- The Crypto Minute

- Posts

- The Crypto Minute

The Crypto Minute

Your Weekly Guide to Surviving the Crypto Rollercoaster.

With the world this unpredictable, it’s no surprise Polymarket is where the news is happening. 🌍👀 It also looks like people close to the Trump cabinet know it. This week’s main The Crypto Minute story dives into a wild set of four Venezuela bets. 🎯

⤵️ Today’s Agenda:

The $400K Polymarket Maduro snipe that went dark, and why the timing feels way too clean…

One of the oldest US banks, BNY, is putting bank deposits onchain, pushing the “always-on” collateral and margin future.

Ripple lands UK FCA EMI approval. What it really allows, and why RLUSD and $XRP narratives are heating up.

Will there be a Polymarket airdrop? Prediction markets are going mainstream, with maker rebates and airdrop optionality in the background.

Creator coin clones on Base and Zora, and how fast YOU turn into exit liquidity.

And more…

📊 Market Snapshot

| $90,928.14BTC-0.53% | $3,114.55ETH-0.86% | $3.11TCrypto Market Cap-0.32% | 29 (Fear)Fear & Greed Index+4 from last week |

📰 News Recap (Jan 5 to Jan 11)

BNY Turns Bank Deposits Into Tokens 🏦

One of the oldest US banks, BNY, just rolled out tokenized deposits for institutional clients, running on its own permissioned blockchain. 💳

🔎 Mind you, it’s not a new stablecoin, but in essence your bank deposit mirrored onchain. Firms can now move “cash” inside the system without waiting on legacy rails.

First use case is boring but powerful: collateral and margin, where speed and settlement certainty actually matter. ⚡

It also fits the bigger TradFi push toward always-on markets, since regulators have been openly talking about expanding trading hours and modernizing settlement. 🌙

If banks tokenize the cash leg, tokenized assets get a real settlement rail, and that is how onchain liquidity stops being a demo and starts being scale. 📈 More tokenized assets will surely follow.

Ripple Gets The UK FCA Green Light, Comeback Season? 💭

Ripple just scored a regulatory win in the UK. Its local arm, Ripple Markets UK, got registered as an Electronic Money Institution and also listed under the UK’s anti money laundering rules. 🛡️

👉 That matters because an EMI setup is basically the boring payments plumbing, and it lines up nicely with Ripple pushing RLUSD and playing the “regulated stablecoin” game. 🪙 In that sense, $XRP works more like a “stock” of the whole firm and ecosystem.

There are still limits though. The FCA filing says they cannot touch crypto ATMs, cannot offer certain services to retail, and they need extra approval before expanding into some areas. 🔒

Big picture, the UK is tightening its crypto regime and MLR registered firms will have to apply under the FSMA framework by October 2027, so this is Ripple getting in early. ⏳

After years of being treated like a courtroom relic, Ripple has been quietly stacking wins lately, and this UK approval is another signal that it is back in the game. 🚀

Riot Sells $161M in $BTC, Pivots From Mining to AI Power 🏗️

🏭 Riot Platforms is one of the biggest public Bitcoin miners. It runs massive energy-heavy mining and data center infrastructure. As Bitcoin profitability dumps, new juicy gains are on the horizon. AI! 🤖

📉 In December, Riot sold 1,818 $BTC for about $161.6M at an average price near $88,870, while still producing 460 $BTC and ending the month with 18,005 $BTC on the balance sheet.

🔒 Some of that stack is “restricted” $BTC, meaning it is pledged as collateral and held separately under its debt setup, so it is not fully free liquidity.

🤖 The bigger story is the pivot. Riot says mining is no longer the end goal, they want to monetize their power and data center footprint and even repurpose it toward a proposed 1 GW AI data center campus. 🖱️

📊 They are also ditching monthly mining updates and moving to quarterly reporting, which is a pretty loud signal they want investors to stop valuing them like a pure miner and start valuing them like infra. If AI is indeed in a bubble, this could turn out to be a terrible bet. 💣💥

Riot isn’t alone, miners like Core Scientific, TeraWulf, Cipher Mining, and IREN are also pivoting into AI data centers and HPC hosting.

