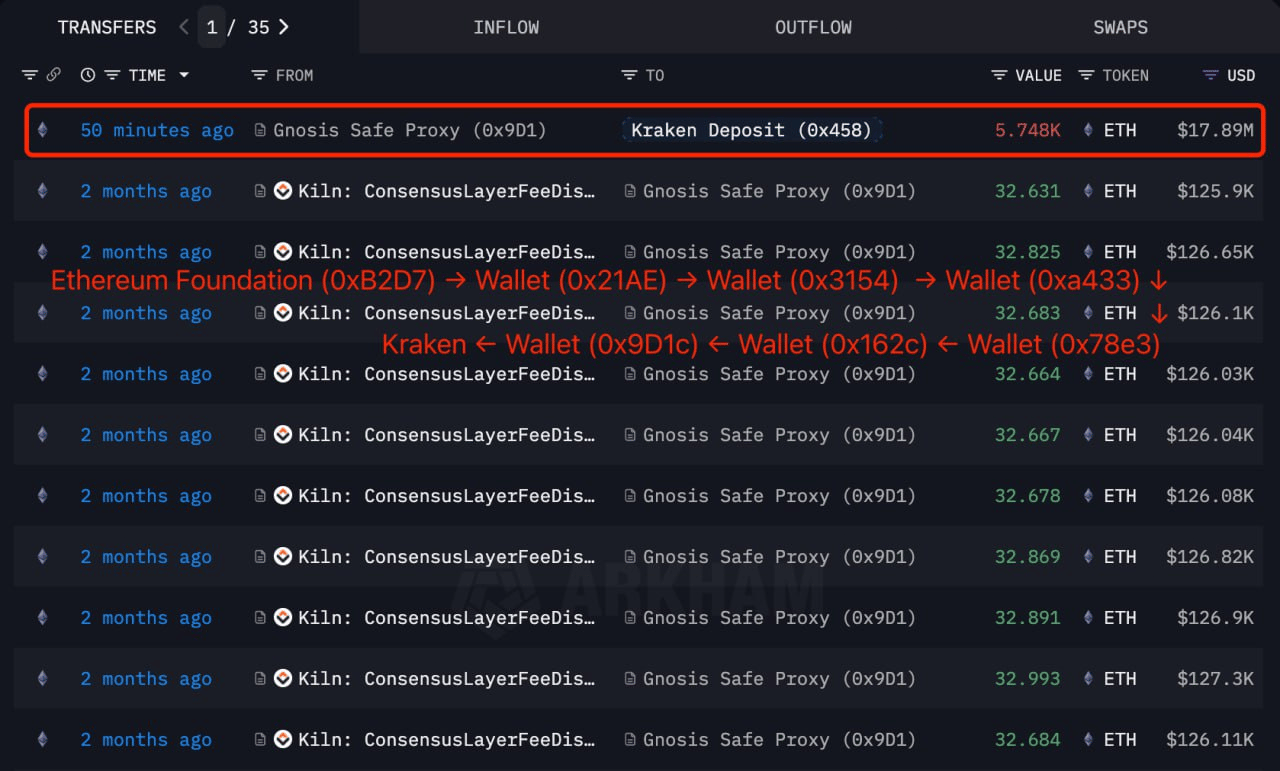

Tuesday, Dec 9th: Wallet 0x9D1c sent 5,748 $ETH (about $17.89M) to Kraken. It looks like the funds come from the Ethereum Foundation.

Wednesday, Dec 10th: $ETH pumped, and known BTC OG 1011short’s 70,001 $ETH ($227.7M) long is now sitting on $12.87M+ in unrealized profit. Later that day, he added even more!