🌍️ Story of the Week: Polymarket Whale Vanishes After $400K Maduro Bet

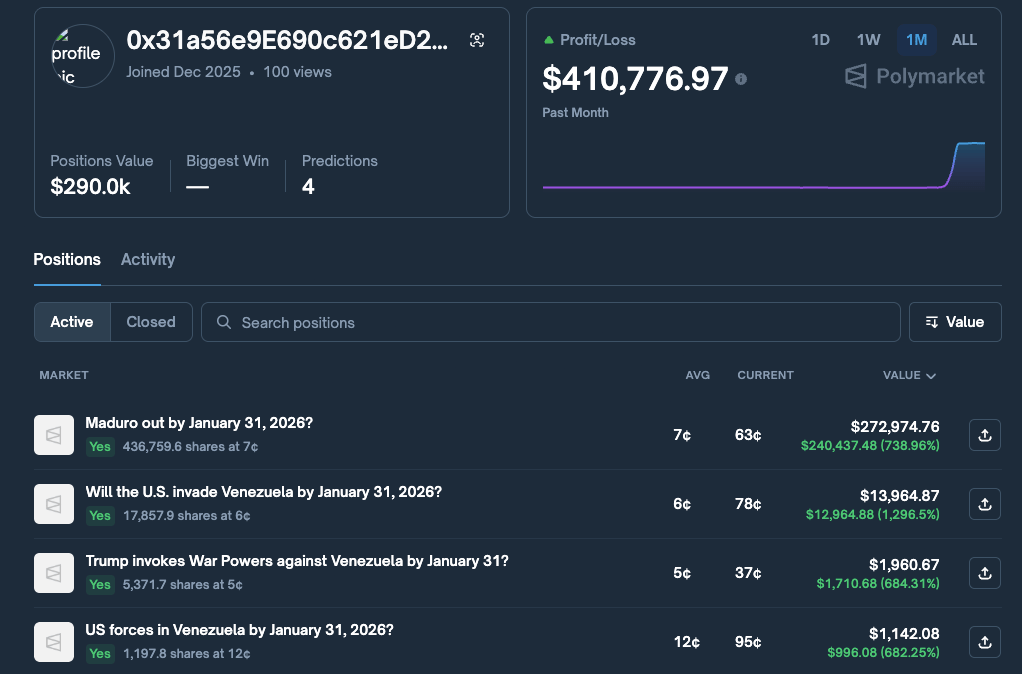

👀 A Polymarket account called 0x31a56e nailed a headline market, then basically vanished. The profile page now errors out while other accounts still load, which instantly lit up “insider” discourse again. 👇

Lookonchain spotted it early, and the debate went nuclear.

🧾 The trade that kicked this off was a roughly $32K bet tied to Nicolás Maduro being captured and removed as Venezuela’s president, placed right before the news broke. The payout was big enough to matter, around $400K in profit, and the timing was… spicy.

The Receipts: Wallet Flow And Cashout 🧾

Let’s get into the weeds. 🔎 The onchain trail is what makes it feel real, not just X gossip. The address linked to the account received about $436.7K $USDC from the Polymarket CTF Exchange on Polygon, and then about $437.8K $USDC left the wallet later that same day. In other words, win, cash out, disappear. 🏃♂️💨

📌 This was not a one market yolo either. 👉 Archived views show the same account also played related “US forces in Venezuela”, “US invades Venezuela”, and “War Powers” style markets around the same timeline.

4 predictions, $410K up… bro just secured a nice paycheck. Or herself, ofc.

That bundle of correlated bets is why people keep saying “this looks informed”. 🧠

🧨 The mess got bigger because Polymarket has also been fighting over how to settle some of those Venezuela contracts, with users accusing the platform of moving the goalposts while millions sit stuck in unresolved markets. ⚖️

🏛️ Political fallout is already landing. Rep. Ritchie Torres introduced the Public Integrity in Financial Prediction Markets Act of 2026 after the controversy, aiming to crack down on insider style participation on prediction markets, especially by government officials. 👔

Even Kalshi’s CEO jumped in publicly, framing insider trading as a straight up financial crime. 👮♂️

Alpha Leak 👉 Prediction Markets Go Mainstream

Let’s stick with Polymarket. 👌 Polymarket just landed an exclusive data deal with Dow Jones, so its odds are about to show up across outlets like The Wall Street Journal, Barron’s, and MarketWatch. More eyeballs usually means more volume, tighter spreads, and faster reactions to headlines. 🗞️📈

👉 Here is the tradable angle: Polymarket has taker fees on some fast crypto markets, and those fees fund daily $USDC rebates for market makers. 👀 If you can quote both sides and not get run over, it is basically “get paid to provide liquidity” meta.

Also, when mainstream media starts printing probabilities, it turns into a feedback loop. The odds become the story, the story moves the odds, and degens show up to trade the swing. 🔁

Why even pick this as our Alpha Leak? Because there are public talks of a Polymarket token and an airdrop after a US relaunch, so being an active user could be a free call option. 🪂🧠

🐋Smart Money Tracker

Monday, Jan 5th:Whale 0x8c08 just spent $8.49M to buy 1,948 $XAUT at an average price of $4,357 per token. We called it, RWAs are the 2026 hype.

Tuesday, Jan 6th: Three brand-new wallets just pulled 752 $BTC (about $70.3M) off Binance and OKX eight hours ago.

Wednesday, Jan 7th: A fresh wallet (5CmCRV) just YOLO’d 250,000 $USDT into 8.54M $114514 at the top, and after the crash it’s down to $34.38K, a $215.6K loss (−86%).

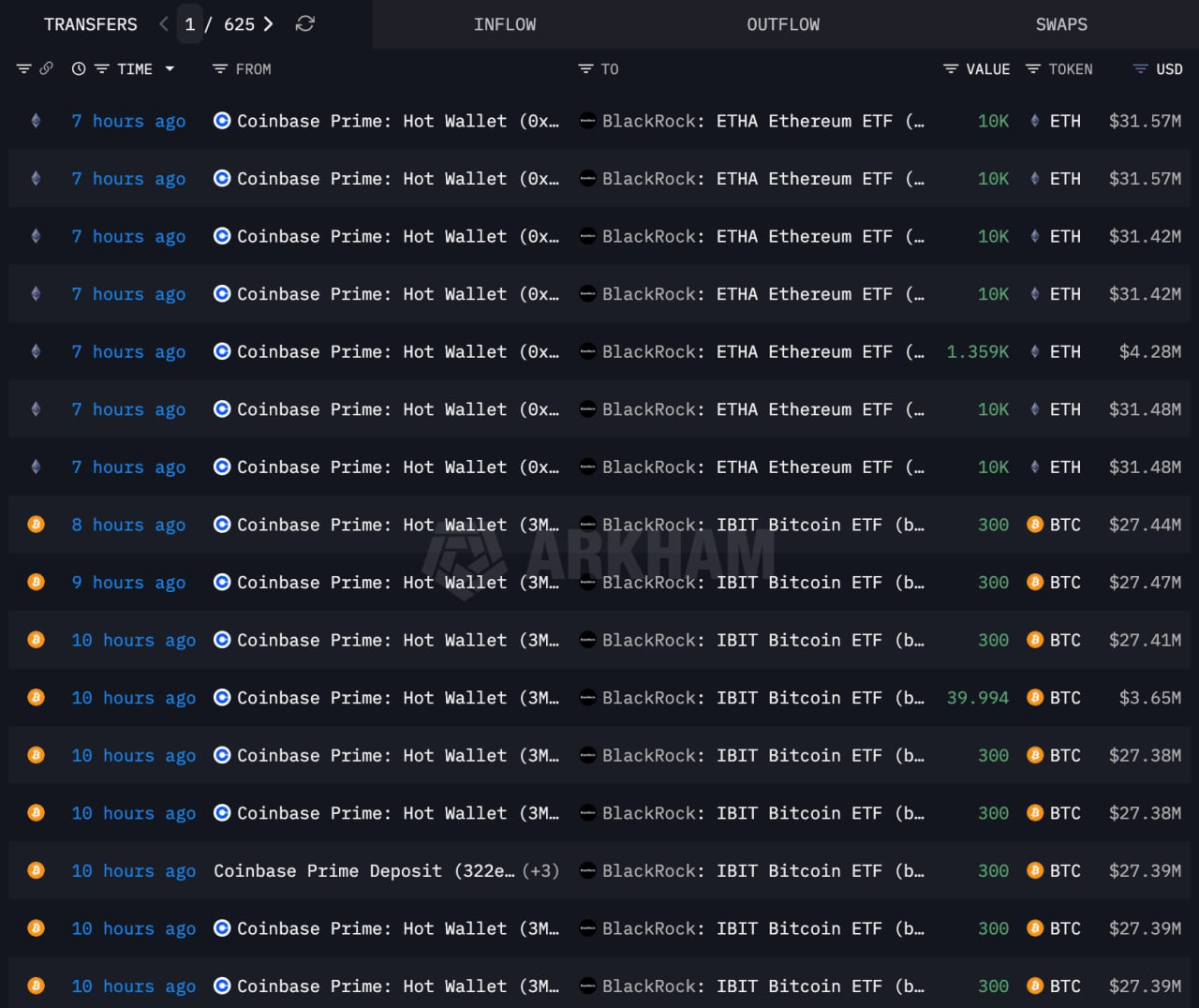

Thursday, Jan 8th: BlackRock has been stacking lately, adding 9,619 $BTC (about $878M) and 46,851 $ETH (about $149M) in total.

Friday, Jan 9th: Two fresh wallets, “goldbless” and “Getthegoop”, just put $23K on the Polymarket bet “Israel strikes Iran by Jan 31, 2026. Maybe another insider tip?

Saturday, Jan 10th: This Ethereum OG who bought 154,076 $ETH at a $517 average just sent another 40,251 $ETH (about $124M) to Bitstamp. He still holds roughly 26,000 $ETH (about $80.15M).