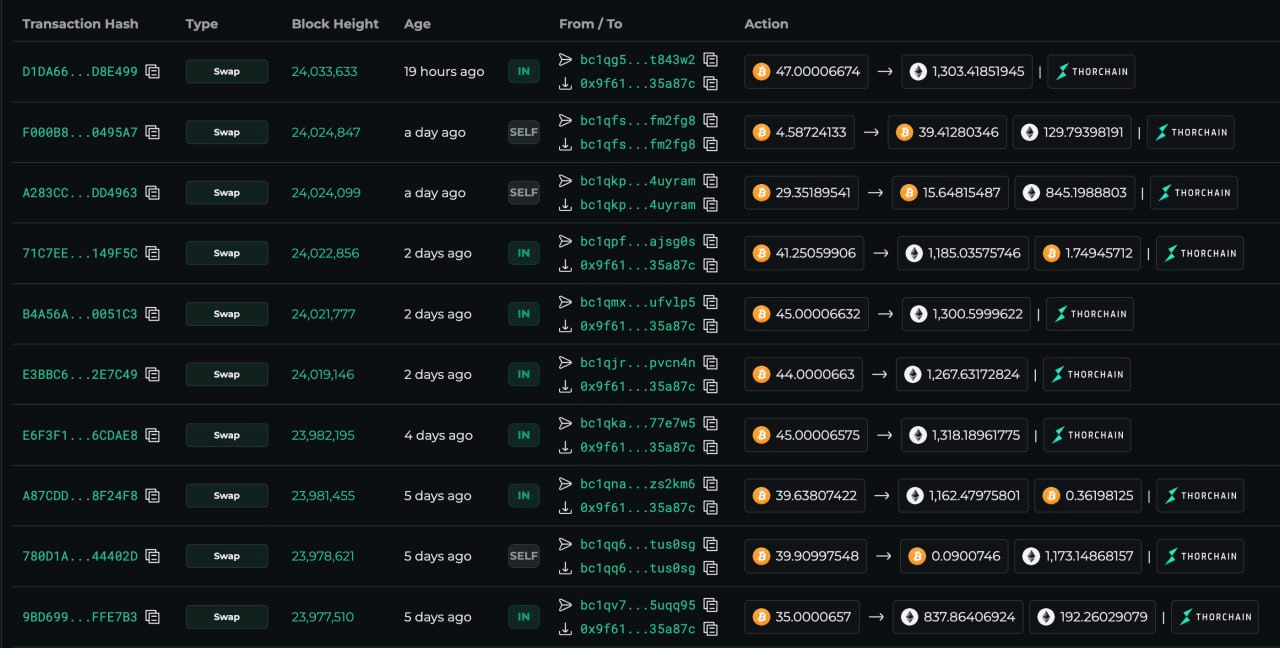

Thursday, Dec 11th: Whales are pumping $ETH like crazy. One trader swapped 1,466 $BTC ($132M) for 43,649 $ETH ($139M) over the past 16 days.

Friday, Dec 12th: Whale 0xE9D0 is back on recursive borrowing, taking 1M $USDC to buy 5,211 $AAVE, and now sits on 338,544 $AAVE ($69.08M) on Aave with $30.8M in $USDC debt.

Saturday, Dec 13th: Wallet 0x2ee6 scooped up 1.65M $RAVE with 539.6 $BNB (about $476K), and the position is now roughly $950K, putting it up around $474K, basically a near 2x.

Source: Lookonchain

🔒 Major Token Unlocks of the Week

$STRK - 1.63% of the locked supply will enter circulation on Dec 15, 2025.

$ASTER - 2.5% of the locked supply will enter circulation on Dec 15, 2025.

$GPS - 8.44% of the locked supply will enter circulation on Dec 16, 2025.

$CRO - 1.17% of the locked supply will enter circulation on Dec 17, 2025.

$LVN - 4.45% of the locked supply will enter circulation on Dec 19, 2025.

Explore more unlocks with full vesting details.

⚠️ Scam Alert: Wallet Drainers via Signatures and Approvals

This one is particularly sneaky. This is not a seed phrase scam, instead scammers bait you with a fake airdrop, claim, refund, or verify page, then ask you to connect your wallet and sign something. 🪤 Who doesn’t want an airdrop?!

The trap is the approval or permit. You grant spending rights, often unlimited, and they can drain tokens later without asking again. 🔓

Red flags are urgency, repeated signature prompts, and approvals that do not match what you are trying to do. Use a burner wallet for random links, keep approvals tight, and revoke old allowances regularly. 🛡️

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.