Source: Lookonchain

🔒 Major Token Unlocks of the Week

$UB - 1.75% of the locked supply will enter circulation on Jan 12, 2026.

$C - 6.14% of the locked supply will enter circulation on Jan 14, 2026.

$LAYER - 3.89% of the locked supply will enter circulation on Jan 15, 2026.

$KULA - 1.44% of the locked supply will enter circulation on Jan 15, 2026.

$CRO - 1.17% of the locked supply will enter circulation on Jan 17, 2026.

Explore more unlocks with full vesting details.

Scam Alert ⚠️ Creator Coin Clones On Base

Base and Zora are pushing “creator coins”, basically tokens tied to a creator profile, and scammers love that because it is easy to copy a name, a pfp, and a vibe. 🧪

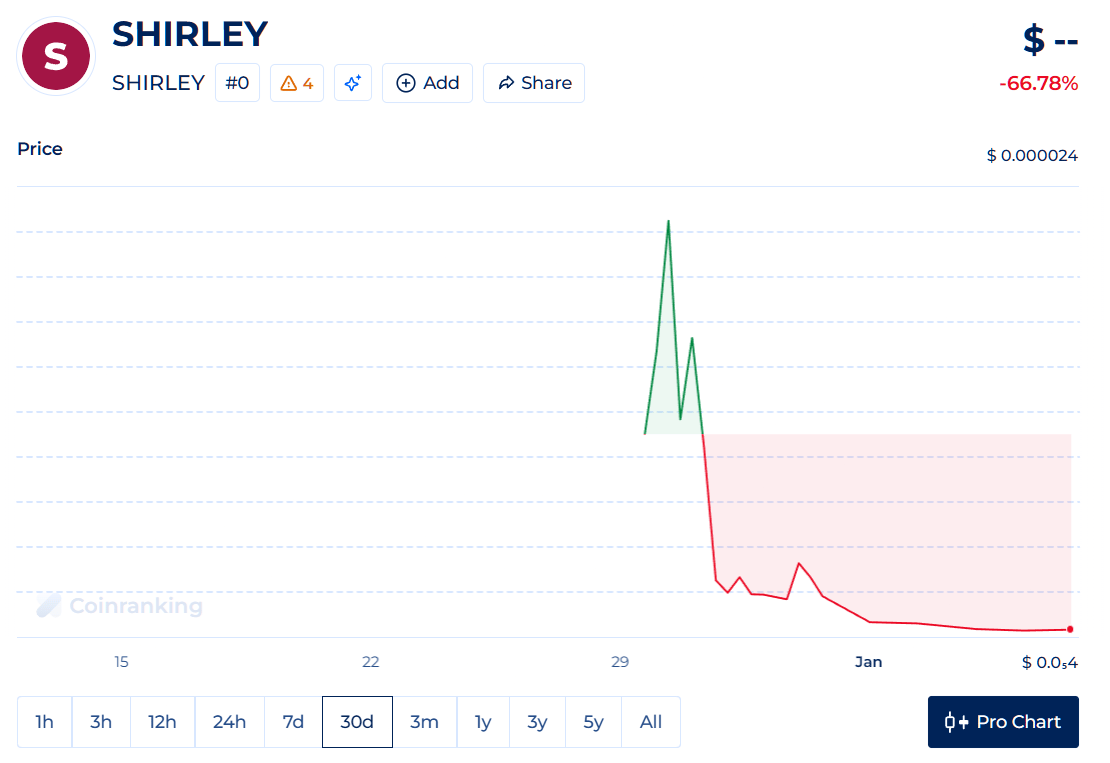

🔎 Maybe you heard, but this got extra noisy after Nick Shirley went viral off the Minnesota daycare fraud video drama, then launched a token on Zora that briefly pumped and then dumped. 🧨

The scam pattern is simple: a fake account drops a “new coin” link, you ape into thin liquidity, volume is mostly wash, and you become the exit. 💀

Also, Zora has literally had to hide coins for impersonation and show warning labels in wallets, so treat “looks legit” as a trap. 🕵️

How to spot it?

Source check: only trust links posted by the creator’s real account or official site. 🔗

Label check: if the coin is hidden or flagged for impersonation, walk away. 🚫

Liquidity check: if it is all hype and no depth, you are the liquidity. 🫗

Time check: if it launched 5 minutes ago and everyone is screaming “send it”, that is usually the whole plan. ⏳

🗞️ From our Blog

And that’s a wrap! 🎉 Enjoyed this newsletter? Forward it to a friend, and let them know they can subscribe here.

Got any ideas or feedback? We’d love to hear from you! Drop us an email at [email protected].

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and not investment advice or a solicitation to buy or sell any assets or make financial decisions. Always do your own research and stay safe out there.